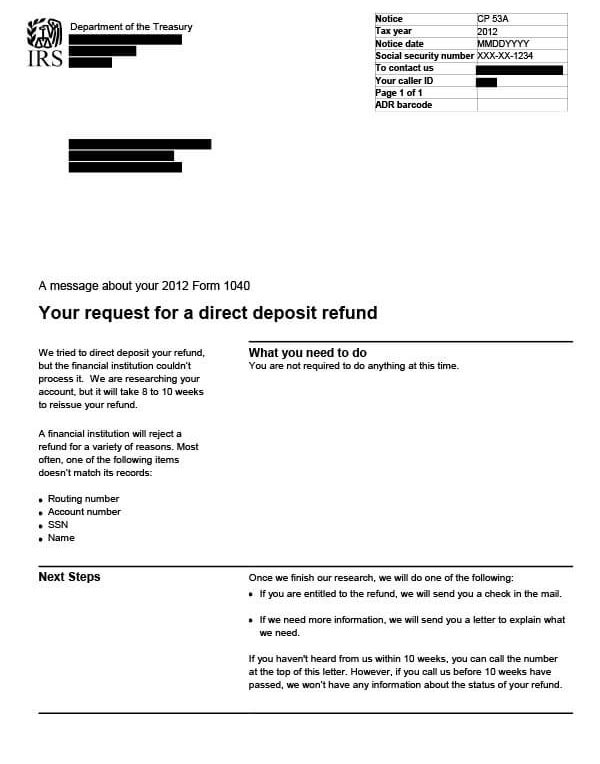

IRS Notice CP53A – Request for a Direct Deposit Refund

IRS Notice CP53A is sent to taxpayers when the IRS attempts to direct deposit a tax refund but the financial institution rejects it.

Why Did I Receive IRS Notice CP53A?

You received IRS CP53A because the IRS attempted to direct deposit your tax refund but your financial institution could not process it. The IRS is now researching your account. In approximately 8-10 weeks, you’ll either receive your refund by check in the mail, or the IRS may request additional information before it issues your refund.

Next Steps

Keep a copy of CP53A notice for your records. There are no additional steps required at this time.

Once the IRS completes its investigation, you’ll either receive a refund check by mail, or they will send you a letter asking for additional information. If you don’t hear from the IRS after 10 weeks, call them at the number listed at the top of your CP53A notice.

Who Should I Contact if I Have More Questions?

If you have questions concerning your IRS Notice CP53A, call the number listed on the notice or 800-829-1040.