Do you owe taxes and can’t afford to pay? The IRS Fresh Start Program can offer a lifeline in managing tax obligations and alleviating financial burdens. Understanding the intricacies of the program, its eligibility criteria, and the application process is crucial for making an informed decision. And thanks to recent program changes, it’s now easier than ever to get tax relief. Keep reading to learn more about this IRS initiative and to see if you qualify.

What Is The IRS Fresh Start Program?

The IRS Fresh Start Initiative, often referred to as the Fresh Start Program, is an expansion of existing tax relief programs created to help taxpayers address their tax debt issues. Tax relief programs offered under the initiative include penalty abatement, installment agreements, Offer in Compromise (OIC), and Currently Not Collectible (CNC) status.

Determining which program is best for your situation can be difficult if you are not familiar with the various tax laws and rules. This is why we strongly recommend speaking with a tax professional to determine your eligibility before moving forward.

Advantages of the IRS Fresh Start Program

The advantages of enrolling in the IRS Fresh Start Program are multifaceted. The program provides a structured approach to addressing tax liabilities, offering manageable installment plans tailored to your financial capacity. This can significantly alleviate the immediate financial strain associated with large tax bills, allowing you to fulfill your obligations without experiencing undue hardship. Moreover, the opportunity for lien withdrawals while in an installment agreement can enhance your financial flexibility, enabling you to engage in transactions such as asset refinancing or property sales without the encumbrance of IRS liens.

Another facet of the Fresh Start Program, an Offer in Compromise (OIC), allows you to settle your tax debts for less than the full amount owed. An OIC can lead to substantial savings and provide a fresh start in managing your financial responsibilities. Additionally, the program’s leniency in considering factors such as income, expenses, and asset equity ensures that individuals facing genuine financial hardship can seek a viable resolution through the program.

Who Qualifies For the IRS Fresh Start Program?

