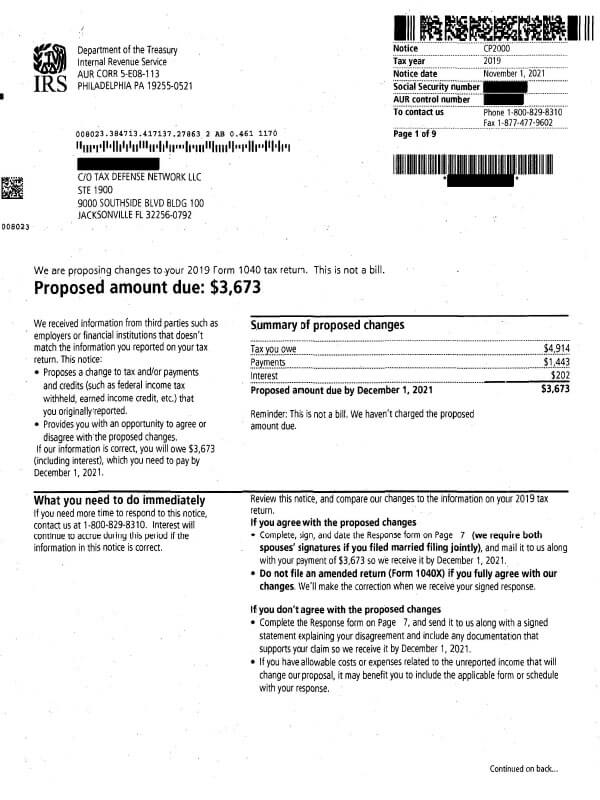

Aviso CP2000 del IRS – Cambios propuestos a tu declaración de impuestos

El Aviso CP2000 del IRS se envía cuando la información de ingresos o pagos que el IRS tiene archivada no coincide con la información reportada por el contribuyente.

¿Por qué recibí el aviso CP2000 del IRS?

Recibiste el aviso CP2000 porque la información que proporcionaste en tu declaración de impuestos no concuerda con la información que el IRS tiene en sus registros. En muchos casos, se debe a la infradeclaración de ingresos o problemas con los créditos fiscales que reclamaste. Por ejemplo, podrías no haber incluido un Formulario 1099 o reclamado un crédito al que no tenías derecho. La discrepancia puede causar un aumento o reducción de la cantidad que debes, que esperabas recibir (reembolso), o no provocar ningún cambio. Ten en cuenta que un CP2000 no es un recibo. Es un resumen de los cambios propuestos a tu declaración de impuestos.

Siguientes pasos

Revise cuidadosamente su aviso CP2000 y guarde una copia para sus registros. El aviso explicará qué información utilizó el IRS para determinar los cambios, si los hubiera, en su declaración de impuestos. Asegúrese de completar el formulario de respuesta al aviso e indique si está de acuerdo o en desacuerdo con el aviso.

Si está de acuerdo con los cambios propuestos:

- Complete, firme y feche el formulario de respuesta. Si presentó una declaración conjunta, ambas partes deben firmar el formulario.

- Envíe el formulario y el pago (si corresponde) antes de la fecha límite a la dirección proporcionada en el aviso.

- No presente una declaración de impuestos enmendada. El IRS hará las correcciones necesarias a su declaración.

Si no está de acuerdo con los cambios propuestos:

- Complete, firme y feche el formulario de respuesta.

- Incluya una declaración firmada que explique por qué no está de acuerdo con los cambios.

- Proporcione documentación/evidencia para respaldar su declaración. Si la información proporcionada al IRS por una empresa es incorrecta (W-2, 1099, etc.), debe comunicarse directamente con la empresa. Solicite un documento corregido o una declaración que respalde por qué la información inicial proporcionada fue errónea.

- Envíe por correo el formulario, la declaración y cualquier documentación/evidencia a la dirección proporcionada.

No es necesario presentar una declaración enmendada si no está de acuerdo con los cambios propuestos. Sin embargo, si decide hacerlo, asegúrese de escribir “CP2000” en la parte superior de la declaración y adjuntarlo detrás de su formulario de respuesta completo.

Si no envía el formulario de respuesta antes de la fecha límite, el IRS asumirá que está de acuerdo con todos los cambios. Si debe un saldo, el IRS le enviará un Aviso de deficiencia seguido de una factura final.

¿A quién puedo contactar si tengo más preguntas?

Para preguntas sobre tu aviso CP2000 del IRS, llama al número que aparece en tu aviso. Si debes impuestos y no puedes pagarlos completamente, llama a Tax Defense Network al 855-476-6920 para una consulta gratuita. Nuestros especialistas en impuestos revisarán su caso y le explicarán sus opciones de desgravación fiscal.