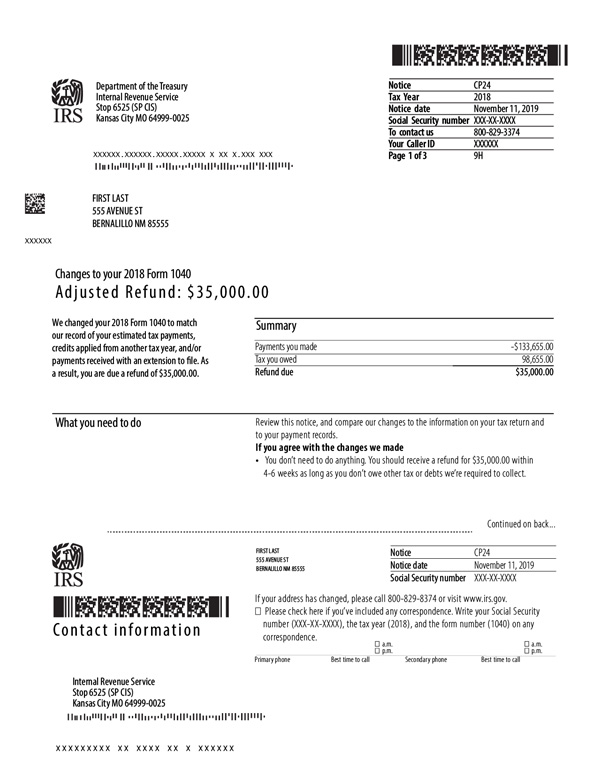

IRS Notice CP24 – Changes to Form 1040 (Refund Due)

IRS Notice CP24 is sent to a taxpayer when the estimated tax payments posted to their account don’t match what was reported on their tax return.

Why Did I Receive IRS Notice CP24?

You received IRS Notice CP24 because you made estimated tax payments, but the amount reported on your federal income tax return doesn’t match what the IRS has on file. The IRS corrected the error which resulted in a refund.

Siguientes pasos

Read your CP24 notice carefully. It will explain the changes the IRS made to your return. Be sure to compare the payments recorded on the notice with your records.

If you agree with the changes made:

- Correct your copy of your tax return and keep it for your records. Do not send the amended copy to the IRS.

- Si no tiene ninguna deuda tributaria pendiente, debería recibir su reembolso en unas semanas. Puede consultar el estado de su reembolso visitando IRS.gov/reembolsos and using the “Where’s My Refund” tool.

If you disagree with the changes made:

- Contact the IRS within 60 days of the date on your notice. You can either call the number provided on the notice or respond by mail.

Make sure you have a copy of your tax return and documentation available when you call. In some cases, the IRS may be able to correct your account immediately. If you respond by mail, include a copy of your notice along with any documentation. Please be aware that it may take 90 days or longer for a resolution if you go this route.

¿A quién debo contactar si tengo más preguntas?

Si tiene preguntas adicionales sobre su Aviso CP24 del IRS, comuníquese con el número de teléfono que figura en su carta o llame 800-829-1040.