Form 9465, Installment Agreement Request

If you can’t pay your federal income taxes in full, you may be eligible to request an installment agreement by filing IRS Form 9465. This will allow you to pay off your tax debt over several months or years. Before requesting a payment plan, however, consider other alternatives for paying your tax bill. Penalties and interest fees will continue to accrue until your balance is paid in full, so a loan or line of credit may be less costly.

Who Can Use Form 9465?

You are eligible to use IRS Form 9465 if you’re an individual who:

- Owes income tax on Form 1040 or 1040-SR,

- Is or may be responsible for a Trust Fund Recovery Penalty,

- Owes employment taxes related to a sole proprietor business that is no longer operating, or

- Owes an individual shared responsibility payment under the Affordable Care Act.

Do not use Form 9465 if you can pay the balance within 120 days, want to request a payment plan online, or your business is still operating and you owe employment or unemployment taxes. If you’re in bankruptcy proceedings or the IRS has accepted an Offer in Compromise from you, do not use this form. Instead, call 800-829-1040 for assistance.

Automatic Approval of an Installment Agreement

If you owe $10,000 or less, the IRS will automatically approve your installment agreement if the following conditions are met:

- During the past five (5) tax years you (and your spouse, if filing jointly) have filed all required returns on time and paid all taxes due;

- You haven’t entered into an installment agreement in the last five (5) years;

- You agree to pay your full tax balance within three (3) years and comply with all tax laws while the agreement is in effect;

- You’re unable to pay your taxes in full when they are due.

For tax debts over $10,000, the IRS will generally let you know within 30 days if your request for a payment plan is approved or denied. Once approved, you’ll receive a notice detailing the terms of your agreement and associated fees.

Installment Agreement Fees

The IRS charges a setup fee for installment agreements. The amount varies based on how you submit your request and how you plan to make your payments.

| Payment Method | Applicable Fee | |

|---|---|---|

| Using the online application | Other application methods | |

| Direct debit | $31 | $107 |

| Check, money order, credit card, or debit card | $149 | $225 |

Low-income taxpayers may be eligible for a fee waiver or reimbursement if they meet the requirements. If you can pay your tax debt within 120 days, you can avoid the setup fee by using the online payment agreement (OPA) application at IRS.gov/OPA. You can also call the IRS at 800-829-1040 to set up an agreement over the phone.

How to Complete Form 9465

Taxpayers who owe more than $50,000 must submit Form 9465 by mail. If you owe less than $50,000, you can apply for an installment agreement online or submit the paper form. Below is a brief overview of what to expect when completing the form.

