Mistakes happen, but what do you do when they appear on your tax return? If it’s a simple mathematical error or you neglected to attach a document, there’s no need to worry. The Internal Revenue Service (IRS) will likely catch the mistake and correct it for you. If they need additional information or documents, you’ll receive a letter in the mail requesting these items. Other errors, however, may require you to file an amended return.

Common Reasons to File an Amended Return

There are several instances where an omission or error may trigger the need for an amended tax return. Here are some of the most common.

Unreported Income

It’s not uncommon to forget to add taxable income you may have earned from a short-lived job, gig work, or even interest earned from a bank account. This can easily happen when you file before January 31 and do not have all your income statements. If you failed to claim all your income, you’ll need to amend your return.

Missing Credits or Deductions

If you neglected to take advantage of a deduction or tax credit that you are due, and it results in a refund, definitely file an amended tax return. Conversely, if you took a credit or deduction you weren’t eligible to receive, you’ll want to amend that, as well.

Incorrect Filing Status

Did you file as head of household when you should have used married filing separately? Any instance where your filing status is inaccurate should be corrected through an amended return.

Corrected Form W-2

When an employer makes a mistake on your Form W-2, they will send out a corrected one (Form W-2 C, Corrected Wage and Tax Statements) that shows the previously reported information alongside the updated information. If you filed using the incorrect W-2, you’ll need to submit an amended return.

Retroactive Tax Laws

Retroactive tax laws are those that are enacted during the current calendar year, but are eligible to be applied to previous tax years. In some cases, these laws may also revive or extend previous tax laws that have expired. An example of this would be the temporary revival of the “energy efficient homes credit” or the “deduction for qualified tuition and related expenses,” both of which were extended under a 2019 tax act. If you find that you are eligible for any retroactive tax breaks/deductions, you may want to file an amended return.

Natural Disaster

Did you recently suffer a loss due to a federally declared disaster, such as a hurricane, wildfire, or tornado? Consider filing an amended tax return. Victims of natural disasters have the option of claiming a casualty loss either in the current tax year or the tax year before the disaster. There is one caveat, however. If you decide to apply the loss to last year’s return, you must submit your amended return no later than six months from the original filing date in the year in which the loss occurred. For example, those affected by the California wildfires in 2025 would need to file by October 15, 2025, if they want to claim the loss on their 2024 return.

Keep in mind that changes made to your federal tax return may also affect your state tax return. In many cases, you may need to file an amended state tax return, too. Be sure to hold on to all your documentation from the original return, as well as any needed for changes made to your return. The IRS typically takes a closer look at amended returns, so you’ll want to be prepared if questions arise.

How to Submit an Amended Return

Amended federal tax returns must be submitted no later than three years from the date you filed your original return, or within two years of paying your tax bill, whichever is later. Once you determine that changes are needed, follow these steps for submitting your amended return.

- Gather documents and forms. This will include your original return and new documents, as well as any forms you are amending (you can download these from the IRS website).

