The home office deduction can help small business owners and entrepreneurs save a lot of money on their taxes. Not everyone who works from home, however, will qualify. There are eligibility requirements and other hoops to jump through before you can take this tax break. To help you sort through all the rules, we’ve put together this easy guide for taking the IRS home office tax deduction.

Home Office Deduction Eligibility

There are three basic eligibility requirements you must meet to qualify for the home office deduction.

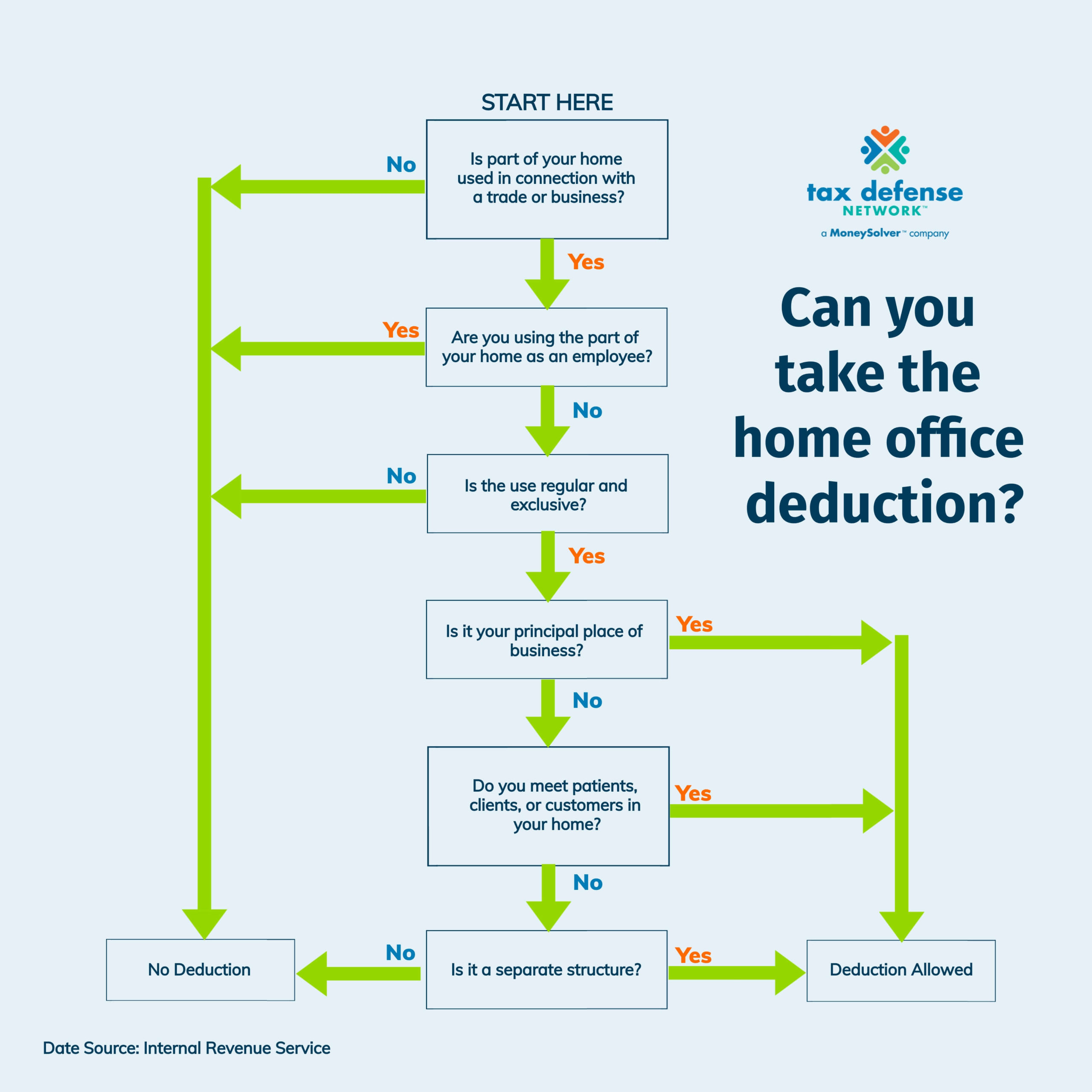

- You must be a business owner or self-employed. If you’re an employee and working from home, you typically cannot take the deduction, but there are exceptions (convenience of employer test). It gets tricky though, so it’s best to consult a tax professional for assistance.

