The COVID-19 pandemic has created quite a bit of economic uncertainty for many Americans. This has led to more people worrying about their retirement. In fact, 56% are more concerned now than they were just a year ago. Although saving for your retirement is always a smart move, the tax implications will vary depending upon which type of retirement account you choose, as well as how much you contribute or withdraw from the account. If you’re wondering how retirement contributions will affect your taxes next season, check out our overviews below for the most common types of accounts.

Traditional IRA Contributions

Tradition IRA accounts offer many tax breaks for contributions. For example, if you and your spouse are enrolled in retirement plans through work, you can take a full tax deduction on your contributions if you meet certain income limits.

For the 2021 tax year, the total amount you can contribute to all of your IRAs (traditional and Roth) can’t exceed $6,000 (49 or younger) or $7,000 (50+), or 100% of your earned income, whichever is less. The total deduction amount, however, will depend on your modified adjusted gross income (MAGI).

Your contribution (up to the total allowed) is fully deductible if your MAGI is less than $66,000 (single) or $105,000 (married filing jointly). It is partially deductible if you’re single and your MAGI is between $66,000 and $76,000, or between $105,000 and $125,000 for married filing jointly. If your MAGI exceeds $76,000 (single) or $125,000 (married filing jointly), you are not eligible for any deduction. For married filing separately, you may take a partial deduction if your MAGI is between $0 and $10,000.

If either you or your spouse is covered by a retirement plan at work (but not both), your contributions are fully deductible if your MAGI is less than $198,000. It is partially deductible if your MAGI falls between $198,000 and $208,000. If it exceeds $208,000, it is not deductible.

What about early withdrawals? If you’re under 59½, you may have to pay a 10% IRS penalty for an early withdrawal, though there are exceptions for certain circumstances, such as using the money for a first-time home purchase or qualified education expenses.

Roth IRA Contributions

Contributions made to a Roth IRA are not tax-deductible. Contributions, however, can be withdrawn tax-free at any time since you’ve already paid taxes on the money you deposited. You may also withdraw earnings tax-free if the account has been open for at least five years, you’re 59 ½ or older, and buying a home for the first time ($10,000 lifetime maximum) or you’re disabled. If your contributions are from conversion IRAs, they must be held in deposit for at least five years to avoid the 10% early withdrawal penalty.

401(k) Contributions

Contributions made to an employer-sponsored 401(k) retirement plan aren’t tax-deductible because they don’t count as part of your taxable income. If you make a withdrawal from a 401(k), you’ll have to pay taxes since the IRS will treat this as income. In most cases, if you withdraw funds before the age of 59 ½, you’ll also be subject to a 10% tax penalty. The IRS permits some exceptions, such as withdrawing money early because you are now totally and permanently disabled.

Traditional Pension Plan Contributions

Typically, contributions to a traditional pension plan are tax-free. You will, however, pay income taxes on any monthly or lump-sum pension payments you receive. If you withdraw the money early, you could be required to pay a 10% penalty on your federal tax return if you’re not at least 59½ or older. As with other plans, there is an exception for those who become totally and permanently disabled.

If you live in one of these 12 states, your pension payments won’t be subject to state income taxes.

- Alaska

- Florida

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

- Alabama

- Illinois

- Hawaii

- Mississippi

- Pennsylvania

All of these states, except for Alabama and Hawaii, also refrain from taxing your IRA and 401 (k) distributions.

Retirement Contributions & The Saver’s Credit

You may be eligible for the Saver’s Credit if you made contributions to an IRA or employer-sponsored retirement plan. Also known as the Retirement Savings Contribution Credit, the Saver’s Credit is available to those who are:

- 18 years or older,

- Not claimed as a dependent on another taxpayer’s return, and

- Not a student.

