Each year, the IRS sends millions of letters notifying taxpayers that they have a balance due. Known as IRS Notice CP14, this letter is required by law (Internal Revenue Code Section 6303) and must be sent 60 days after the IRS assesses a taxpayer’s liability.

If you receive a CP14, it means you owe taxes. Although receiving a notice from the IRS can be unsettling, there’s no need to panic. Just follow these three steps to address your CP14 and the various payment options available to you.

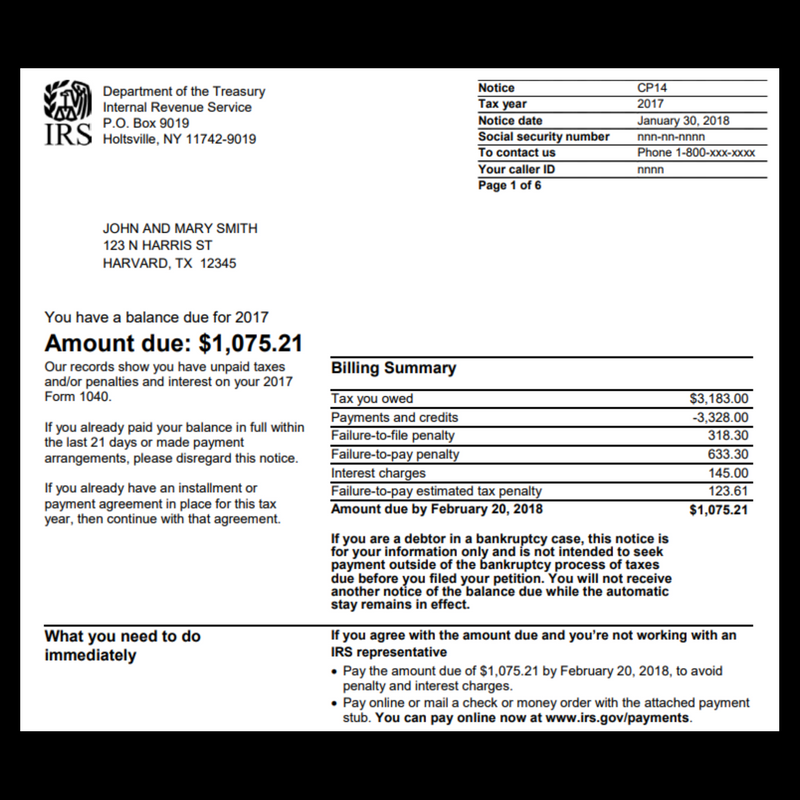

1. Review the Notice CP14 Details

When you receive an IRS Notice CP14, don’t ignore it. Carefully review all details to understand why the IRS sent it. The notice will include the following:

- The tax year for which taxes are due

- The notice issue date

- Your Social Security number (SSN)

- IRS phone number

- Tax amount owed

- Payments and credits

- Penalties charged on taxes owed

- The final amount due to be paid

- The deadline for paying the amount owed

The Notice CP14 also includes information on payment options, penalties, and interest.

2. Determine If The IRS Is Correct

Before agreeing or disagreeing with Notice CP14, check to see if your return had errors that led to the assessment of taxes due. If you find errors, you will need to pay the amount owed before the payment deadline in order to avoid further penalties and interest.

If you don’t see any errors or you find a different amount than what the IRS determined, you can call the number on your notice and speak with an IRS representative. It may be better, however, to contact a tax professional. A tax specialist can correspond with the IRS on your behalf and determine if an amended return is needed. If you still owe taxes and can’t pay, they can also find a solution to address your back taxes and avoid IRS collection actions.

