Tax debt is nothing to brush off, especially when you owe an outrageous amount. If you can’t afford your tax debt, the IRS must decide if – and how – you’ll be able to pay. What does the IRS use to make that decision? You guessed it – tax forms. In this case, the IRS uses forms like Form 433-A or Form 433-F to determine if an agreement is in your future.

How to Start Tackling Your Tax Debt

The first step toward federal tax debt relief is to contact the IRS. This can be as simple as picking up the phone to give them a call, just be prepared for wait times. You can also use a tax debt relief company to contact the IRS on your behalf. Although you can deal with your tax debt on your own, hiring a professional service can help you reach a better resolution quicker, easier, and with less stress.

Whether you go DIY or professional with your tax relief help, the IRS agent who ends up working on your case will determine what the next steps look like for you. While the IRS will need to investigate your payment ability next, how they do that will vary depending on your situation.

What the IRS Considers for Your Payment Ability

To figure out how much you can reasonably pay your owed federal income tax, the IRS must have certain financial information about you. This includes:

- Any assets that you can take a loan against (e.g. house, other property, etc.)

- Any asset such as your car, boat, or house that you can sell to pay the tax debt

- Property that is yours but is held by someone else, including funds in bank accounts, retirement accounts, and trust funds

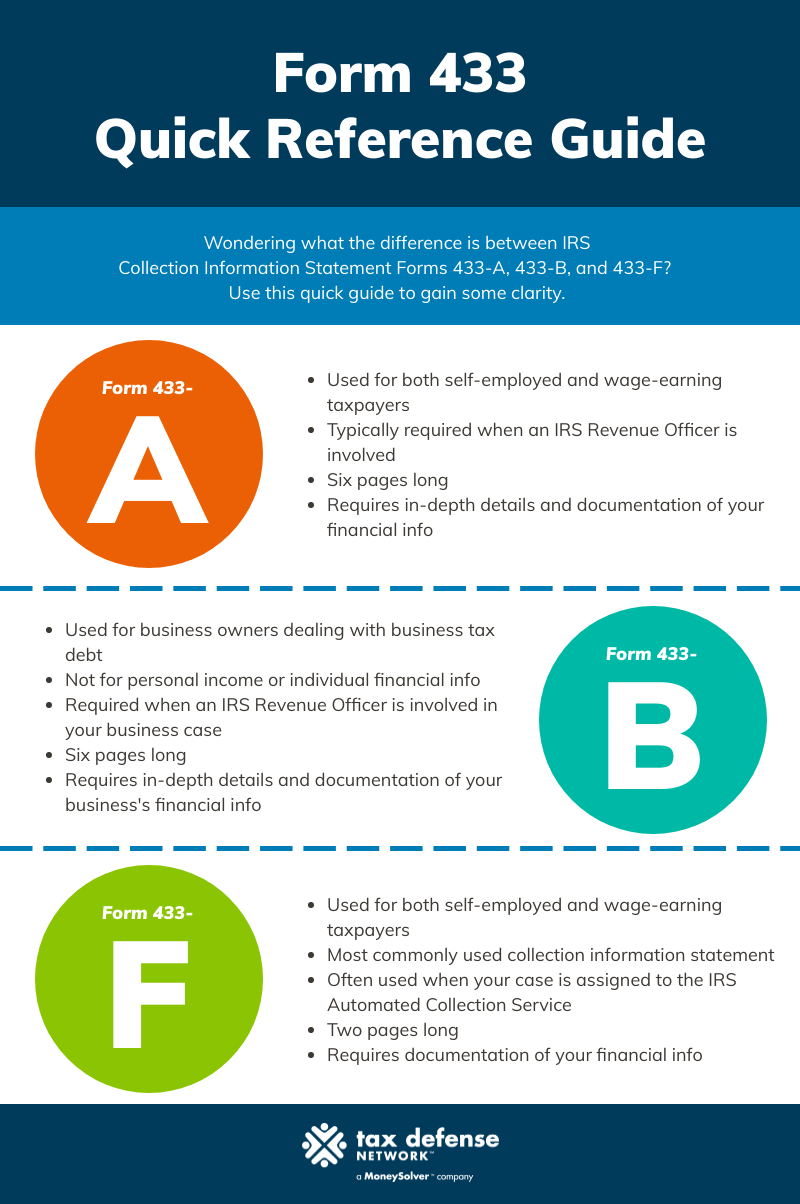

To gather this information, the IRS will ask you to send them a form, which could be Form 433-A, 433-B, or 433-F.

