Most people understand the value of setting aside money for retirement. There could be, however, an added bonus for building up your nest egg. It’s called the saver’s credit. Formerly known as the retirement savings contributions credit, the saver’s credit gives eligible low- and moderate-income taxpayers a special tax break in addition to other retirement account tax benefits.

Saver’s Credit Eligibility

Most people are unaware that they are eligible to take the saver’s credit. In fact, only about 12% of qualified taxpayers claim it. Don’t make the mistake of missing out on this valuable tax benefit. If you meet the following requirements, you’re eligible to claim this non-refundable tax credit.

- You‘re 18 years or older

- You can’t be claimed as a dependent on another taxpayer’s return

- You’re not a student

- You’ve made contributions to an eligible retirement account

- You meet the adjusted gross income (AGI) limits

Eligible Retirement Accounts

Contributions made to the following retirement accounts are eligible when determining your tax credit amount:

- Traditional or Roth IRA

- 401(k)

- 403(b)

- 457(b)

- SARSEP

- SIMPLE plan

- Federal Thrift Savings Plan (TSP)

- 501(c)(18)(D)

- ABLE (Achieving a Better Life Experience)

Elective salary deferral and after-tax employee contributions, as well as contributions you make on your own, qualify. Contributions made by an employer, such as match amounts, aren’t eligible.

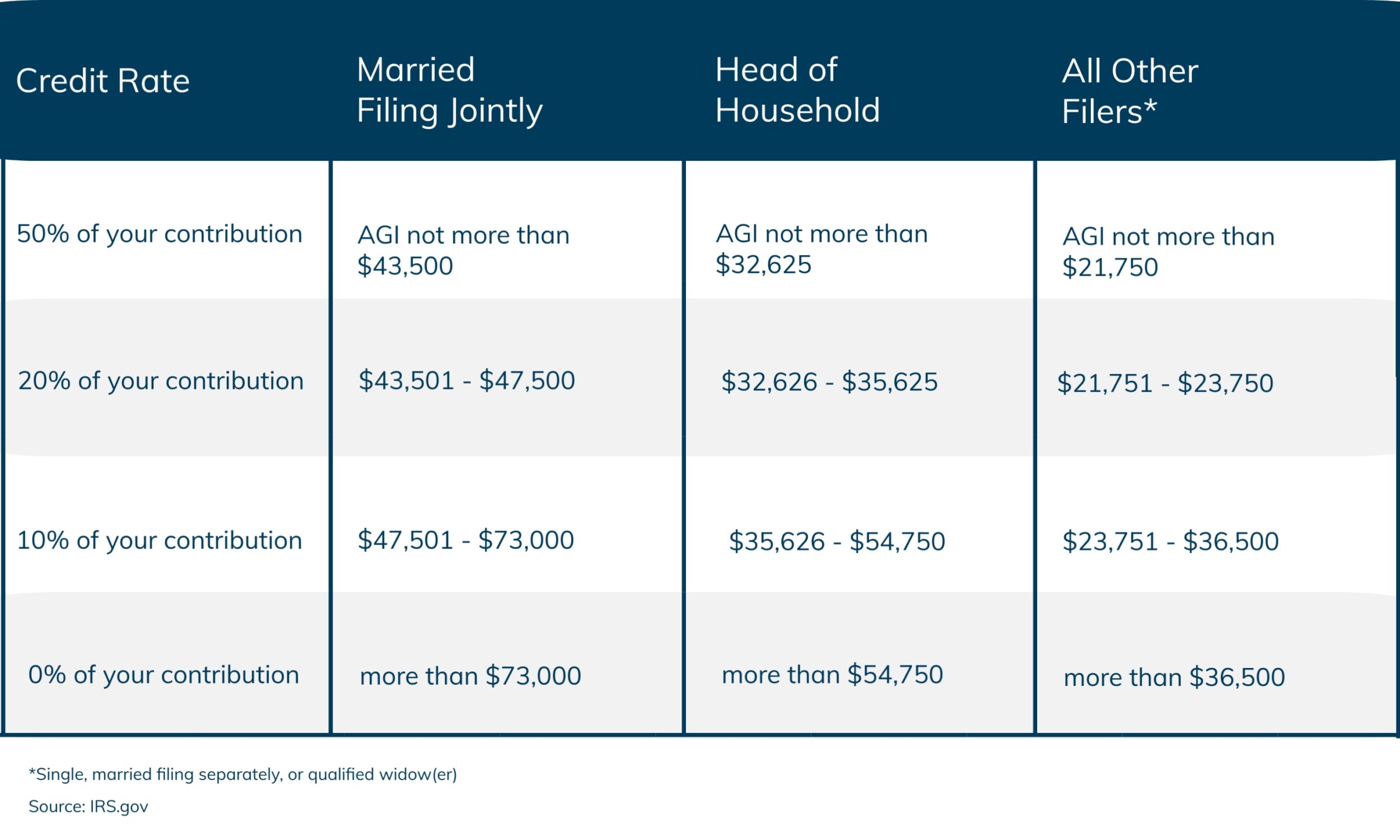

Tax Credit Amount

If you are eligible to take the saver’s credit, the amount you can claim will vary, depending on your AGI. The tax credit is worth either 10%, 20%, or 50% of your eligible contributions, depending on your income level. The maximum contribution amount eligible for the credit is $2,000 ($4,000 if you are married filing jointly).This means that the maximum credit you may claim is $1,000 ($2,000 for those filing jointly). If you exceed the income threshold for your filing status, however, you are not eligible to take the credit.

2023 Saver’s Credit Income Thresholds

Keep in mind that rollover contributions do not qualify for the saver’s tax credit. If you received any distributions from a qualified retirement plan, those amounts should be deducted from your total contribution when determining your credit amount.

How to Claim The Saver’s Credit

To claim the credit on your IRS Form 1040 (Schedule 3, line 4), you’ll need to complete IRS Form 8880, Credit for Qualified Retirement Savings Contributions.

If you need assistance preparing your taxes, be sure to give Tax Defense Network a call. We offer affordable rates for your personal and business tax needs. Call 855-476-6920 for a free quote today!