Earlier this month, the IRS reopened its campuses and began the monumental task of processing nearly 11 million pieces of unopened mail, in addition to the 20 million notices that were generated during the pandemic shutdown. Many of these notices included compliance actions, as well as collection and payment deadlines. Since these notices were not sent out as expected, many will contain deadline dates that are past due. Taxpayers who receive these notices over the next few weeks should not panic.

IRS Extension

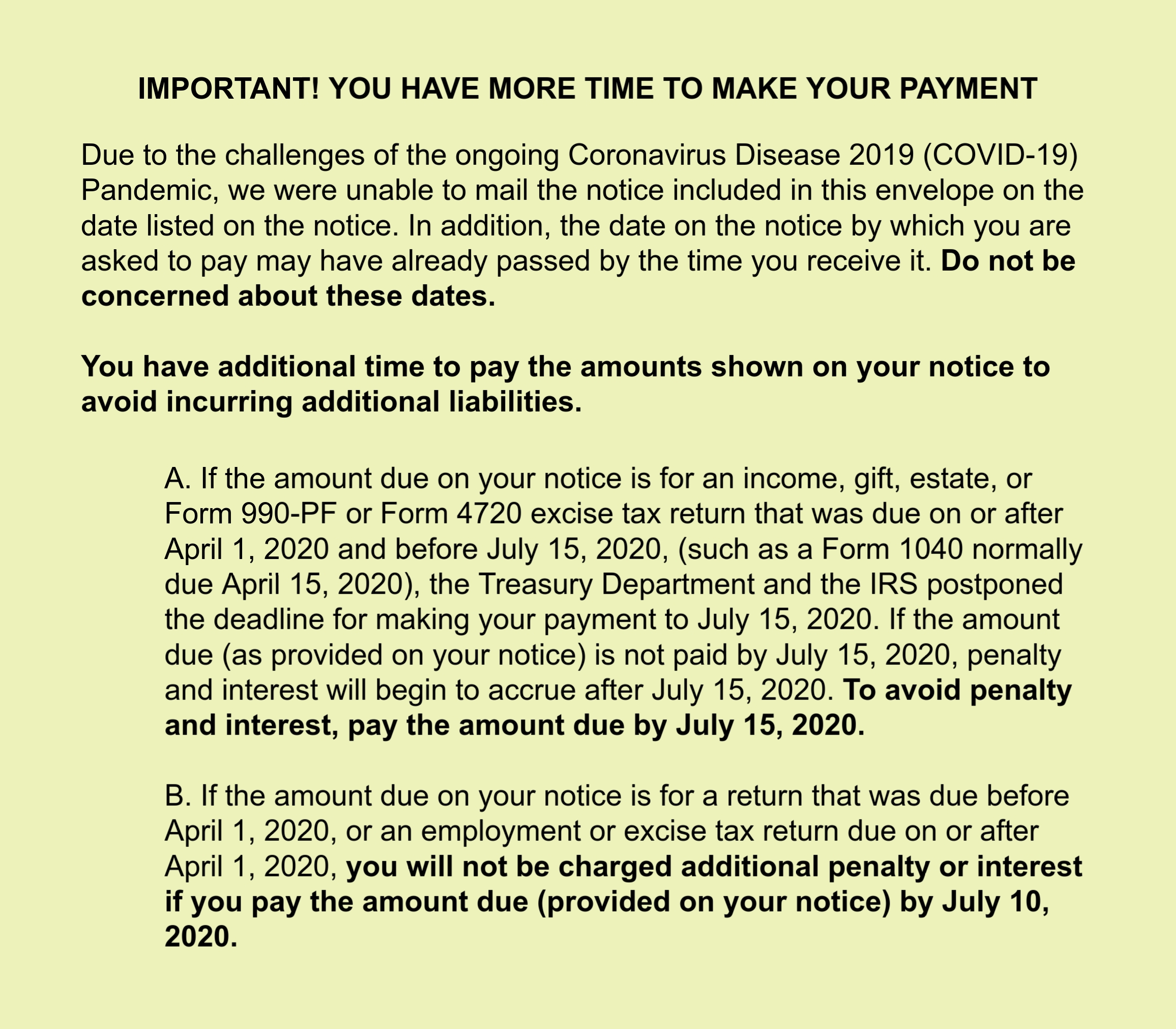

Thanks to the People First Initiative, the IRS already provided extensions for those who need to file or make payments. It also included a temporary stay on collection actions until after July 15, 2020. The IRS, however, is aware that many people may still be confused. According to the Taxpayer Advocate Service, for business reasons, the IRS elected not to reprint the notices with new dates. Instead, they will include inserts, such as Notice 1052-A, which provides the following information:

The insert also includes a link to the IRS.gov webpage on coronavirus relief, which provides additional information on relief for filing and payment deadlines.

Need Help?

If you receive a notice from the IRS, it’s important that you read everything to avoid confusion. Don’t panic if the deadline date has passed. Review any enclosed inserts to determine your new date, as well as how to contact the IRS for additional assistance. You can also reach out to Tax Defense Network for help with tax preparation and filing extension requests, applying for an installment agreement (if you are unable to pay in full), or other tax-related issues. Contact us today for a free consultation.