Key Takeaways

For 2025, the SALT deduction cap has increased from $10,000 to $40,000 ($20,000 for married filing separately).

For tax years 2026 through 2029, the cap will increase 1%. In 2030, it will revert to $10,000.

The SALT cap is reduced for those with MAGIs between $500,000 and $600,000. Those with a MAGI over $600,000 may only claim up to $10,000.

What Is the SALT Deduction?

The SALT deduction is a tax provision (federal) that allows taxpayers to deduct certain state and local taxes from their taxable income. This includes:

- Income Tax. Most states impose income taxes on individuals and corporations, although the rates and income brackets vary. Nine states – Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming – do not levy state income taxes.

- Sales Tax. Taxes collected on the sale of goods and certain services at the point of purchase. Sales tax rates vary by state and differ within local jurisdictions.

- Property Tax. Property tax levied on the value of real estate properties, such as homes, land, and commercial buildings. The tax rate is typically based on the assessed fair market value of the property.

- Personal Property Tax. Personal property taxes levied on the value of items such as vehicles or boats that are charged annually qualify under SALT.

The SALT deduction was formally established as part of the Revenue Act of 1913, which created a permanent federal income tax. Since its introduction, SALT has changed over the years.

How the 2017 SALT Cap Changed the Game

In 2017, significant changes were made to the SALT deduction under the Tax Cuts and Jobs Act (TCJA), including:

- $10,000 Cap on SALT Deduction. Before 2018, taxpayers who itemized could deduct all their state and local income taxes, property taxes, and, in some cases, sales taxes. The TCJA imposed a $10,000 cap ($5,000 if married filing separately) on the combined total of these deductions.

- No Indexing For Inflation. The $10,000 limit was not indexed for inflation, meaning its real value eroded each year, further reducing potential savings as state and local taxes naturally increased.

- Standard Deduction Doubled. TCJA also nearly doubled the standard deduction, reducing the number of taxpayers who could benefit from itemizing, including the SALT deduction.

High-tax states, like California and New York, were most impacted by these changes since their taxpayers often paid far more than $10,000 in income and property taxes. The increased standard deduction, combined with the limited SALT deduction, also resulted in a reduction of itemized returns. In 2017, 30% of taxpayers itemized, but that number fell to just 10% in 2018.

The lower SALT cap also became a key partisan issue, with Republicans supporting it as a tax equity measure and Democrats lobbying for its repeal or increase. This eventually led to the proposed (and now enacted) expansion in 2025.

2025 SALT Cap Increase: What You Need to Know

Under Trump’s One Big Beautiful Bill Act (OBBBA), the SALT cap increased from $10,000 to $40,000 ($20,000 for married filing separately) for most taxpayers for the 2025 tax year. It’s important to note that:

- Starting in 2026, the cap amount increases by 1% annually. This is a fixed rate and not tied to inflation.

- The increased SALT deduction is only available until 2029 and will revert to $10,000 in 2030, if not extended.

Income Limits & Phase-Outs: Who Benefits Most

In addition to the increased cap, income thresholds were also raised.

- The full benefit applies to those with a modified adjusted gross income (MAGI) below $500,000 ($250,000 if married filing separately).

