If you’re a business owner, you’ve probably heard the buzz about the 20% pass-through deduction, also known as the qualified business income (QBI) deduction. Everyone discussing this deduction has proclaimed it to be a great perk for business owners. Still, it’s been hard to figure out how to claim it.

The IRS released some guidance on the QBI deduction on Jan. 19, 2019 in the form of 274 pages of final regulations. Sounds like it should have cleared things up, right? Actually, it only clarified that this is one of the most complicated changes that came with the recent tax reform. Let’s shed light on the basics of this intricate deduction by responding to some questions we’ve heard a lot since it was signed into law.

Answers to those burning questions about the 20% pass-through deduction:

What is the QBI deduction?

The QBI or 20% pass-through deduction refers to an individual provision (officially named Section 199A) in the Tax Cuts and Jobs Act. The provision is only effective for tax years after Dec. 31, 2017, and before Jan. 1, 2026.

Section 199A allows owners of pass-through entities to deduct 20 percent of the business income that is passed onto their individual return.

Why was it included in the tax reform?

The pass-through deduction was included to offer a tax benefit to businesses that help grow the U.S. economy. This tax break, however, is meant for a specific subset of business owners.

Who is eligible for the 20% pass-through deduction?

Pass-through organizations are eligible for the deduction. These organizations tend to “pass” the business’s profits “through” to owners or shareholders. The owners of pass-through organizations pay tax through individual rather than corporate returns. It’s estimated that about 95% of businesses fall into this category.

These are all pass-through organizations that could be eligible for the deduction:

- Sole proprietorships

- Partnerships

- Limited liability companies

- S corporations

But there is a catch. Even if your business is a pass-through organization, it doesn’t mean you’ll qualify for the 20% pass-through deduction. There are some key limitations to this deduction that we’ll discuss in a moment.

What is a specified service trade or business (SSTB) and how does it apply to the deduction?

A specified service trade or business (SSTB) is defined in the legislative text of IRC Section 199A as:

