If you’ve ever found yourself in a situation where you owe money to the IRS, you may have heard about the dreaded IRS collection agencies. These private agencies are responsible for collecting outstanding tax debts on behalf of the government. But how and when do these debt collectors get involved? Here’s everything you need to know about the IRS collection agencies and what you should do if one contacts you.

But First, A Quick History

Private collection agencies (PCAs) aren’t rookies to the federal tax-debt collection game. They previously assisted the IRS between 1996-1997 and 2006-2009. Unfortunately, their results were not that impressive. The PCAs wasted money, yielded fewer collections than expected, and contributed to inequities in the U.S. tax collection system.

Despite warnings from the IRS and National Tax Advocate, however, history repeated itself in 2015. That’s when Congress passed Fixing America’s Surface Transportation Act (FAST Act). Although it’s technically a highway bill, the FAST Act included a debt-collection section requiring the IRS to use PCAs for outstanding tax debt that the IRS is no longer pursuing.

Additional Protections Added For Taxpayers

In 2019, the Taxpayer First Act (TFA) was passed by Congress. This was meant to provide additional protection to low-income taxpayers facing collection actions. Per TFA, the IRS cannot use collection agencies for taxpayers with an adjusted gross income of less than 200% of the federal poverty level, which is around $30,000 for a family of four in 2023.

Additionally, the tax debt must now be at least two years old from the date of the original assessment. Previously, PCAs could get involved once 12 months had passed. Another added protection under TFA is the extension of up to seven (7) years to pay off debt assigned to a PCA through an installment agreement. The previous law limited it to only five (5) years.

While past programs using third-party debt collectors stopped because they lost money, this is no longer an issue. Between FY2017 and FY 2021, the IRS assigned 4 million delinquent accounts to the PCAs, which collected over $1 billion in commissionable payments and $68.7 million in non-commissionable payments during that period.

What Happens If The IRS Sends You to Collections?

When the IRS determines that you have an outstanding tax debt that you have failed to pay, they have the authority to send your case to a collection agency. This is typically the next step the IRS takes after sending you multiple notices and giving you ample opportunity to resolve your tax debt. Once your case is transferred to a collection agency, they will take over the responsibility of collecting the money owed to the IRS.

PCAs have the authority to contact you directly, request payment, and negotiate payment plans. They may also use various collection tactics such as wage garnishment, bank levies, or property liens to ensure you fulfill your tax obligations.

Not all tax cases, however, are eligible for private collectors to handle. The following types of accounts won’t be sent to an IRS collection agency:

- Accounts with an Offer in Compromise agreement or an installment agreement

- Innocent Spouse cases

- Accounts for minors or the deceased

- People in designated combat zones

- Taxpayers in federally declared disaster zones who have requested relief from debt collection

- Victims of tax-related identity theft

Beware of Scams!

Scam artists can easily pretend to be PCAs since they aren’t required to identify themselves as IRS contractors. In 2022, the IRS flagged $5.7 billion in tax fraud. There were also 8 million reports of suspicious activity.

If someone calls trying to collect a tax debt, be sure to validate that they are from one of the three collection agencies listed below.

| CBE Group Inc. P.O. Box 2217 Waterloo, IA 50704 800-910-5837 |

Coast Professional, Inc. P.O. Box 425 Geneseo, NY 14454 888-928-0510 |

ConServe P.O. Box 307 Fairport, NY 14450 844-853-4875 |

Never disclose any personal information to someone randomly demanding payment over the phone, by email, or online. If you are unable to verify their identity or feel uncomfortable, don’t engage with them. Instead, hang up and call the IRS directly at 800-829-1040.

What You Need to Know to Protect Yourself

Dealing with IRS collections can be a daunting task, but with the right approach, it is possible to resolve your tax debt and regain financial stability. Here are some steps to help you navigate the process.

