In the past, it was common for most people to send in a check with their tax return if they had a balance due. That’s great if you still use a paper return, but how do you make payments to the IRS if you file online or it’s not tax season? No worries. We’ll break it down for you in this easy-to-follow guideline.

How to Make IRS Payments

The IRS offers various ways for taxpayers to make payments. Depending on your preference, you may submit payments online, by mail, over the phone, or even in person.

Electronic Federal Tax Payment System (EFTPS)

With the Electronic Federal Tax Payment System (EFTPS), you can make payments online or by phone from anywhere at any time, 365 days a year. Enrollment is easy and free.

Online: Go to EFTPS.gov and follow the step-by-step instructions. You’ll receive a Personal Identification Number (PIN) by mail within seven (7) business days. Once you have your PIN, simply follow the prompts online to set up your password and begin scheduling your payments.

Phone: Call 888-725-7879 between 9 AM and 6 PM, Monday through Friday (ET) to request an enrollment form. Once you receive the form, you’ll need to complete it and return it by mail. Your PIN will arrive approximately seven (7) business days after the completed form is received by EFTPS. To make or schedule a payment, have your PIN ready and call 800-555-3453. You will also need your financial institution’s routing number and your account number the first time you make a payment.

To avoid potential penalties, it’s best to submit your payment by 8 PM (ET) at least one calendar day before the tax due date.

IRS Direct Pay

You can also pay your taxes through your checking or savings account using IRS Direct Pay. It’s easy to use and secure. Simply fill out the online form information fields (name, SSN, filing status, etc.) and provide your bank information. Since the system does not store any information, you’ll need to do this each time you make a payment. You are limited to a maximum of two (2) payments per 24-hour period.

Unlike the EFTPS option, which is available 24/7, Direct Pay is only available during the following hours and days:

- Monday through Saturday: Midnight to 11:45 PM (ET)

- Sunday: 7 AM to 11:45 PM (ET)

You can also make payments on your smartphone through IRS Direct Pay by downloading the IRS2Go mobile app.

IRS Payments By Credit or Debit Card

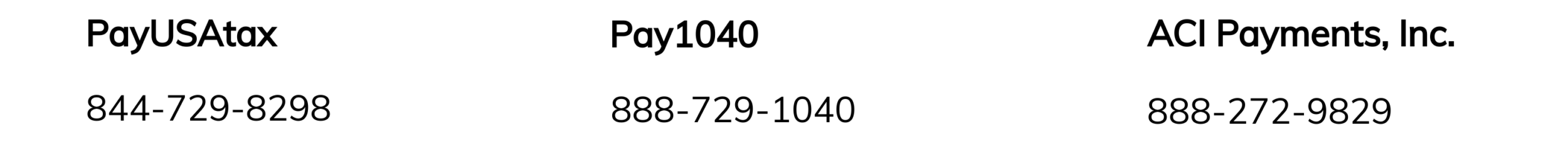

You can pay your taxes by credit or debit card using any of the following third-party payment processors approved by the IRS: PayUSAtax, Pay1040, or ACI Payments, Inc. Please note that the fees vary by processor, payment type, and amount. Credit card fees range from 1.96% to 1.99%, and debit card fees start at $2.00 per transaction.

Payments of $100,000 or more have special requirements. Depending on the tax type and payment type, you will also be limited to a maximum number of card payments per month, quarter, or year. You are also restricted from using card payments to make federal tax deposits.

If you’d like to pay with a credit or debit card by phone, please refer to the information below.

IRS Payments By Mail

If you choose to mail your payment to the IRS, you may pay by check, money order, or cashier’s check. Be sure to include your payment voucher or tax return with your payment. Your check or money order should include the following information:

- Your name and address

- Phone number

- Social Security number (SSN) or employer identification number (EIN). If payment is for a joint tax return, use the SSN shown first on the return.

- Tax year

- Related tax form or notice number

Where you mail your payment will depend on your situation. If you are making an installment payment or you received a notice, follow the mailing instructions on the notice. You can also refer to the IRS “Where to Send Your Individual Tax Account Balance Due Payments” page. The addresses on that page may also be used if you’re sending in a payment after you have filed. When paying and filing at the same time, refer to your form instructions. You can also locate the correct address by state or form on IRS.gov.

Cash Payments

The quickest way to make an IRS payment is online, but it is possible to pay by cash if desired. The IRS partners with several retailers that can process your payment for a small fee ($1.50 to $3.99 per payment), including CVS Pharmacy, Dollar General, 7-Eleven, Walgreens, Family Dollar, and Speedway. Payments are limited to $1,000 or less per day. Monthly and annual limits may also apply. You must follow these four steps if you choose to pay by cash:

- Visit the ACI Payments, Inc. website and follow the instructions to make a cash payment.

- Next, you should receive a confirmation email from ACI Payments, Inc.

- Once the IRS verifies your information, you’ll receive an email from the cash processing company. This email will contain a link to a payment code and additional instructions. You can print the payment code or save it to your smartphone. The code is only valid for seven (7) days.

- Go to the location listed in the cash processing company’s email and provide your code. Be sure to keep your receipt as confirmation of your payment. It may take up to two (2) business days for your payment to post to your account.

You may also make cash payments in person at certain IRS office locations. Just call before heading over to verify your location is currently accepting payments.

Owe But Can’t Pay?

If you owe the IRS and can’t pay, you still have options. You may be eligible for one or more of the IRS Fresh Start programs, such as an installment agreement or an Offer in Compromise. The important thing is to act quickly to avoid costly penalties and aggressive collection actions. To explore your available tax relief options, call Tax Defense Network at 855-476-6920 and request a free consultation today!