- You must regularly use part of your home exclusively for business. To meet the regular and exclusive use provision, you must have a designated space that is used only for your business. For example, a den or corner of your living room may qualify as long as you do not use that space for personal activities at any time.

- Your home must be your principal place of business. You must be able to show that you primarily use your home to conduct business. This includes management and administrative activities, such as billing clients, record-keeping, setting appointments, and ordering supplies. If you have a business location outside the home, but substantially and regularly conduct business at your home, you may still qualify for the home office deduction.

The home office deduction is available to both homeowners and renters. It also applies to all types of homes, including apartments and mobile homes.

Still not sure you qualify? If you don’t use your home for business storage or as a daycare, you can use the short quiz below to determine whether you can take the deduction or not.

Special Rules & Exceptions

Although the exclusive use rule specifically states that you cannot take the home office deduction if you use your office space for both business and personal use, there are a few exceptions.

Daycare Facilities

Do you provide daycare in your home? You may be able to claim a deduction even if you use the space for non-business purposes. To qualify for the exception, you must meet both of the following requirements:

- You must provide daycare for children, the elderly (65 or older), or the disabled (mentally or physically)

- You have applied for, been granted, or be exempt from having a license, certification, registration, or approval as a daycare center or group home under state law

If your daycare license was revoked or rejected, you are not eligible for the home office deduction.

Inventory Storage

Are you storing product samples or inventory in your home? You may still be eligible for the home office deduction if you meet all of the following tests:

- You sell items at wholesale or retail as your business or trade

- You store your business inventory or samples in your home

- Your home is the only fixed locations of your business or trade

- The storage space is used regularly

- The space is a separately identifiable space suitable for storage

Keep in mind that the storage area does not need to be exclusively used for business. You can still deduct expenses if the space is occasionally used for personal purposes.

Separate Structures

You may be eligible to deduct expenses for a free-standing separate structure. This could include a workshop, barn, studio, garage, or other structure used exclusively and regularly for your business. Unlike your home, however, the separate structure doesn’t have to be your principal place of business.