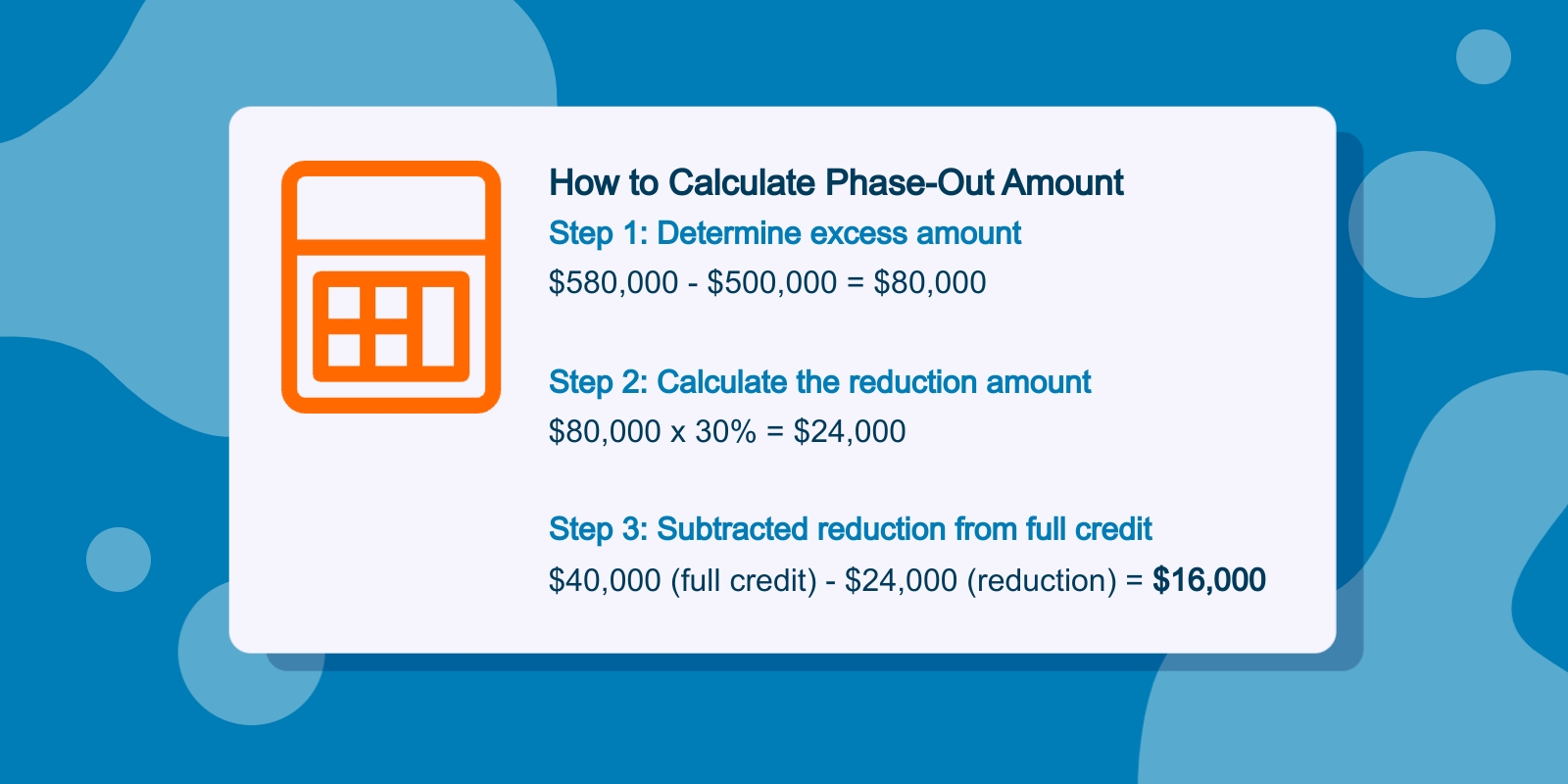

- For taxpayers with a MAGI between $500,000 and $600,000, the cap is reduced by 30% of the income above $500,000. For example, someone with a MAGI of $580,000 would be able to take a SALT deduction of $16,000.

- For those with a MAGI above $600,000, the maximum SALT deduction is $10,000.

