The rising costs of a college education have put millions of Americans into student loan debt. To help offset some of these costs, taxpayers can elect to claim the Lifetime Learning Credit (LLC) on their tax return. Unlike other education tax credits, however, the LLC covers the cost of classes for undergraduate and graduate degrees, as well as certain professional courses. With a maximum value of $2,000, it can help reduce your tax bill dollar for dollar. There is also no limit on the number of years that the credit may be claimed.

Who Can Claim the Credit?

To claim the Lifetime Learning tax credit, all of the following must be true:

- You, your dependent, or a third party pay qualified expenses for post-secondary education;

- The qualified expenses are for an eligible student enrolled in an eligible educational institution;

- The eligible student is yourself, your spouse, or your dependent (must be listed on your tax return).

To be considered an eligible student, you, your spouse, or your dependent must be:

- Enrolled or taking courses at an eligible educational institution;

- Taking a course or courses to earn a degree, receive professional certification, or improve jobs skills;

- Enrolled for at least one academic period (quarter, semester, etc.) during the tax year.

You may not claim the credit if you pay educational expenses for someone who is not your dependent, or if you are married and file separately. Non-resident aliens are also ineligible unless they elect to be treated as resident aliens for tax purposes. Children who file taxes and pay their own expenses may claim the credit unless they are listed as a dependent on your return.

Income Limitations

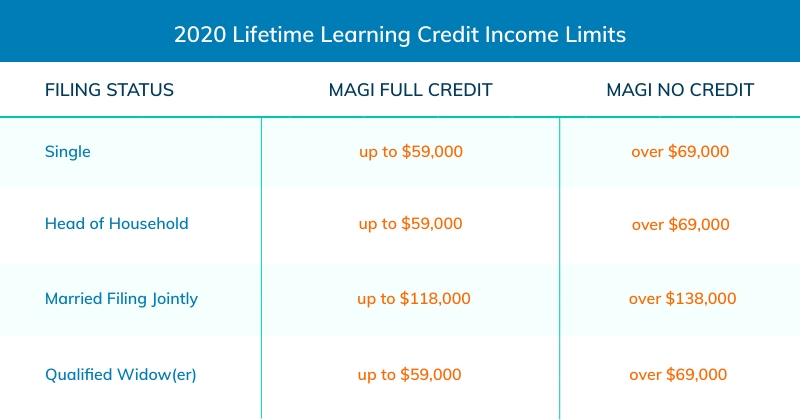

There are income limitations for the Lifetime Learning credit based on your modified adjusted gross income (MAGI) and filing status.

If your MAGI is under the limit for the full credit, you may be eligible to receive up to $2,000. Those with earnings between the full credit and no credit limits will receive a reduced amount based on their MAGI and qualified educational expenses. If your MAGI is above the amount noted in the “no credit” column above, you are not eligible to receive the LLC regardless of how much you spent on qualified educational expenses.

Qualified Educational Expenses

Per the Internal Revenue Service (IRS), the following are considered qualified educational expenses at an eligible institution:

- Tuition

- Fees (such as lab fees)

If textbooks or supplies must be purchased directly from the school as a condition of enrollment, those expenses may be included, as well. Housing, meals, travel, medical fees, insurance, and living expenses are not eligible.

Keep in mind that you must reduce your qualified educational expenses by any amount received through grants, scholarships, or other free financial aid. For example, if you paid $4,000 in tuition and fees but received a $2,500 scholarship, your eligible expenses would only be $1,500.

Calculating & Claiming The Lifetime Learning Credit

To claim the Lifetime Learning credit, use Form 1098-T, Tuition Statement, from your educational institution to determine your eligible costs. Next, use Form 8863, Education Credits, to calculate your tax credit amount. You must complete Part III for each eligible student before completing Part II, Nonrefundable Education Credits.

For the LLC, enter the total amount of adjusted qualified expenses for all students on line 31 (Part III) and line 10 (Part II). On line 11 (Part II), enter $10,000 or your actual costs (whichever is smaller) and then multiply by 20 percent (line 12). This is your tentative tax credit amount. If your MAGI exceeds the maximum credit limits for your filing status but is less than the full phaseout amount, you will use steps 13 through 19 to determine your adjusted credit amount.

Although there is no limit on how many years you may take the credit, the maximum annual credit is $2,000. Please note that this limit is per tax return and not per eligible student. The tax credit is also non-refundable. If you owe $1,800 in taxes, but qualify for the full $2,000, you won’t receive the additional $200 as a refund.

Should You Take the American Opportunity Tax Credit?

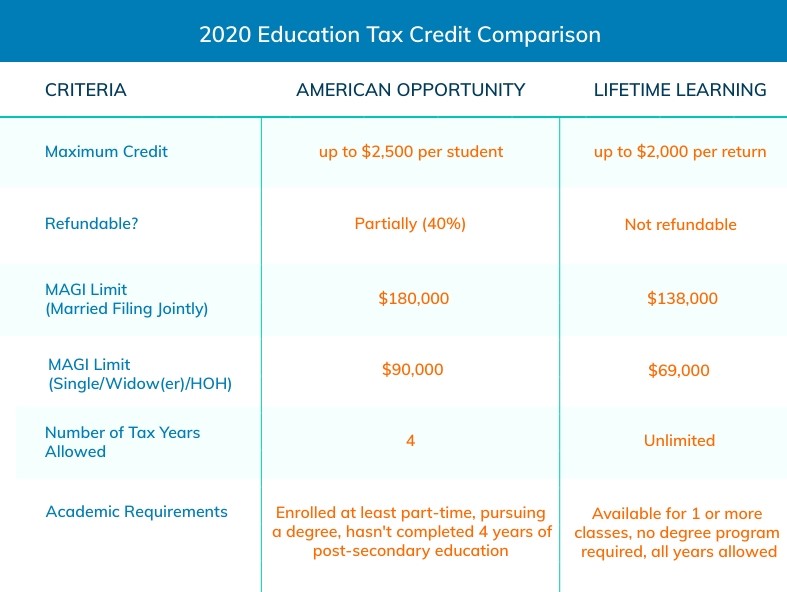

Before you take the Lifetime Learning Credit on your tax return, it may be worthwhile to see if you qualify for the American Opportunity Tax Credit (AOTC), as well. For many undergraduate students, the AOTC offers more tax savings, and it’s partially refundable. You cannot claim both education tax credits in the same year, however, so choose wisely.

If you’re still uncertain if you’re eligible for either the Lifetime Learning or American Opportunity tax credit, take this 10-minute IRS quiz to see if you qualify!