How Do You Know Which Form to Use?

It’s a headache that the IRS has so many different forms that all seem to serve the same purpose. The good news is that you don’t really need to deduce which form you’ll need. At the end of the day, the IRS will determine the form they require from you.

However, it’s always good to be knowledgeable about the form you’re filling out and why. Let’s look at these three forms and note the differences between them.

Form 433-A

IRS Form 433-A is used for both those who are self-employed and those who earn wages. If your IRS case is assigned to a Revenue Officer, they’ll likely require you complete Form 433-A.

You may deal with a Revenue Officer if you have more $250,000 in tax debt owed, you’ve mixed business and personal expenses, or you have payroll tax debt. However, Revenue Officers can still be assigned to cases without any of those characteristics.

Form 433-A is six pages long and requires a good amount of information. The information you’ll need to provide includes:

- Your name, social security number, driver’s license number, and date of birth

- Your employment information

- Any impending lawsuits, trust funds, or life insurance policies

- Any personal assets (e.g., vehicles, bank accounts, real estate)

- Business assets and gross monthly business income or expenses for those who are self-employed

- Paycheck stubs, bank statements, and credit card statements

- Monthly living expenses

Though the IRS has to leave you enough money to live (per the allowable living expenses), the agency will review your specific financial needs for monthly living expenses. There is a place on Form 433-A for you to include necessary total living expenses, including:

- Food, clothing and miscellaneous

- Housing and utilities

- Vehicle ownership and operation

- Public transportation

- Health insurance

- Out-of-pocket health care costs

- Court-ordered payments

- Current year taxes

- Secured debts

- Other expenses, such as student loans, unsecured debts, and tuition fees

Variation with a Purpose: Form 433-A (OIC)

If you’re interested in applying for an Offer in Compromise (OIC), you’ll need to complete Form 433-A (OIC). This form is included in the IRS Form 656 Booklet, which is used to submit a personal Offer in Compromise to the IRS. It requires much of the same detailed information as Form 433-A, but is geared specifically to get information for the IRS to consider an OIC.

Form 433-B

If your business owes taxes to the IRS, then you’ll need Form 433-B. Form 433-B is also generally required if your case has been assigned to a Revenue Officer.

Much like Form 433-A, Form 433-B is six pages long and requires detailed accounts of your finances. The business information you’ll need to provide on Form 433-B includes:

- Your business’s name, date of establishment, type, number of employees, internet sales, and contact information

- Key individuals in the business (partners, board members, or major shareholders) and their phone numbers and social security numbers

- Any impending lawsuits, debts owed, or bankruptcy proceedings

- Business bank accounts, available credit, vehicles, total cash in banks, and other assets and liabilities

- Business’s total monthly income and expenses

If you don’t own a business that has federal tax debt, you won’t need to worry about Form 433-B.

Form 433-F

Form 433-F is the most commonly seen collection information statement. The IRS usually uses 433-F to determine eligibility for payment plans or Currently Non-Collectible status. If your case is assigned to the IRS Automated Collection Service, you’ll likely be required to fill out Form 433-F.

Form 433-F is a simplified version of Form 433-A, with only two pages. There are fewer questions to answer. The information you’ll need to provide on Form 433-F includes:

- Contact information and social security number

- Bank accounts, lines of credit, and mutual funds

- Real estate and other assets (e.g., cars, boats)

- Credit cards owned and amount owed

- Business information if you own a business

- Employment information and non-wage household total income

- Monthly living expenses

Quick Reference Guide

Documentation Matters

No matter which form the IRS needs from you, one thing’s for sure: they’ll need some serious documentation to support the financial information you provide. Although there is certain information they can verify internally using your previous tax returns, it’s still in your best interest to have proof of all the financial information you provided. Even if the IRS doesn’t request those documents, you’ll be ahead of the game if you have everything ready to go.

Fresh Start Initiative

Based on your financial statement given through any of the forms above, the IRS determines your ability to pay and decides whether to approve your application for a payment plan or not. Under the Fresh Start Program, the IRS may not ask for a financial statement if you owe $50,000 or less in tax debt and apply for an Installment Agreement. For tax debts that are greater than $50,000, and to request a tax debt reduction, you will need to provide the IRS with one of the financial statements detailed above.

If you’re unsure if you qualify for any IRS debt repayment programs or forgiveness programs, our licensed tax professionals can review your specific situation to see if you qualify. We work with the IRS on your behalf, so you don’t have to navigate the complex tax laws alone.