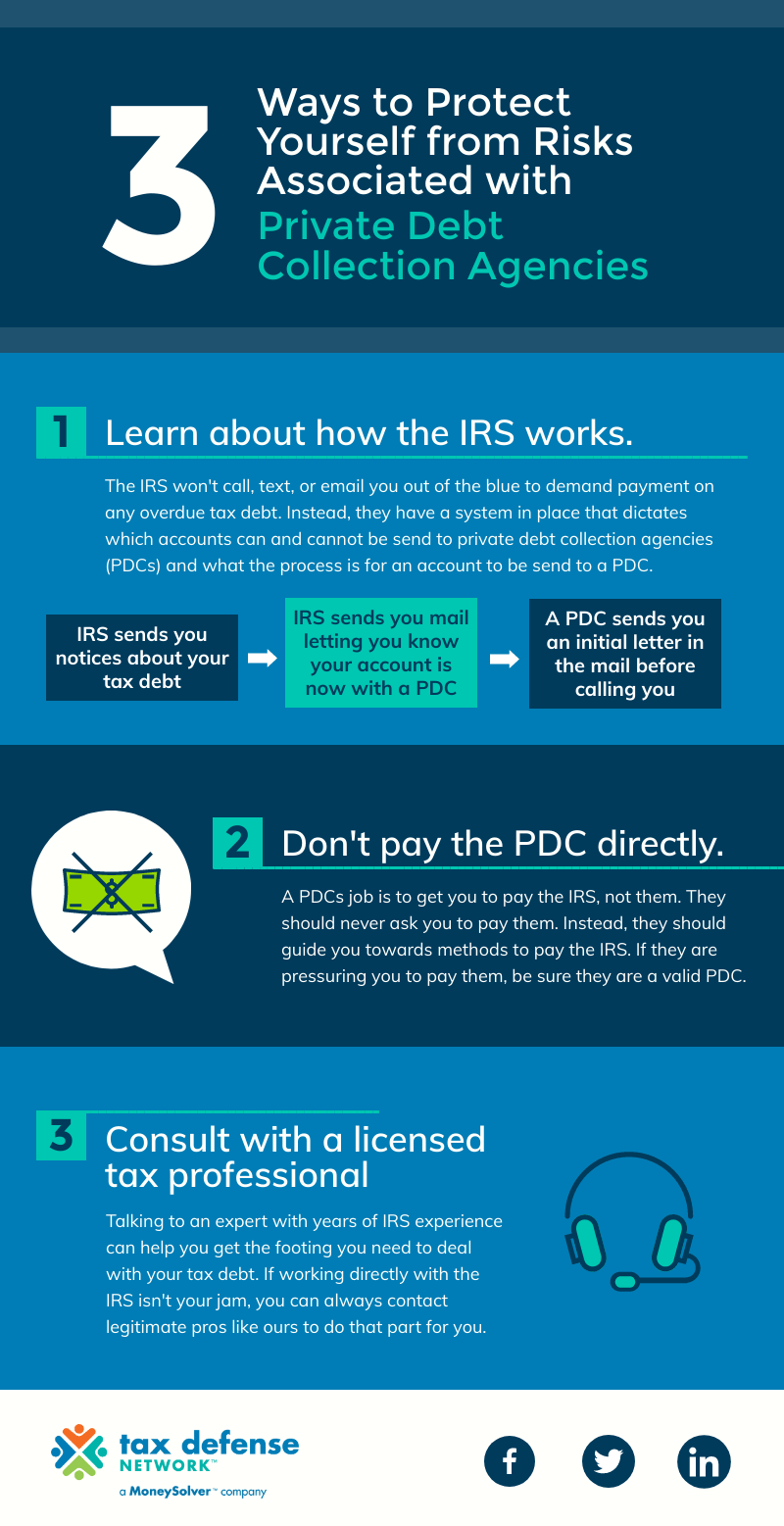

1. Learn How The IRS Works

The IRS isn’t like your crazy ex. The agency will never call, text, or email you out of the blue to demand payment. And they definitely won’t demand that you give them your credit card number on a phone call or threaten to bring in law-enforcement agencies to have you arrested for not paying. Instead, they prefer contacting taxpayers via notices in the mail (like a Notice CP14) that progressively increase in urgency.

If the IRS assigns your case to a PCA, you’ll receive Notice CP40 and Publication 4518. They won’t surprise you by handing you off to a third party without giving you a heads-up. Once the private debt collector has your account, they’ll send you an initial letter in the mail before contacting you via phone.

The IRS, however, can only contact you with the information they have on file. If the address you’ve used in the past is not where you currently reside, you’ll need to update your IRS account to receive these helpful notices.

2. Don’t Pay The Collection Agency Directly

Although the IRS hired the private collection agency to collect your tax debt, you’re not actually writing out your check to the PCA. All your repaid debt will go straight to the IRS as usual.

A private collection agency should never ask you to pay them directly. Their job is to work with you to resolve your tax debt. They should provide you with information about IRS payment options, including online or via check made payable to the U.S. Treasury sent in the mail directly to the IRS.

3. Consult With a Licensed Tax Professional

Turning to a licensed tax professional – which may include CPAs, enrolled agents, or tax attorneys – can give you the support and direction you need regarding your tax debt. These experts can negotiate with the IRS on your behalf to relieve tax debt or tie-ups like liens, levies, and wage garnishments.

Although the lawfulness of PDC use is under scrutiny, it is today’s reality. The key to avoiding trouble is being smart about tackling your tax debt and not going at it alone.

Whether you choose to work directly with the IRS or with a collection agency like the CBE Group, it is crucial to stay proactive and communicate openly. By taking the necessary steps and seeking professional tax guidance when needed, you can successfully resolve your tax debt and move forward with peace of mind.