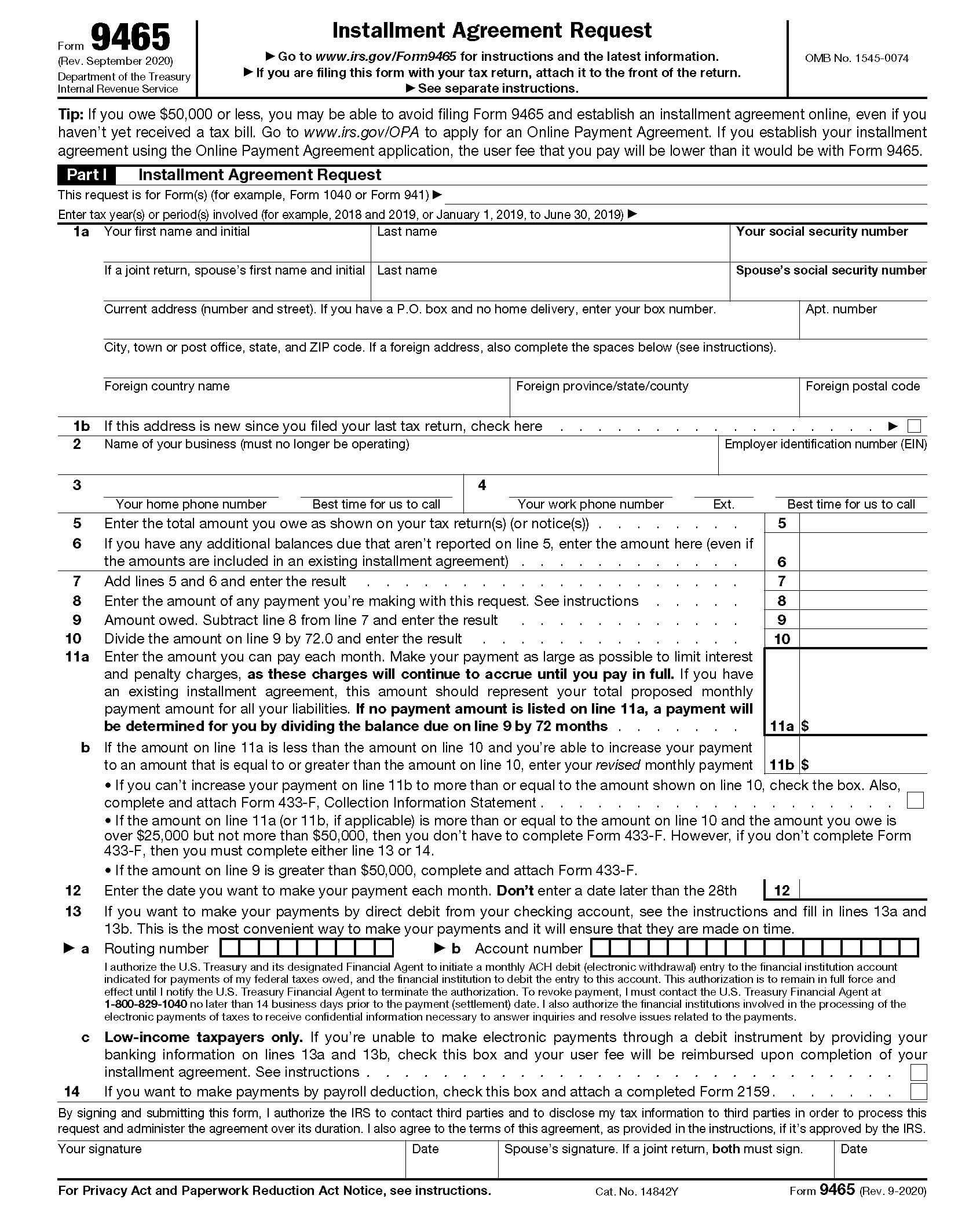

Part 1 – Installment Agreement Request

Form 9465, Part I must be completed by all applicants. Be sure to include which type of tax return (Form 1040, Form 941, etc.) the request is for and which tax year(s).

Lines 1 through 4. Enter your contact information in this section, as well as your Social Security number (SSN). If you’re a sole proprietor whose business is no longer operating, you’ll need to complete line 2 and enter your employer identification number (EIN), as well.

Line 5. Enter the total amount of tax owed from your return or IRS notice.

Line 6. Include any additional tax balances due on this line.

Line 7. Add lines 5 and 6. Enter the result here.

Line 8. Enter the amount you are including with the form. To limit your penalty and interest charges, pay as much as you can upfront.

Line 9. Subtract line 8 from line 7. Enter the result here.

Line 10. Divide the amount on line 9 by 72 and enter the result.

Line 11a. Enter the amount you can pay each month for ALL your tax liabilities, including any existing installment agreement. If you leave this blank, your payment will be determined by dividing your balance due by 72 months.

Line 11b. If the amount on Line 11a is less than line 10, and you can increase the amount of your payment to the same or greater than line 10, write the revised amount on Line 11b. If you can’t increase the amount to be equal to or greater than line 10, check the box below line 11b. You’ll also need to complete and attached Form 433-F, Collection Information Statement. If the amount on line 11a is greater than line 10, and your tax balance is between $25,000 and $50,000, you aren’t required to complete Form 433-F. You will, however, need to complete line 13 or 14. For tax balances (line 9) over $50,000, Form 433-F is required.

Line 12. Enter the date you wish to make your payment each month. Do not include any date past the 28th.

Line 13 (a-c). If you plan to make payments by direct debit from a checking account, enter your routing number on 13a and account number on 13b. Low-income taxpayers who wish to be reimbursed the user fee and can’t make direct debit payments should check box 13c.

Line 14. For payments through payroll deduction, complete Form 2159 and check this box.