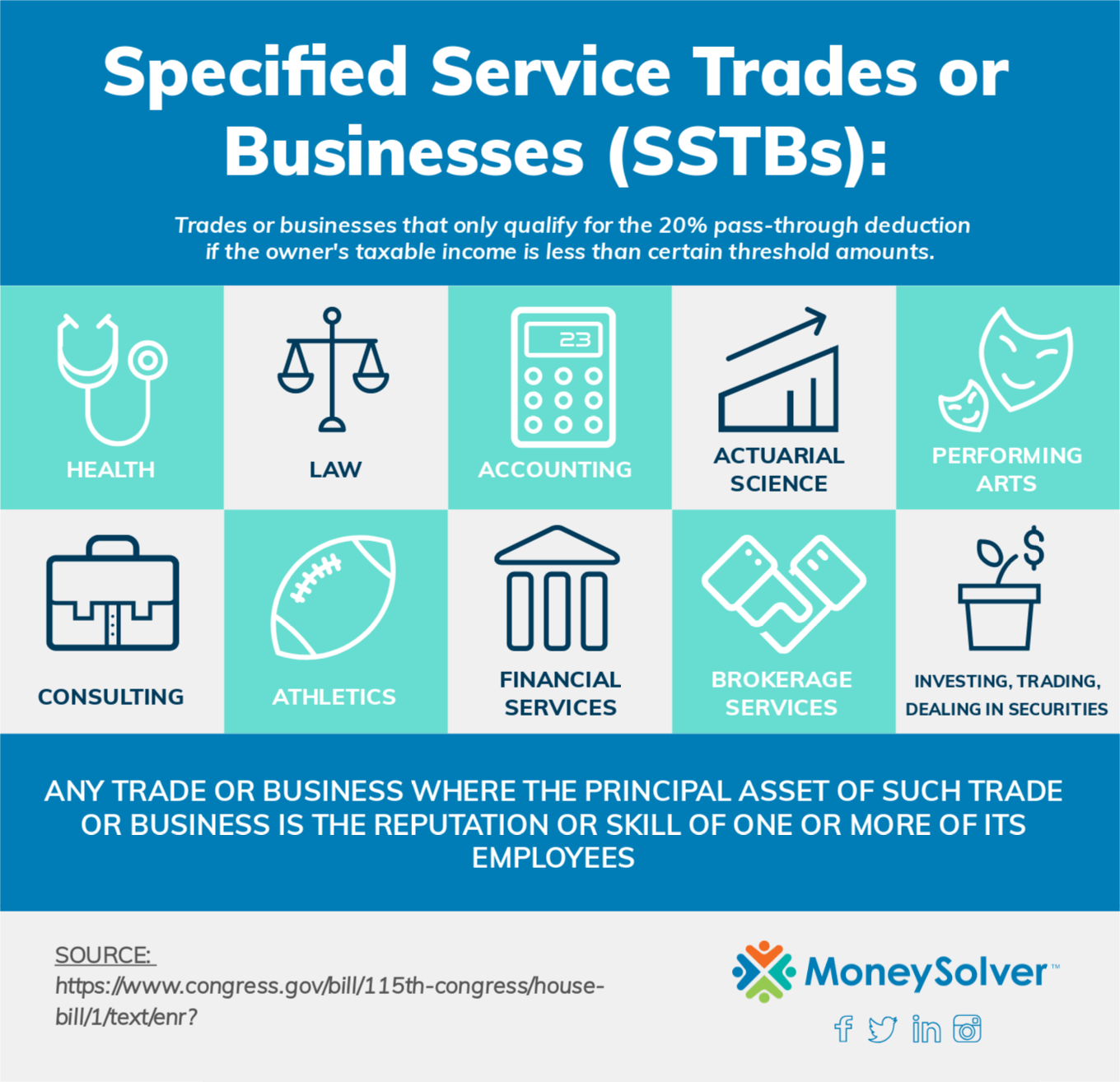

“Any trade or business involving the performance of services in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of 1 or more of its employees [or] any trade or business which involves the performance of service that consist of investing and investment management, trading, or dealing in securities.”

Any business that fits that definition only qualifies for the deduction if the owner’s taxable income is less than certain threshold amounts. Here’s a handy visual breakdown of the trades and business fields that fall into the category of SSTBs:

How do I calculate how much I could save with the 20% pass-through deduction?

Unfortunately, it’s not as simple as just multiplying your pass-through income by 20 percent. Even most tax professionals have to run complicated calculations through advanced tax programs. The best way to really find out how much you can save is to find a business tax professional who is experienced in running these calculations.

Can I split my company into different entities to lower my tax bill?

No. Originally, some tax professionals believed that they could split firms into different entities to avoid limits on the new tax break (also known as “crack and pack”). However, the IRS swiftly blocked this tactical move.

What is the best business structure for me and will it qualify me for the 20% pass-through deduction?

This is a near-impossible question to answer without knowing the specifics of your business and income. The pass-through deduction will inevitably help some business owners. Meanwhile, others may benefit more by maintaining a C-corporation structure.

Your best bet is to find a qualified tax professional who can evaluate your business and then give you personalized guidance on business structure and the best tax breaks available to you.

If I do qualify for the QBI deduction, what are the limitations?

Here are the main limitations of the 20% pass-through deduction:

- The deduction cannot exceed 20 percent of your taxable income in excess of capital gains.

- You cannot deduct more than the lesser of QBI or the greater of:

- 50 percent of your allocable share of the wages paid by the business with respect to QBI, or

- 25 percent of your allocable share of wages plus 2.5 percent of the unadjusted basis of qualified property owned by the business.

- This limitation begins getting phased in at taxable incomes of $157,500 for single taxpayers and $315,000 for married taxpayers filing jointly.

- As mentioned before, the deduction is temporary and may not exist past 2026.

- The complicated nature of the 20% pass-through deduction makes it difficult to navigate for the average taxpayer.

If I don’t qualify for the deduction, are there other ways I can save on my taxes?

Don’t worry. The QBI deduction is not the only way to save on your business taxes. The tax reform also brought along a lower tax rate for C-corporations and repealed the corporate alternative minimum tax.

In sum, the 20% pass-through deduction could bring you a great tax break. But it’s also a complex and headache-inducing change. The good news is that there are tax experts like ours ready to help you decipher what Section 199A means for you and your business taxes.