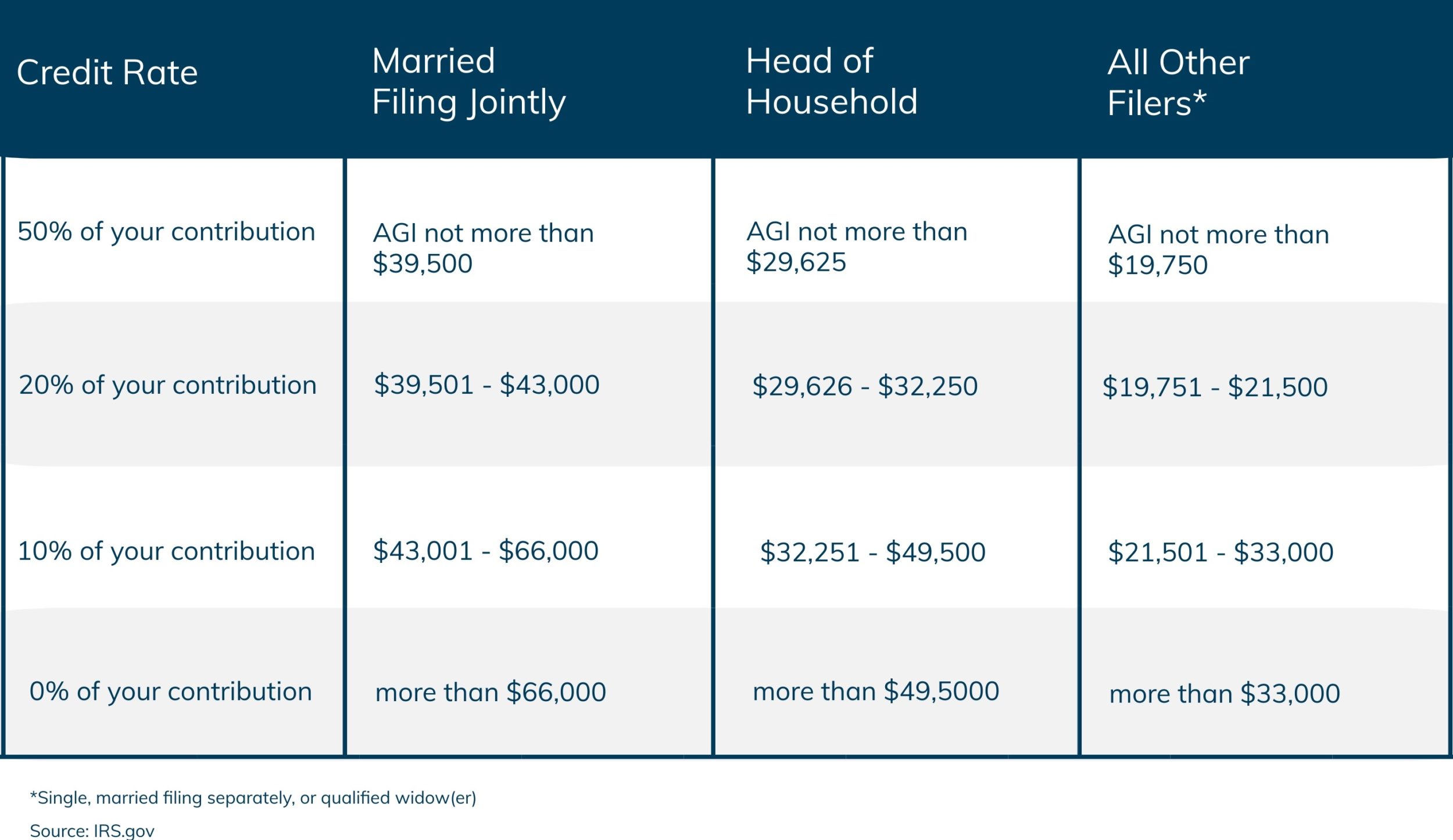

Depending on your adjusted gross income (AGI), the amount of the credit may be 50%, 20%, or 10% of:

- Contributions you made to an IRA (traditional or Roth),

- Elective salary deferral contributions, such as a 401 (k),

- Voluntary after-tax employee contributions made to a qualified retirement plan, such as the federal Thrift Savings Plan,

- Contributions made to a 501(c)(18)(D) plan, or

- Contributions made to an ABLE account (you must be the designated beneficiary).

The maximum contribution amount is $2,000 (single) or $4,000 (married filing jointly), making the maximum credit $1,000 (single) or $2,000 (married filing jointly).

2021 Saver’s Credit AGI Brackets

Unfortunately, rollover contributions are ineligible for the Saver’s Credit.

Bottom Line

Saving for your retirement is an important step in securing your financial future. Knowing which plan is right for you and which will give you the best tax benefits, however, can get complicated. If you’re uncertain as to which deductions you are eligible to take, or unclear as to how your contributions may impact your taxes, is best to reach out to a tax professional. Call 855-476-6920 to speak with a Tax Defense Network tax pro today!