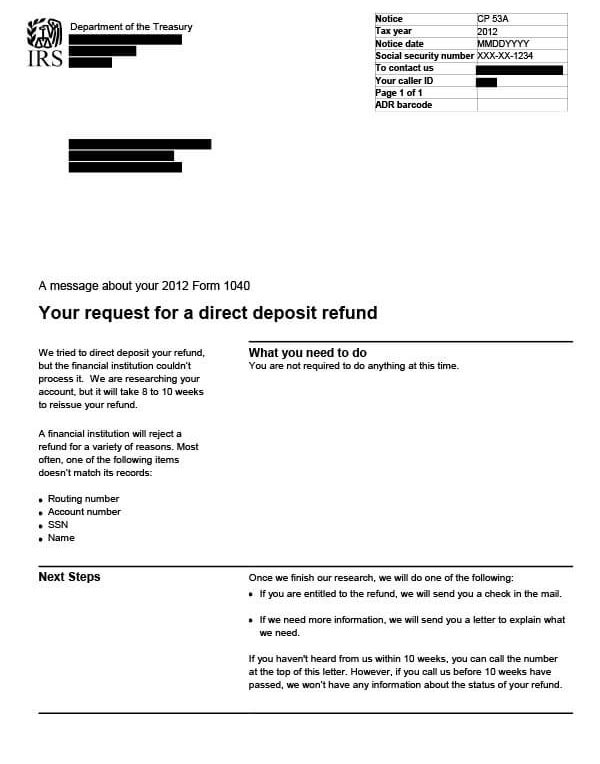

Aviso CP53A del IRS – Solicitud de reembolso mediante depósito directo

El aviso CP53A del IRS se envía a los contribuyentes cuando el IRS intenta depositar directamente un reembolso de impuestos pero la institución financiera lo rechaza.

¿Por qué recibí el aviso CP53A del IRS?

Recibió CP53A del IRS porque el IRS intentó depositar directamente su reembolso de impuestos pero su institución financiera no pudo procesarlo. El IRS ahora está investigando su cuenta. En aproximadamente 8 a 10 semanas, recibirá su reembolso mediante cheque por correo o el IRS puede solicitar información adicional antes de emitir su reembolso.

Siguientes pasos

Guarde una copia del aviso CP53A para sus registros. No se requieren pasos adicionales en este momento.

Una vez que el IRS complete su investigación, recibirá un cheque de reembolso por correo o le enviarán una carta solicitando información adicional. Si no recibe noticias del IRS después de 10 semanas, llámelos al número que figura en la parte superior de su aviso CP53A.

¿A quién debo contactar si tengo más preguntas?

Si tiene preguntas sobre su Aviso CP53A del IRS, llame al número que figura en el aviso o al 800-829-1040.