According to a recent report, adoptions in the United States are declining. The adoption process can be long and expensive, especially for international adoptions. Fortunately, the federal government provides some financial relief through its adoption tax credit. Not all taxpayers who adopted or started the adoption process in 2024, however, will be eligible to take the credit. To determine if you can claim it, read on to learn more about eligibility requirements, income limits, and what qualifies as eligible expenses.

Adoption Tax Credit Eligibility

If you have out-of-pocket expenses due to an adoption in 2024, you may be eligible for the adoption tax credit (partial or full) if all of the following are true:

- The child you adopted is not your stepchild;

- The child is 17 or younger, or is a U.S. citizen or resident alien who is physically or mentally unable to care for themselves (any age); and

- Your family’s modified adjusted gross income (MAGI) is below $292,150.

If your adopted child does not have a Social Security number, you will also need to apply for an Adoption Taxpayer Identification Number (ATIN) to claim them as a dependent on your tax return. Families with a MAGI above $292,150 are ineligible for the tax credit.

How Much is The Credit Worth?

The full value of the tax credit is based on your MAGI and the total amount of qualified expenses. If your MAGI is below $252,150, you are eligible to receive the full credit of $16,810 per child or the total of your eligible expenses, whichever is less. MAGIs between $252,151 and $292,150 are eligible for partial credit.

If your tax liability is less than the credit you are eligible to receive, you may carry over any remaining credit for up to five (5) additional years. In the event that you do not owe any taxes, we still recommend claiming the adoption tax credit as it may become refundable in future years.

Who Qualifies As a Special Needs Child?

Taxpayers who adopt a special needs child may claim the full $16,810 credit regardless of their qualified adoption expenses. Per the IRS, a child qualifies as special needs if the following are true:

- The child was a citizen or resident of the U.S. or its possessions at the time the adoption process began.

- A state (including the District of Columbia) has determined that the child can’t or shouldn’t be returned to their parents’ home.

- The state has determined that the child won’t be adopted unless assistance is provided to the adoptive parents. Factors used to make this determination include:

- The child’s ethnic background and age,

- Whether the child is a member of a minority or sibling group, and

- Whether the child has a medical condition or a physical, mental, or emotional handicap.

Unless a state has made the determination that the child is special needs, having a specific condition or factor isn’t enough to deem them as special needs for the tax credit. Foreign children, regardless of age or abilities, do not qualify for the special needs designation.

Eligible Expenses

The IRS allows most expenses related to the legal adoption of an eligible child. This may include:

- Reasonable and necessary adoption fees

- Court costs and attorney fees

- Travel expenses, such as meals and lodging

- Re-adoption expenses related to the adoption of a foreign child

Fees paid for home studies at the beginning of the adoption process are also eligible adoption expenses. If two taxpayers, who are not married to one another, shared the costs of the adoption, the adoption tax credit must be divided between them.

Expenses for a surrogate or adopting your spouse’s child are not eligible. If you received funding from a local, state, or federal program, or were reimbursed through an employer program, those expenses are also ineligible for the tax credit.

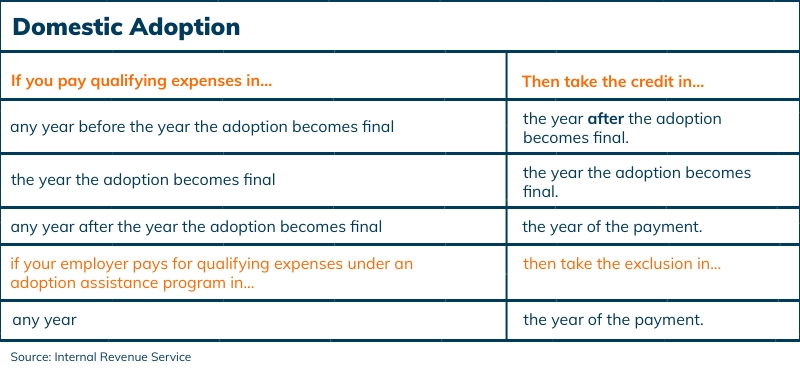

When to Claim the Credit

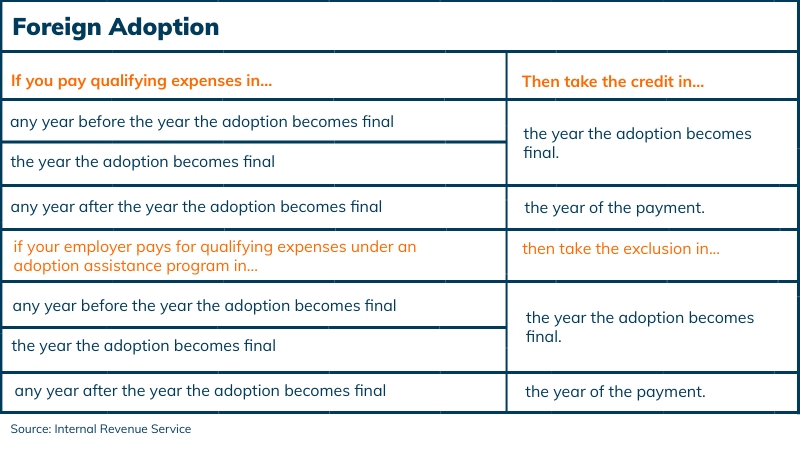

When you can claim the adoption tax credit depends on whether the adoption is domestic or foreign. Use the tables below to determine when to take the credit.

If the eligible child is a U.S. citizen or resident, you can take the credit even if the adoption is never finalized. For foreign adoption, however, you may only claim the credit when the adoption becomes final.

Children who are not U.S. citizens or residents of the United States at the time of adoption fall under foreign adoption guidelines.

How to Claim the Adoption Tax Credit

To claim the credit, you must complete IRS Form 8839, Qualified Adoption Expenses. This form should be submitted with your Form 1040 when filing taxes. Most tax software programs will complete the form for you. In some cases, you may be able to amend a previous tax return to claim the adoption tax credit. Depending on how long ago the original return was filed, however, the IRS may or may not allow the credit.

If you are filing a paper return or need additional assistance, it may be beneficial to work with a tax professional to ensure your calculations are correct. Contact Tax Defense Network at 855-476-6920 to schedule a free consultation and learn more about our affordable tax preparation fees!