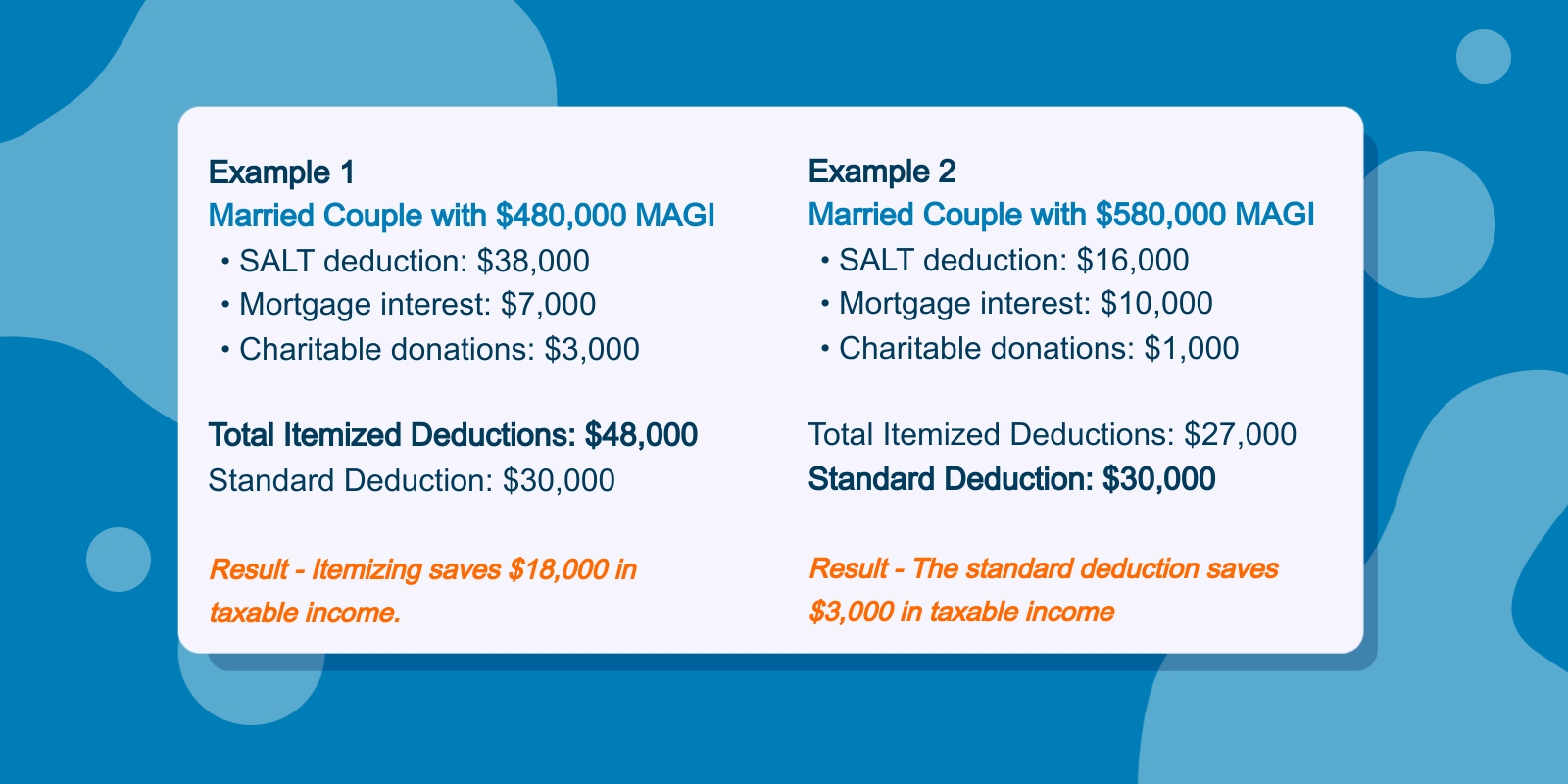

With the increased cap and income limits, higher-income taxpayers stand to benefit the most from the recent SALT changes. Many may now find it worthwhile to itemize instead of taking the standard deduction.

Itemizing vs. Standard Deduction Under the New Cap

The 2025 expansion of the SALT deduction cap under OBBBA has reopened the itemization conversation for millions of taxpayers. Although the standard deduction remains a strong choice for many, the increased SALT limit now makes itemizing a viable and potentially more rewarding strategy for high-income filers and homeowners in high-tax states.

