The Internal Revenue Service (IRS) uses penalties to encourage people and businesses to file and pay their taxes on time. In fiscal year 2020, more than $14 billion was assessed in civil penalties on individual and estate and trust income tax returns. Thankfully, there are several options to help you reduce or remove your IRS penalties, if qualified.

Most Common IRS Penalties

There are over 150 different types of penalties in the U.S. Internal Revenue Code. Depending on the severity of the IRS penalty, monetary fines or the forfeiture of property may be involved. If it is a criminal penalty, you may also face jail time. The most common penalties include:

- Failure to File (FTF). The Failure to File penalty is based on how late you file your tax return and how much you owe as of the original payment due date. For returns over 60 days late, the minimum FTF penalty is $435 (for 2020 returns) or 100% of the tax owed on the return, whichever is less. Each month you do not file, you’ll be charged 5% of the unpaid taxes. It maxes out after 5 months and will not exceed 25% of your unpaid taxes.

- Failure to Pay (FTP). The Failure to Pay penalty may be imposed for taxes you did not pay on your return, as well as those you didn’t report. The FTP penalty is .5% of the unpaid taxes for each month you do not pay. If you receive a Notice of Intent to Levy and do not pay, the penalty increases to 1% per month. The penalty maxes out at 25% of your unpaid taxes. If the FTF and FTP penalties are assessed in the same month, the total for both will not exceed 5% of your unpaid taxes per month.

- Accuracy-Related Penalty. The IRS may impose an Accuracy-Related penalty equal to 20% of any underpayment of taxes due to certain actions on your behalf. This may include negligence, disregard of rules (careless, reckless, or intentional), understatement of income tax, or valuation errors.

