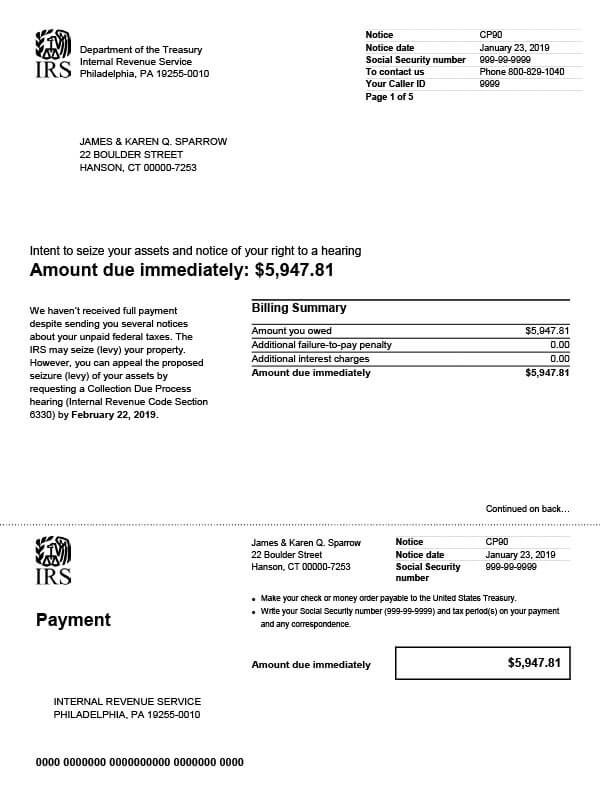

Aviso CP90 del IRS – Aviso final de intención de embargo

El Aviso CP90 del IRS, también conocido como Aviso final de intención de embargo, es la advertencia final de un contribuyente para que pague su saldo de impuestos atrasado o el IRS embargará sus activos.

¿Por qué recibí el aviso CP90 del IRS?

Recibiste el aviso CP90 del IRS porque no pagaste tus impuestos morosos antes de la fecha límite. Debes haber recibido varios avisos antes de éste solicitando pagar. Como no respondiste, el IRS te está dando 30 días más a partir de la fecha en el aviso CP90 para solicitar una audiencia por Proceso debido de cobro antes de embargos tus bienes.

Siguientes pasos

Revise cuidadosamente su aviso de CP90 y los detalles de facturación. Guarde una copia del aviso para sus registros.

Si no puede pagar el saldo adeudado antes de la fecha límite:

- Paga tanto como puedas ahora y aplica para un plan de pago del IRS.

- Llame al número que figura en el aviso para analizar sus opciones.

Si desea apelar la acción de embargo propuesta:

- Complete y envíe por correo el Formulario 12153 adjunto, Solicitud de debido proceso de cobro o audiencia equivalente, antes de la fecha límite. Asegúrese de incluir el motivo por el que solicita una audiencia y cualquier otra información solicitada en el formulario. No presentar esto antes de la fecha límite resultará en la pérdida de sus derechos de apelación.

Si no hace arreglos de pago o solicita una audiencia dentro del plazo de 30 días, el IRS puede embargar sus activos. Esto incluye sus salarios, cuentas bancarias, activos comerciales, activos personales (casa, vehículos, etc.), beneficios del Seguro Social y cualquier reembolso de impuestos futuro (estatal y federal).

¿A quién debo contactar si tengo más preguntas?

No ignores el aviso CP90 del IRS. Se trata de un asunto serio. Te sugerimos buscar inmediatamente el apoyo de un profesional fiscal con experiencia. Para recibir una consultoría gratuita, llama a Tax Defense Network al 855-476-6920. También puede llamar al número del IRS que figura en su aviso o al 800-829-1040.