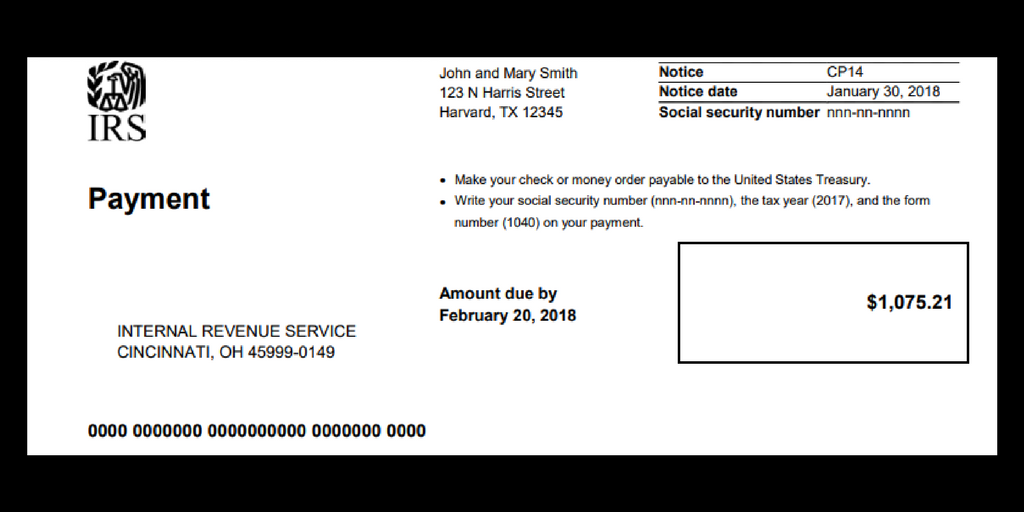

3. Pay The Amount Due

You can pay the amount indicated on the Notice CP14 using IRS Direct Pay, a service that allows you to electronically pay your taxes directly from your savings or checking account. Alternatively, you can pay by check, credit, or debit card, if desired.

In the event you are unable to pay your balance due in full, there are many payment options available to help you address your IRS Notice CP14. Some of these are easy to set up on your own. Others are a bit more complicated. That’s where the knowledge and experience of a tax professional can come in handy.

IRS Payment Plans

The IRS offers several different types of payment plans, also known as installment agreements, to help you pay your balance off in a few months or years.

- Short-Term Payment Plan – This is often referred to as a payment extension. It gives you an additional 180 days to pay your balance in full. There is no fee to apply. You can request an extension online or by phone.

- Guaranteed Installment Agreement (GIA) – If you owe less than $10,000, you are automatically approved for a GIA, as long as you have filed all required tax returns and haven’t had a payment plan in the past five years. You can apply online, by phone, or by submitting Form 9465 with your return. Setup fees range from $31 to $225, depending on how you set up your agreement. Payments can be spread out over 36 months.

- Streamlined Installment Agreement (SLIA) – Do you owe up to $50,000? An SLIA may be a better choice. Payments can be made for up to 72 months or the remainder of the IRS collection statute of limitations, whichever is shorter. Setup fees are the same as a GIA, but you must make automatic payments if you owe between $25,000 and $50,000.

- Non-Streamlined Agreement – In 2020, the IRS also introduced an additional payment plan for those with tax balances up to $250,000. It allows you to make payments until the statute of limitations expires on collecting your debt (generally 10 years). This type of agreement must be set up by phone with the IRS.

If you don’t meet the qualifications for any of these installment agreements, you may still qualify for a payment plan. The IRS will assess your ability to pay through the use of a collection information statement (Form 433-A or 433-F) and determine your monthly payments.

Offer in Compromise

Another option for paying your tax debt is an Offer in Compromise (OIC). This allows you to settle your taxes for less than you owe. The IRS will typically approve an OIC application if there is a doubt to collectability. It may also agree to settle for less if paying the balance in full will cause economic hardship. It’s a very complicated process and most applications are denied. Enlisting the help of a tax professional, however, may improve your chances.

Currently Not Collectible

In extreme cases of economic hardship, the IRS may place you in a temporary Currently Not Collectible (CNC) status. This means that you won’t be required to make any payments unless your financial outlook improves. If you owe more than $10,000, however, the IRS will file a tax lien. Unlike installment agreements, there is no fee when applying for CNC status.

It’s important to note that the IRS will also take any future tax refunds (state and federal) to pay toward your tax balance even if you’re in a payment plan or CNC status. Other collection actions, such as wage garnishment and bank levies, are suspended.

What Happens If I Don’t Pay?

The one thing you don’t want to do is ignore your IRS Notice CP14 and refuse to pay. Any unpaid balance after the due date will be subject to interest and penalty fees. The failure-to-pay penalty is 0.5% of your unpaid tax balance for each month (or part of a month) it remains unpaid. The penalty cannot, however, exceed 25% of your unpaid taxes.

In addition to the interest and penalties, you may also face IRS collection actions. This includes, but is not limited to the seizure of your wages, bank accounts, and property. Depending on the total balance, your passport could also be in jeopardy.

In extreme cases, the IRS may even charge you with tax evasion if you deliberately refuse to pay your tax debt. This can result in a fine of up to $250,000 and/or jail time.

Get Help

If you recently received an IRS CP14 notice and can’t afford to pay the amount due, or you want to dispute the amount assessed, speak with a tax professional ASAP. Tax Defense Network offers free consultations with zero obligation to use our services. Just call 855-476-6920 and speak to one of our experienced tax debt specialists today.