Standard Deduction at a Glance

For tax year 2025, the standard deduction amounts are as follows:

- Single and Married Filing Separately – $15,000

- Head of Household – $22,500

- Married Filing Jointly – $30,000

When Itemizing Makes Sense Under SALT

The new $40,000 SALT deduction cap (or $20,000 MFS) can substantially boost your itemized deductions, especially if you have:

- Significant mortgage interest

- Charitable contributions

- Large medical expenses (exceeding 7.5% of AGI)

- Investment interest or miscellaneous deductions

For taxpayers who qualify for the full deduction, that alone may make it worthwhile to itemize instead of taking the standard deduction. Those with MAGIs above $500,000 and fewer other deductions, however, may find that the standard deduction is the better option.

Tax Strategies to Maximize the SALT Deduction

With the SALT cap raised to $40,000 under OBBBA, savvy taxpayers have new opportunities to reduce their federal tax liability, especially through careful timing, entity structuring, and deduction planning. Here’s how to get the most out of the revised SALT deduction rules between 2025 and 2029.

- Time State and Local Payments Strategically.

If you’re near the standard deduction threshold or facing phase-out exposure, the timing of payments can make or break your ability to itemize.

- Prepay property taxes before year-end when possible. FYI – IRS rules prohibit deducting prepaid taxes not yet assessed, so work with your state’s payment guidelines to ensure compliance.

- Consider paying estimated state income taxes in December rather than January.

- If you expect income to push you over the $500,000 MAGI threshold in a future year, front-load deductible taxes now to capture the higher cap before phase-outs reduce your benefit.

- Leverage Mortgage Interest to Bolster Itemizing.

Mortgage interest is still deductible on loans up to $750,000. If you’re close to the itemization threshold:

- Buy or refinance strategically, especially in high-rate environments.

- Combine your mortgage interest with SALT payments and charitable giving to exceed the standard deduction in select years.

- Bundle Charitable Contributions.

Bunching charitable donations into one tax year can help taxpayers itemize in that year while taking the standard deduction in others.

- Use Donor-Advised Funds (DAFs) to consolidate multiple years of giving.

- Consider pairing high-SALT years with high-charity years to maximize deductions.

- Use Trusts to Expand SALT Deduction Access.

High-income earners facing the MAGI phase-out may benefit from advanced planning strategies using non-grantor trusts:

- Each trust is treated as a separate tax entity and can claim its own $40,000 SALT cap.

- Commonly used in states like NY and CA to preserve deductions across multiple trusts.

- Not a DIY approach. Work with a tax professional, as this requires estate and tax planning expertise.

- Shift Income or Deductions Across Tax Years.

If you’re teetering near the $500,000 MAGI threshold, managing the timing of income and deductions can prevent phase-out erosion:

- Delay bonuses, capital gains, or stock option exercises into the next year if it helps keep MAGI below the limit.

- Defer business income or accelerate business expenses (if self-employed) to preserve deduction eligibility.

- Harvest losses in investment portfolios to reduce taxable income.

Because the SALT deduction eligibility now varies based on income, location, timing, and legislation, it’s wise to recalculate your deduction strategy every year. The expanded cap won’t last forever (it reverts to $10,000 in 2030), so take full advantage while it’s in place.

Final Thoughts

Expansion of the SALT deduction marks a dramatic shift for taxpayers, especially those in high-tax states. It offers a much-needed opportunity to reassess deduction strategies and potentially lower your federal tax burden. Still, the enhanced cap comes with income limits, phase-outs, and the need to itemize wisely. Stay proactive by tracking your state and local tax payments, consider timing moves, and watch for shifts at the local level that may respond to this newfound federal flexibility. With prudent planning and insight, you can make the most of this evolving deduction landscape and adapt quickly when the next round of tax changes arrives