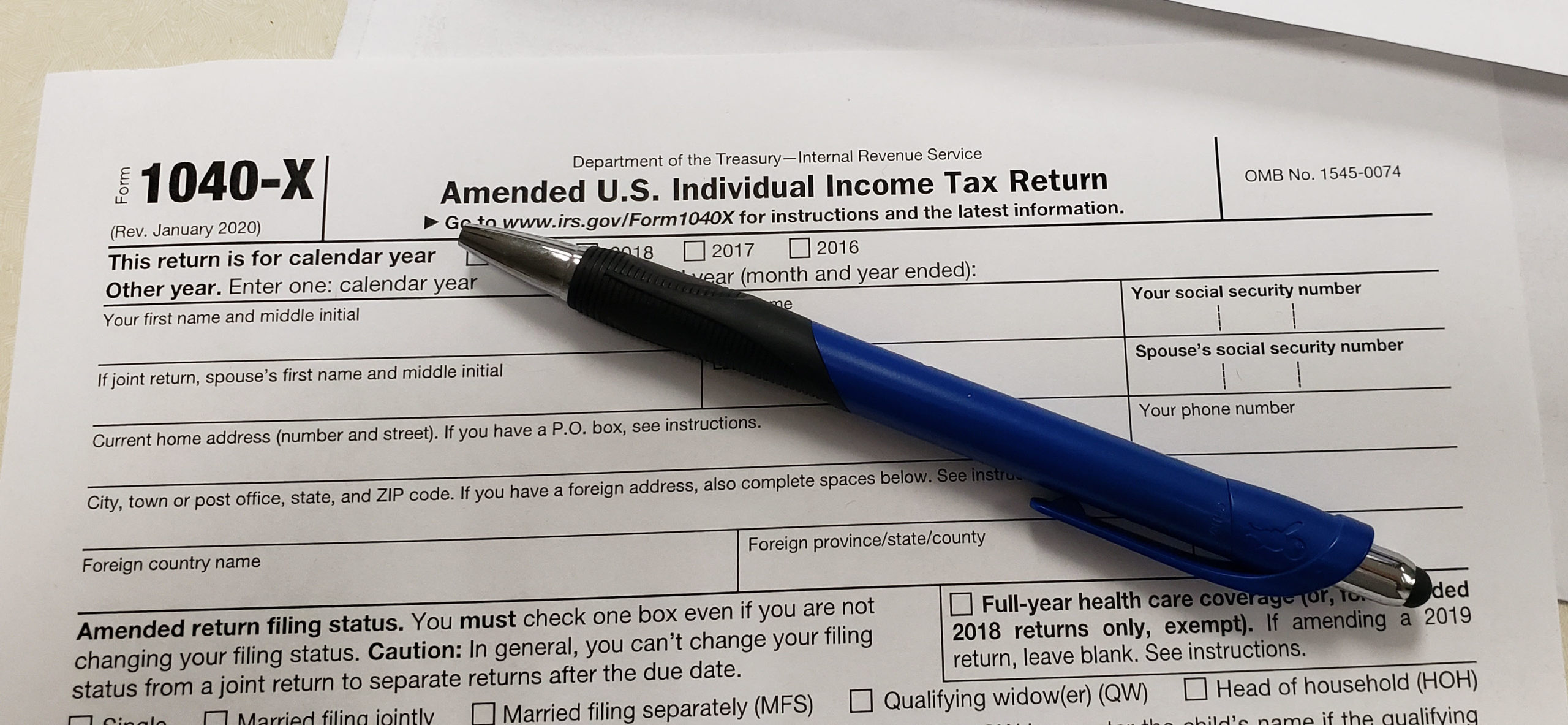

- Complete Form 1040-X. Download the current year’s Form 1040-X, Amended U.S. Individual Tax Return, and follow the instructions for completing the form. You can also use online software to complete your amended return for the current tax year. If you are amending multiple returns, you’ll need to complete a separate 1040-X for each tax year.

- Submit your amended return. If you e-filed your original tax return, you may now file your amended return online or through the mail. All previous years, however, must be filed through postal mail. Be sure to sign and date your amended return, and pay close attention to the assembly instructions. Your forms must be placed in a specific order. You must also explain the reason why you are amending your return, so make sure Part III on your Form 1040-X is filled out. Do not mail multiple amended returns together. Each should be mailed separately.

- Track your submission. Processing an amended return that is sent through the mail can take up to 16 weeks. After three weeks, you can view your amended return status here or call 866-464-2050 for an update.

In cases where an error is found shortly after submitting your tax return, and the filing deadline has not passed (including extensions), you should not file an amended return. Instead, you’ll need to submit a new return by mail with the words “Superseding Return” written at the top of your Form 1040. You should also hold off on filing an amended tax return if it’s past the deadline date and you have not yet received your refund. Sending in an amended form may cause confusion and further delay your money.

I Owe the IRS More Money. Now What?

Although there is no penalty for amending your tax return, you may find that you owe the IRS (and possibly your state) more money. Interest and late payment penalties may be assessed, so it’s in your best interest to submit the additional funds as soon as possible. If you are unable to pay the amount due, you have options, such as an installment agreement.

If you need help submitting an amended tax return or cannot pay your taxes in full, contact Tax Defense Network. We can help you minimize your tax liability and determine which tax relief programs would best suit your needs. Schedule a free consultation today!