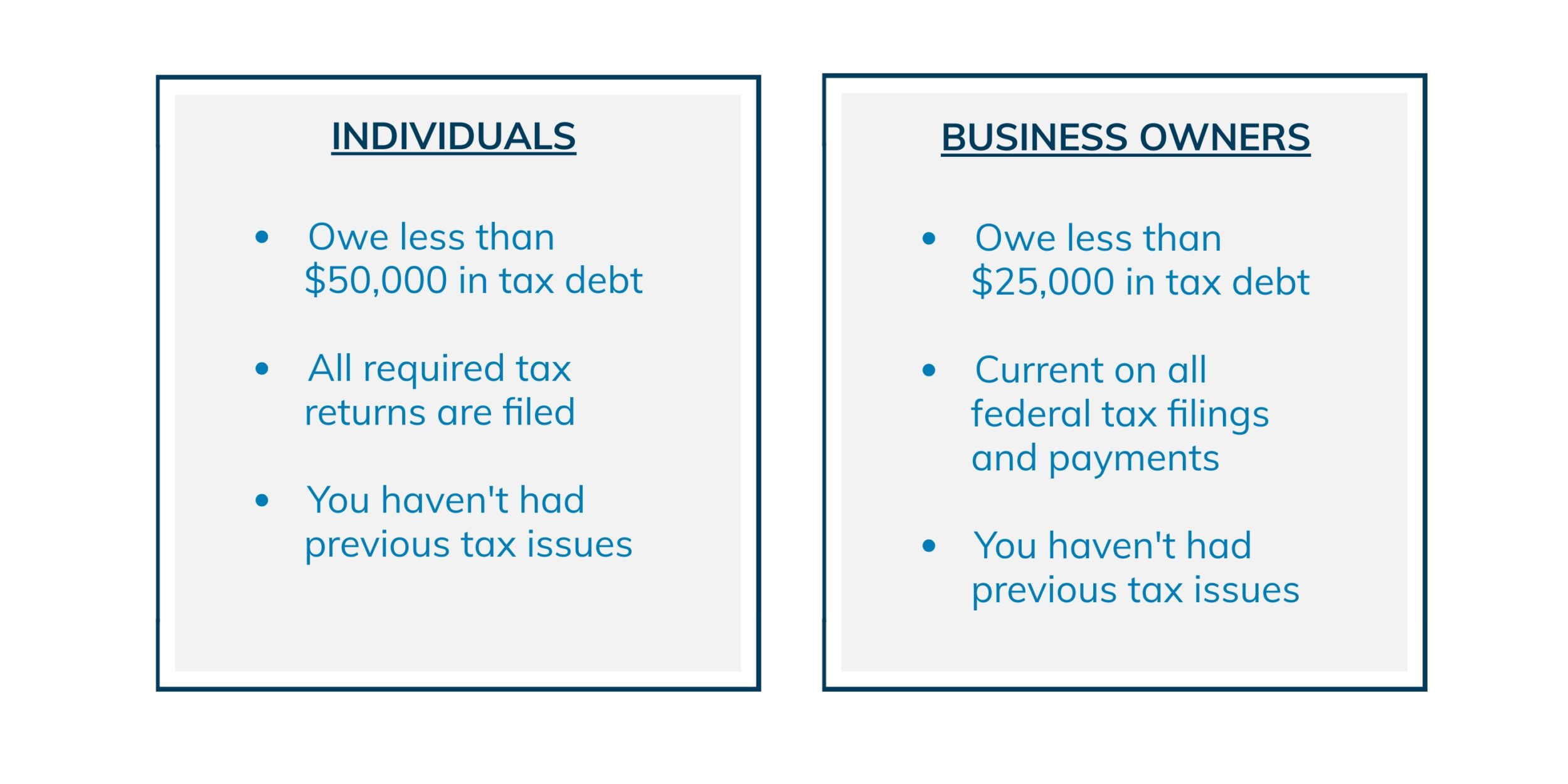

The IRS has made it easier than ever for individuals and business owners to qualify for the Fresh Start Initiative. In general, you must meet the eligibility requirements listed below to apply for any of the Fresh Start programs.

If you are self-employed, you must also be able to show that you’ve had at least a 25 percent reduction in your income over the past year.

Additional Program Requirements

Keep in mind that each tax relief program under the IRS Fresh Start Program has additional eligibility requirements. Below is a brief overview of each one.

Penalty Abatement

Under the IRS Fresh Start Program, you may be eligible for First-Time Penalty Abatement (FTA) if you; (1) have no penalties in the past three tax years, (2) are up to date on filing, and (3) you have paid or made arrangements to pay your tax bill. Individuals and businesses can request FTA for failure-to-file and failure-to-pay penalties. Businesses may also request FTA for failure-to-deposit penalties.

Streamlined Installment Agreement

The streamlined installment agreement is a popular option under the Fresh Start Program. It allows you to pay off your debt within 72 months, or the collection statute of limitations, whichever is less. You can request this payment plan online, by mail, or by calling the IRS. If you meet the general requirements for the Fresh Start Program, you should be approved.

If you owe less than $25,000 and currently have a tax lien against you, entering an installment agreement may also qualify you to have the lien removed after a certain number of payments.

Offer in Compromise

An Offer in Compromise is about as close as you can get to tax debt forgiveness. If approved, you may be able to settle your tax debt for substantially less than you currently owe. The IRS will generally approve an OIC if paying your tax debt will cause extreme financial hardship and they don’t believe that they can collect in full. You must also meet the following qualifications:

- Current on all tax returns

- Have at least one IRS bill

- Not behind on any estimated tax payments (if applicable)

- No open Innocent Spouse Relief claim

- Not currently being audited by the IRS

- No open bankruptcy proceedings

- No case open with the Department of Justice

If you are a business owner, you must also make all required federal tax deposits for the present quarter. You can easily check your eligibility by using the Offer in Compromise Pre-Qualifier Tool on IRS.gov.

IRS Fresh Start – Currently Not Collectible

To qualify for Currently Not Collectible (CNC) status, you must provide evidence that your income is insufficient to meet your necessary living expenses. If you owe less than $10,000, the IRS has eased the documentation requirements, making it much easier to qualify. If approved for CNC status, all collection actions will cease until your financial situation improves. Your tax debt may be forgiven if you remain in CNC status until the statute of limitations runs out.

Common Misconceptions About The IRS Fresh Start Program

Despite its potential to provide significant relief, the IRS Fresh Start Program is often shrouded in misconceptions that can deter individuals from exploring its benefits. One prevalent misconception is the notion that the program is inaccessible to a wide range of taxpayers, leading to a lack of awareness about its provisions and eligibility criteria. In reality, the program caters to diverse financial circumstances and offers avenues for relief to a broad spectrum of taxpayers facing tax burdens.

Another common misconception pertains to the complexity of the application process and the perceived challenges associated with navigating the program’s requirements. Although it is true that the Fresh Start Program entails specific criteria and documentation, seeking guidance from tax professionals and leveraging available resources can facilitate a smoother and more informed approach to enrolling in the program. Dispelling these misconceptions is essential in empowering taxpayers to make well-informed decisions regarding their tax obligations.

Get Help

The biggest hurdle to qualifying for the IRS Fresh Start Program is making sure all of your tax returns are up to date. If you have any unfiled returns, you won’t qualify. At Tax Defense Network, we can help you file past-due returns and determine which Fresh Start programs will best match your specific needs. To learn more about our affordable services, call 855-476-6920 and receive a free consultation today!