Aviso CP566 del IRS – Solicitud de ITIN, se necesita más información

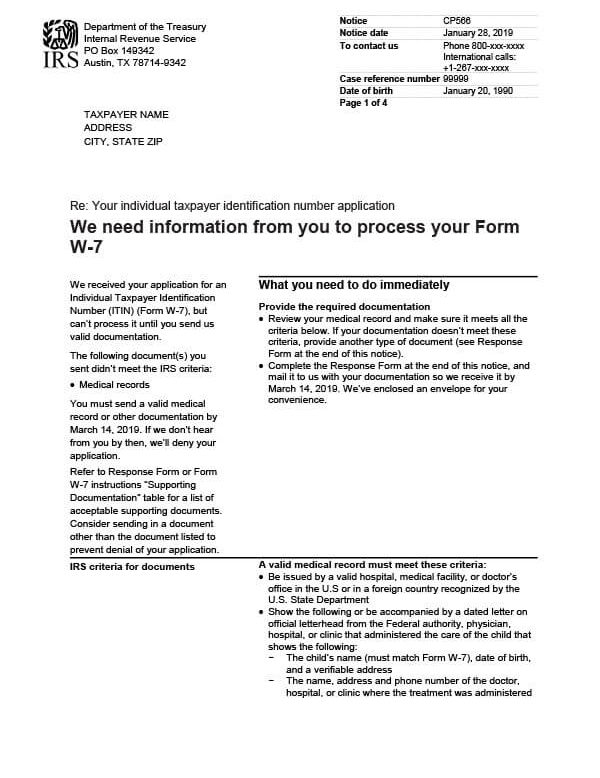

El Aviso CP566 del IRS informa al contribuyente que su solicitud de Número de Identificación Individual del Contribuyente (ITIN) no puede procesarse hasta que el IRS reciba información adicional.

¿Por qué recibí el aviso CP566 del IRS?

Recibiste el aviso CP566 porque tu solicitud de ITIN estaba incompleta o porque enviaste los documentos equivocados. El IRS está solicitando información adicional antes de poder procesar tu solicitud.

Siguientes pasos

Revise cuidadosamente su aviso CP566. Le explicará en detalle qué información se necesita para seguir adelante con su solicitud de ITIN. Tendrá 45 días a partir de la fecha del aviso para enviar la documentación solicitada y el Formulario de Respuesta incluido con el aviso.

Si no responde antes de la fecha límite, el IRS rechazará su solicitud. Su solicitud también será denegada si falta alguno de los documentos solicitados. Si esto sucede, deberá enviar una nueva solicitud para que se le asigne un ITIN.

¿A quién debo contactar si tengo más preguntas?

Si tiene preguntas sobre su Aviso CP566 del IRS, llame al IRS al número que figura en el aviso o al 800-829-1040.