Home Office Deduction Calculation Options

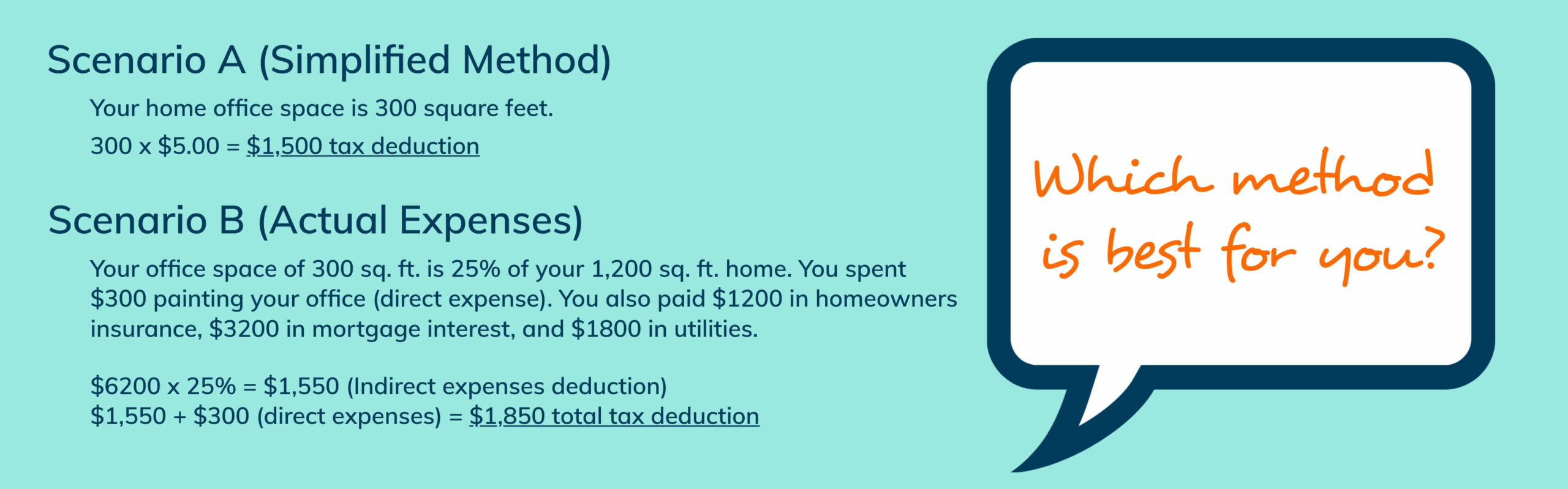

There are two options for calculating the value of your deduction. One is easy to use (simplified method) and the other is a bit more complicated (actual expenses). Deciding which method is best for you generally comes down to which will give you the biggest tax deduction.

Simplified Method

You may elect to use the simplified method to calculate your home office tax deduction if your office space is 300 square feet or less. With this option, you don’t have to worry about adding up actual expenses. Instead, you simply multiply the total square footage by the $5 IRS rate to determine your deduction amount.

Actual Expenses

If your office space is more than 300 square feet, you must use actual expenses to calculate your deduction. You should also use this method for smaller spaces if it provides a bigger deduction. Although this method is more complicated, you can deduct direct expenses in full. This would include costs for repairs or upgrades made only to your home office space. Indirect expenses, however, are deductible based on the percentage of your home used for business. For example, if your office space takes up 10% of your home’s square footage, you could only deduct 10% of all indirect expenses. Typical indirect expenses include home insurance, utilities, and general repairs. Expenses for areas of your home not used for business, such as paint purchased for a child’s room or lawn care, are not deductible.

Here’s an example of how your tax deduction may look using the two different options.

You will need to keep detailed records and retain receipts if you plan to use the actual expenses method. You will also be required to depreciate the value of your home. In some cases, using the actual-expenses method may also prevent you from avoiding capital gains tax when selling your primary residence.

Allowable Home Office Expenses

Once you determine that you are eligible to take the home office deduction, the next step is figuring out which expenses you can deduct. If you choose to use actual expenses to calculate your tax deduction, the following costs may be deductible.

- Rent

- Utilities

- Mortgage interest

- Mortgage insurance premiums

- Homeowners insurance

- HOA fees

- Real estate taxes

- Security system

- Pest Control (dwelling only)

- Internet service

- Repairs & maintenance

- Cleaning services

- Casualty losses

- Depreciation

Keep in mind that how much you can deduct will depend on whether your expenses are direct or indirect.

Telephone Charges

Telephone expenses are not treated the same as other utility expenses. The first telephone landline into your home is a nondeductible personal expense. If you have a second phone used exclusively for business or make long-distance calls on the primary landline, those expenses are deductible. Do not include any telephone expenses as a cost of using your home for business. Instead, these charges should be deducted separately using the appropriate form or schedule (line 25 on Schedule C).

Daycare Meal Expenses

If you run a daycare, you may also deduct the cost of meals and snacks prepared for clients and employees. This can be done using actual expenses or using the standard rates set by the federal government. When calculating actual expenses, 100% of the food costs for daycare recipients may be deducted. For employees, you can deduct 50% of the costs, if meals are factored into their wages, or 100% if excluded from their wages.

Confused and Need Help?

Are you still trying to wrap your head around all the math or worried that you might be audited? Don’t stress out. Contact Tax Defense Network. Our licensed tax professionals can help you complete the necessary forms and get you the biggest tax deduction possible. We’ll also have your back if the IRS should decide to audit your return. To learn more about our small business tax services, schedule your free consultation today!