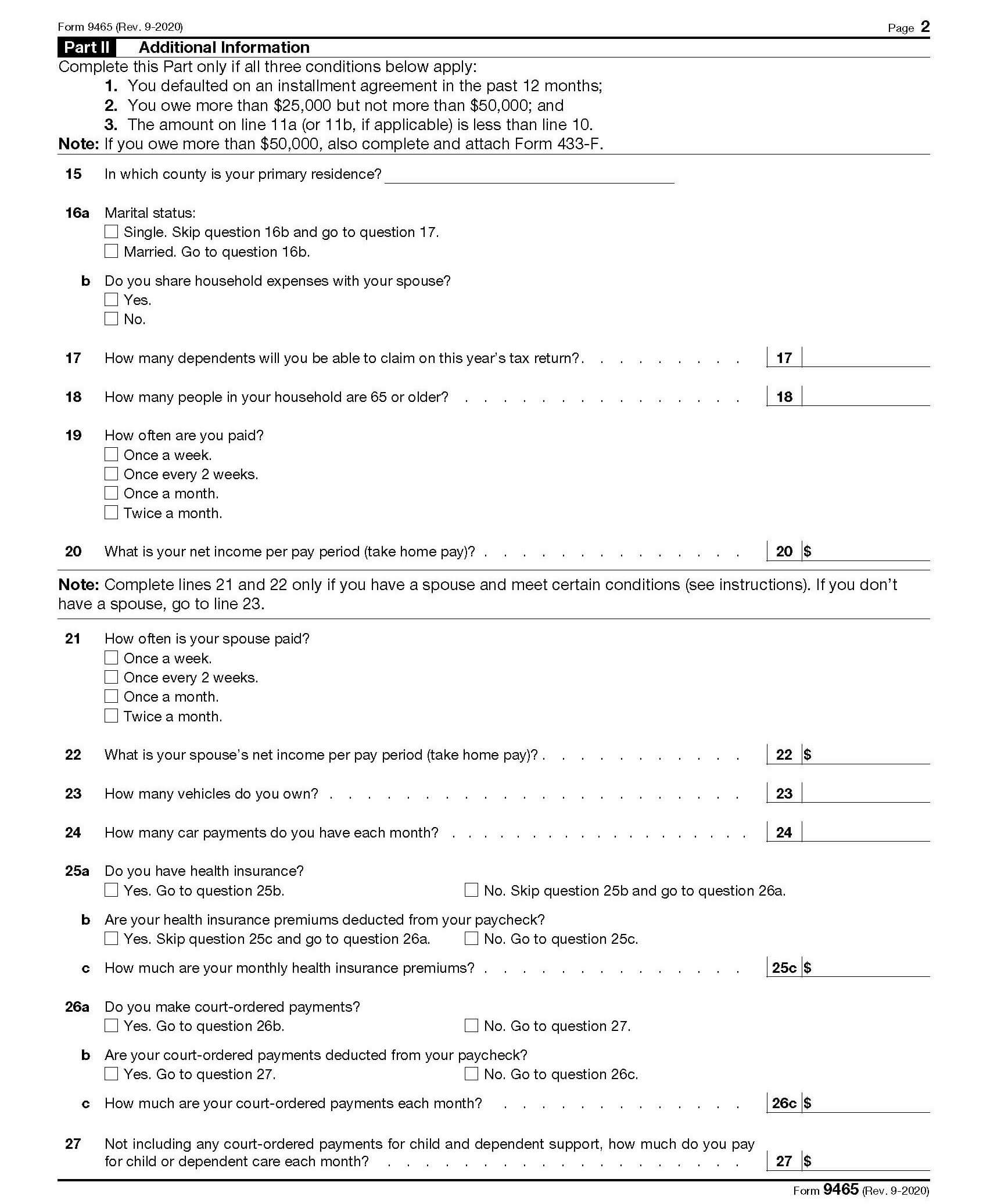

Part II – Additional Information

Part II includes more personal information about your household, employment, and any court-ordered payments you currently make. You do not have to complete Part II unless all three of the following conditions apply:

- You defaulted on an installment agreement within the last 12 months;

- You owe between $25,001 and $50,000; and

- The amount on line 11a (or 11b, if applicable) is less than line 10.

Once the form is complete, attach it to the front of your tax return and send it to the address shown on your tax return booklet. If you are mailing Form 9465 on its own because you already filed or received a notice, refer to the chart in the instructions to find the correct mailing address for your location and tax return filed. Be sure to include your initial payment, as well.

Need Help?

If you need help applying for an installment agreement or would like to explore your other tax relief options, call Tax Defense Network at 855-476-6920 for a free consultation today!