Have you ever stumbled upon information about someone or a company evading taxes? If so, you might be eligible to become an IRS whistleblower and potentially earn a substantial reward. The Internal Revenue Service (IRS) has a program that encourages individuals to report tax fraud, and in return, they may receive a portion of the collected proceeds.

The decision to become an IRS whistleblower should not be taken lightly. It’s crucial to understand the process, the potential rewards, and the risks involved. Sit back as we delve into the intricacies of the IRS whistleblower program, exploring whether it truly pays off to become one.

The Role of an IRS Whistleblower

As an IRS whistleblower, your primary role is to provide credible information about individuals or entities that are violating tax laws. This could involve tax evasion, tax fraud, or other forms of tax-related misconduct. By coming forward with this information, you’re assisting the IRS in identifying and rectifying these violations, ultimately contributing to a fairer tax system.

Whistleblowers can be current or former employees, contractors, or other individuals who know of tax violations. The key requirement is that you possess specific and credible information about the wrongdoing, backed by evidence or documentation.

How Does The IRS Whistleblower Program Work?

The IRS whistleblower program is designed to incentivize individuals to report tax fraud and other violations. Here’s how the process typically unfolds:

- Submission of Information: You must submit a formal claim (IRS Form 211) to the IRS Whistleblower Office, providing detailed information about the alleged tax violation. This includes the names of the individuals or entities involved, the nature of the violation, and any supporting documentation or evidence.

- Evaluation and Investigation: The IRS Whistleblower Office will review your claim and determine whether it meets the necessary criteria for further investigation. If the claim is deemed credible, the IRS will initiate an investigation into the alleged tax violation.

- Enforcement Action: If the investigation confirms the tax violation, the IRS will take appropriate enforcement actions. This may include audits, assessments, or legal proceedings, to collect the unpaid taxes, penalties, and interest.

- Reward Determination: If the IRS collects proceeds as a result of the information you provided, you may be eligible for a reward. The reward amount is typically a percentage of the collected proceeds, subject to certain criteria and limitations.

Who is Eligible to File a Claim?

Although most people are eligible to file a claim, the IRS Whistleblower Office will reject any submitted by the following:

- Current employees of the Department of Treasury (or a past employee who obtained the information while employed by the Department of Treasury);

- Individuals working for the federal government who obtained the information through their official duties or while acting within the scope of their duties;

- Any individual who is or was required by federal law or regulation to disclose the information or who is or was precluded by federal law or regulation from disclosing the information;

- Any individual who had access to or obtained the information due to a federal contract; or

- Any individual who filed a claim for an award based on information obtained from an ineligible whistleblower to avoid the rejection of the claim if the claim had been filed by the ineligible whistleblower.

If you are deemed ineligible, the IRS will provide written notice of its rejection.

How Much Does The IRS Pay For Fraud Tips?

The IRS has a sliding scale for determining the reward amount for whistleblowers. Generally, if the collected proceeds from the tax violation exceed $2 million, the whistleblower may receive between 15% and 30% of the collected amount. If the collected proceeds are less than $2 million, however, the reward is capped at a maximum of 15%.

It’s important to note that the IRS has discretion in determining the exact percentage within the specified range, based on various factors, which we’ll explore in the next section.

Factors That Determine The Reward Amount

While the IRS whistleblower program offers the potential for substantial rewards, the actual amount you receive can vary significantly based on several factors:

- Substantiation of Information: The credibility and quality of the information you provide plays a crucial role in determining the reward amount. Well-documented and substantiated claims are likely to receive a higher percentage of the collected proceeds.

- Degree of Assistance: The extent to which your information and cooperation assists the IRS in investigating and resolving the case can impact the reward amount. If your assistance is deemed invaluable, you may receive a higher percentage.

- Timeliness of Information: The timeliness of the information you provide can also influence the reward amount. If you report the tax violation promptly, before the IRS becomes aware of it, you may receive a higher percentage compared to situations where the IRS was already investigating the case.

- Compliance with IRS Requests: Your cooperation and responsiveness to any requests or inquiries from the IRS during the investigation process can positively impact the reward amount.