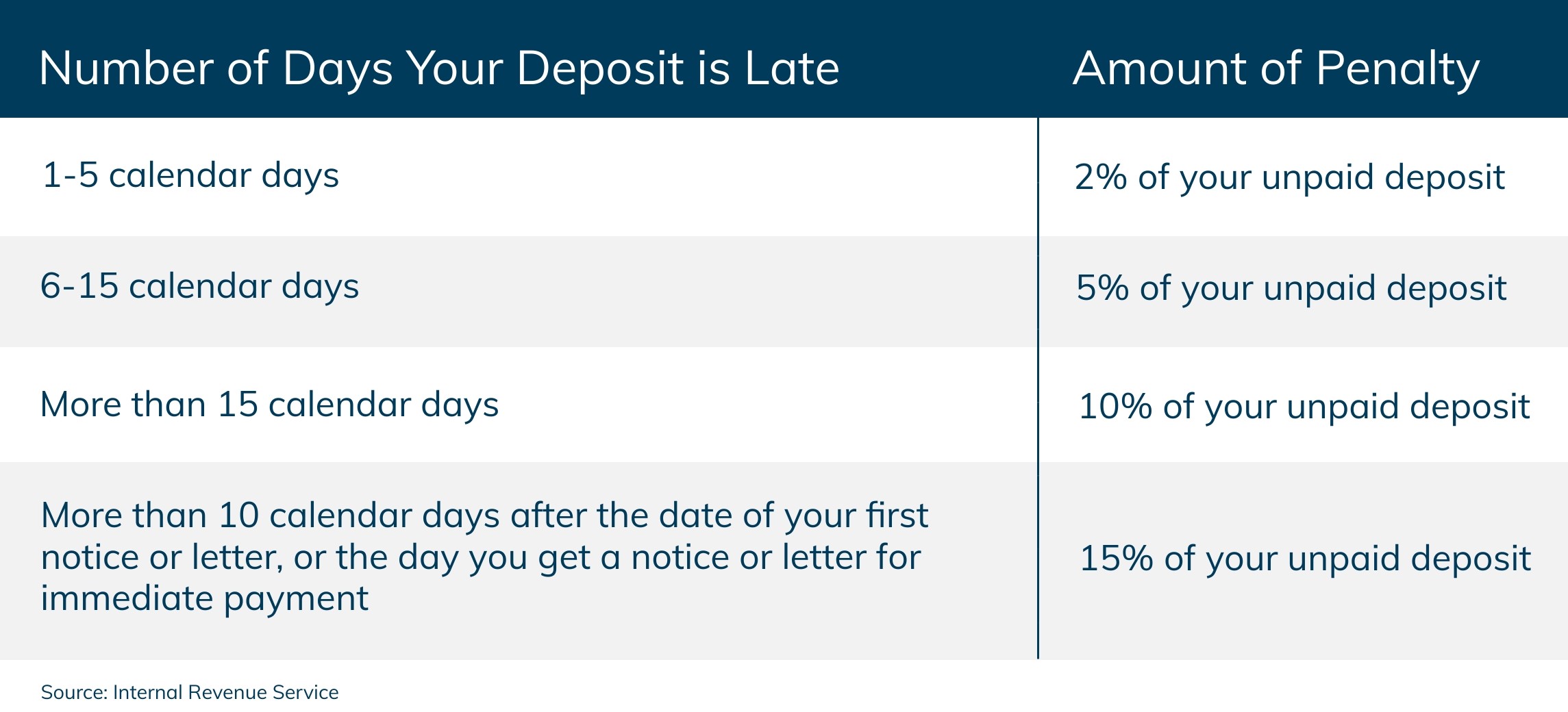

- Failure to Deposit (FTD). Employers who do not make employment tax deposits on time, in the correct amount, or in the right way will face a Failure to Deposit penalty. The penalty amount varies from 2% to 15% of your unpaid deposit.

- Underpayment of Estimated Tax. If you do not pay enough in taxes throughout the year, either through withholding or estimated taxes, you may have to pay a penalty. Unlike other penalties, there is no set percentage or flat amount assessed. The IRS will calculate your penalty amount based on the total underpayment amount when it was underpaid, and the interest rate for that specific period (it changes every quarter).

Keep in mind that the IRS also charges interest on penalties. In some cases, this can significantly increase the amount you owe.

Can I Get My Interest Reduced or Waived?

Generally, the IRS does not reduce or remove any interest charges unless the penalty is removed or reduced. In very rare cases, due to an IRS error or delay, the IRS may remove any interest accrued due to its negligence. There is, however, one surefire way to reduce your interest – an IRS payment plan. If approved, the IRS will cut your Failure to Pay penalty in half which will reduce your interest fees, as well.

IRS Penalty Relief

It is possible to reduce or remove some tax penalties, though it is never guaranteed. There are three types of penalty relief offered by the IRS:

- Reasonable Cause. The IRS may waive an FTF, FTP, or FTD penalty if you can show reasonable cause why you were unable to meet your tax obligations. Death, serious illness, natural disasters, and the inability to obtain records are just a few examples. When requesting this type of penalty relief, you’ll need to establish the facts and provide sufficient evidence to support your claim.

- First-Time Penalty Abatement. You may qualify for First-Time Penalty Abatement, also known as an administrative waiver, if all of the following are true:

- No previous tax return was required or you haven’t been penalized within the last three tax years prior to the year you received the penalty.

- All required tax returns are filed or you have a filing extension.

- You have paid, or made arrangements to pay, any taxes due.

You may also qualify for an administrative waiver if you received incorrect oral advice from the IRS. Please note that the FTP penalty will continue to accrue until you have paid your taxes in full. Therefore, it’s best to wait until your balance is paid off before requesting First-Time Penalty Abatement.

- Statutory Exception. If you received incorrect written advice from the IRS, you may qualify for a statutory exception. IRS Form 843, Claim for Refund and Request for Abatement, should be filed when seeking this type of relief.

For the Underpayment of Estimated Tax penalty, the fees may be waived if any of the following are true:

- You did not owe taxes the previous year

- A disaster, casualty, or other unusual event caused you to miss the payment

- During the current tax year, you retired at age 62 or older

- You became disabled during the prior or current tax year

- You qualify under the “estimated tax safe harbor rule”

The “estimated tax safe harbor rule” applies if you paid 90% or more of your total tax from the current tax year or 100% from the prior year, or you owe less than $1,000 in taxes. If your adjusted gross income (AGI) is $75,000 or higher ($150,000 or more for married filing jointly), you may not be subject to the penalty if you paid 90% of the tax from this year’s return or 110% from the prior year, whichever is less.

Helpful Tips

Make sure you choose the correct penalty relief option for your situation and the best communication method. For First-Time Penalty Abatement requests, calling the IRS directly is your best option. Written requests, however, are better when seeking relief through reasonable cause.

Unfortunately, the IRS is notorious for losing penalty abatement requests. Be sure to follow up on your relief request by calling the IRS. If they have no record of your request, refile it ASAP. You should also ask that they place a collection hold on your account while your request is being reviewed.

Although First-Time Penalty Abatement requests are typically resolved within two to three months, requests for penalty relief due to reasonable cause can take much longer. If an appeal is required, you could be waiting up to a year for a final resolution.

If you need assistance with reducing or removing your tax penalties, call 855-476-6920 to schedule a free consultation with Tax Defense Network today!