- Existence of Other Whistleblowers: In cases where multiple whistleblowers provide information about the same tax violation, the IRS may allocate the reward among them based on the significance and timing of their respective contributions.

How Long Does it Take to Get Paid For an IRS Tip?

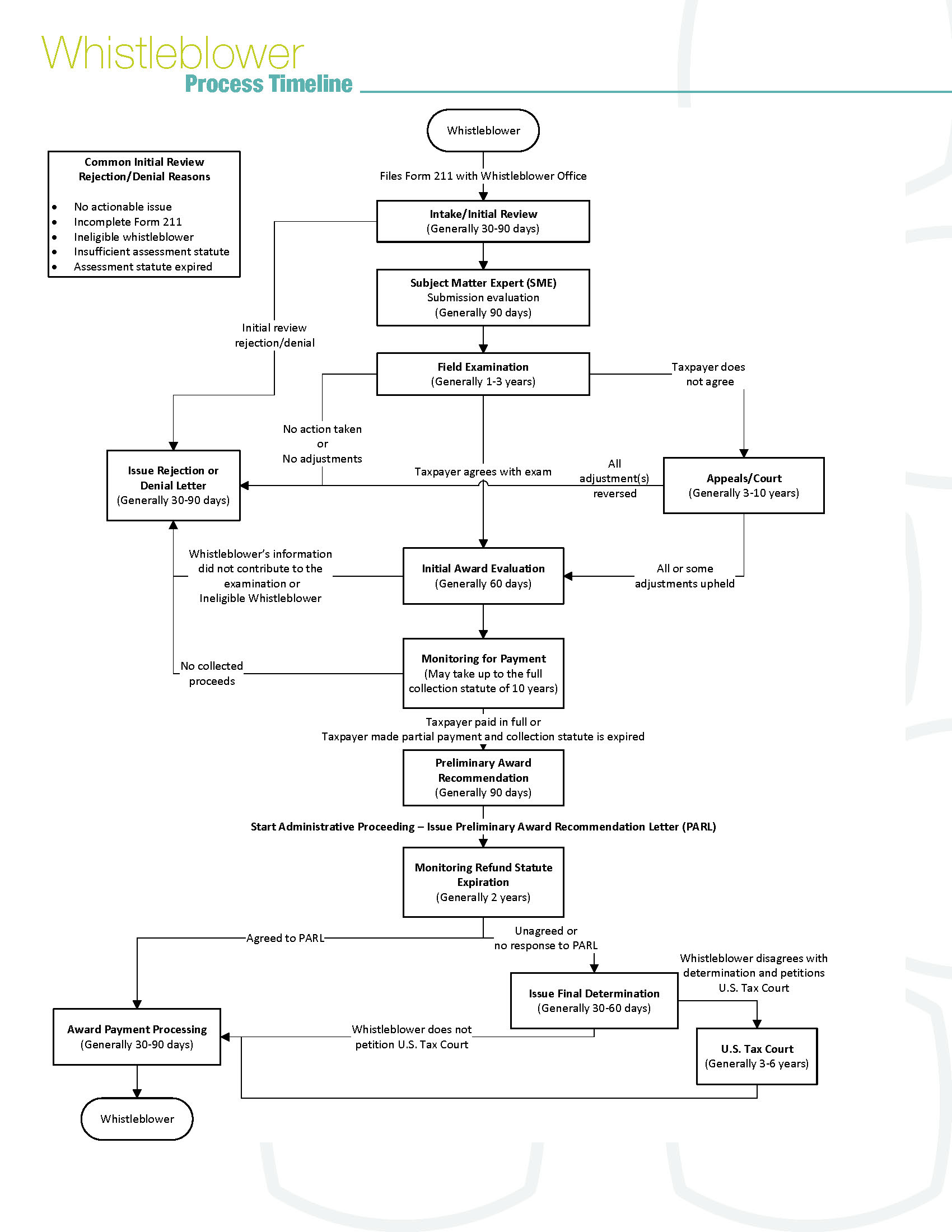

The process of receiving a reward from the IRS whistleblower program can be lengthy and may take several years. Here’s a general timeline of what to expect:

It’s important to note that the IRS does not provide updates on the status of your claim during the investigation and enforcement process. You can request a status update by mail, however, once per calendar year. The request must include your claim number and be mailed to:

Internal Revenue Service

Whistleblower Office – ICE

M/S 4110

1973 N. Rulon White Blvd.

Ogden, UT 84404

Pros & Cons of Becoming an IRS Whistleblower

Like any significant decision, becoming an IRS whistleblower has its advantages and disadvantages. Here are some key pros and cons to consider:

Pros:

- Potential for Substantial Financial Rewards: If your information leads to the successful collection of unpaid taxes, you may be eligible for a significant reward, potentially ranging from 15% to 30% of the collected proceeds.

- Contributing to a Fair Tax System: By reporting tax violations, you’re helping to ensure that individuals and entities pay their fair share of taxes, promoting a more equitable tax system.

- Whistleblower Protection Laws: Various federal and state laws provide protections for whistleblowers, safeguarding them from retaliation or discrimination by their employers.

Cons:

- Lengthy Process with Uncertain Outcomes: The process of investigating and resolving tax violations can be lengthy, and there is no guarantee that your claim will result in a reward, even if the information you provided is credible.

- Potential for Retaliation: Despite legal protections, whistleblowers may still face the risk of retaliation or negative consequences from their employers or the individuals/entities they report.

- Confidentiality Concerns: While the IRS takes measures to protect the identity of whistleblowers, there is always a risk that your identity could be inadvertently revealed, potentially exposing you to personal or professional repercussions.

- Emotional and Professional Stress: Becoming a whistleblower can be emotionally and professionally taxing, as you may face scrutiny, legal proceedings, and potential conflicts with those you reported.

Protecting Yourself as an IRS Whistleblower

If you decide to become an IRS whistleblower, it’s crucial to take steps to protect yourself and your interests. Here are some recommendations:

- Consult a Legal Professional: Consider seeking advice from an experienced attorney who specializes in whistleblower cases. They can guide you through the process, ensure you follow proper procedures, and help safeguard your rights.

- Gather and Preserve Evidence: Collect and securely store any documentation, emails, recordings, or other evidence that supports your claim of tax violations. This evidence will be essential in substantiating your allegations.

- Maintain Confidentiality: Avoid discussing the details of your claim with anyone other than your legal counsel and the appropriate IRS officials. Maintaining confidentiality can help protect your identity and prevent potential retaliation.

- Understand Whistleblower Protection Laws: Familiarize yourself with the relevant federal and state laws that provide protections for whistleblowers, such as the False Claims Act and the Whistleblower Protection Act. These laws can help shield you from retaliation or discrimination.

- Seek Support: The process of becoming a whistleblower can be emotionally and mentally taxing. Consider seeking support from trusted friends, family members, or professional counselors to help you navigate the challenges.

Final Thoughts

Becoming an IRS whistleblower can be a complex and potentially rewarding endeavor. While the prospect of receiving a substantial financial reward for reporting tax fraud is enticing, it’s essential to carefully weigh the pros and cons, understand the process, and take necessary precautions to protect yourself.

The decision to become an IRS whistleblower should not be taken lightly, as it can have far-reaching consequences, both positive and negative. It’s crucial to have credible information, gather evidence, and seek legal guidance to navigate the process effectively.

Ultimately, the decision to become an IRS whistleblower rests on your personal values, risk tolerance, and commitment to upholding a fair and equitable tax system. If you possess information about tax violations and are willing to take the necessary steps to protect yourself, the IRS whistleblower program may present an opportunity to make a positive impact while potentially earning a significant reward.

If you have information about potential tax fraud or violations, consider consulting with an experienced whistleblower attorney. They can provide you with personalized guidance and assess the strength of your case. They can also help you navigate the complexities of the IRS whistleblower program. By taking the right steps and seeking professional advice, you can protect your interests while contributing to a fairer tax system. Don’t hesitate to take action – the rewards for being an IRS whistleblower can be substantial, but the process requires careful consideration and preparation.