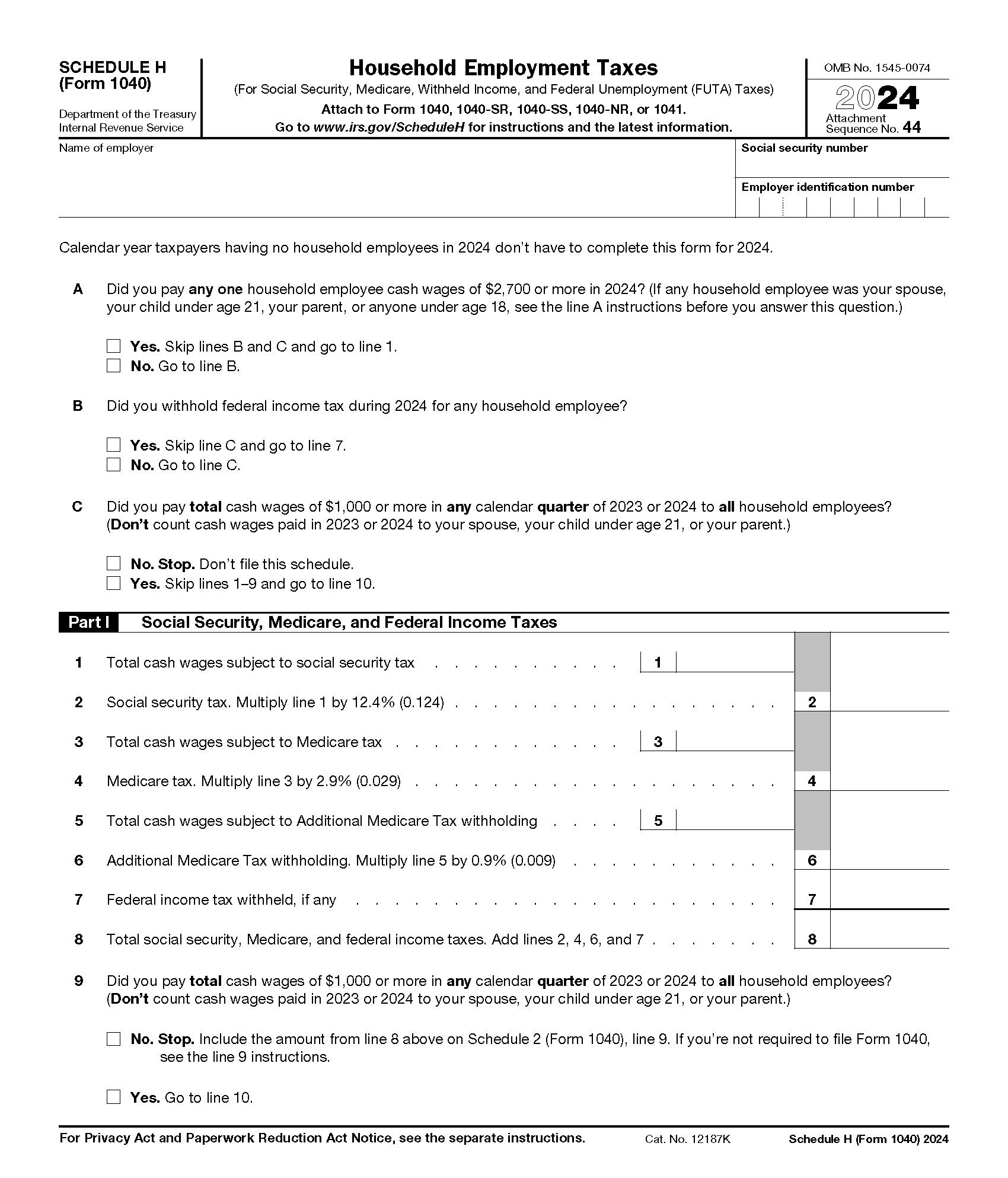

Schedule H, Household Employment Taxes

Use Schedule H to report household employment taxes if you paid wages to a household employee, such as a nanny, and those wages were subject to Social Security, Medicare, or FUTA taxes. You should also use Schedule H if you withheld federal income tax from your household employee’s wages.

Who Should File Schedule H?

You must include Schedule H with your tax return if you paid any single household employee $2,700 during the tax year (2024), paid cash wages of $1,000 or more during any quarter, or withheld federal income taxes from their wages (regardless of the amount earned). Generally, a person doing work for you around your home is considered a household employee if:

- You control the work being done, and;

- You control how the work is done.

Examples of typical household employees include maids, private cooks, drivers, private tutors, and caregivers. It’s important to note that the rule applies to both part-time and full-time workers, and the frequency of payment has no bearing on your requirement to file.

How to Complete Schedule H

Before you fill out Schedule H, be sure to have the following information on hand:

- Total wages paid

- The amount of federal income taxes withheld from your employee

- The Social Security and Medicare taxes withheld

- Federal unemployment insurance taxes paid

You’ll also need an employer identification number (EIN). If you don’t have one, you can apply for one online at IRS.gov. Be sure to include your name, Social Security number (SSN), and EIN at the top of the form.

Part I – Social Security, Medicare, and Federal Income Taxes

If you answered yes to question A or B, you need to complete all or a portion of Part I. This section will help you calculate and report the Social Security and Medicare tax you owe for your employee.

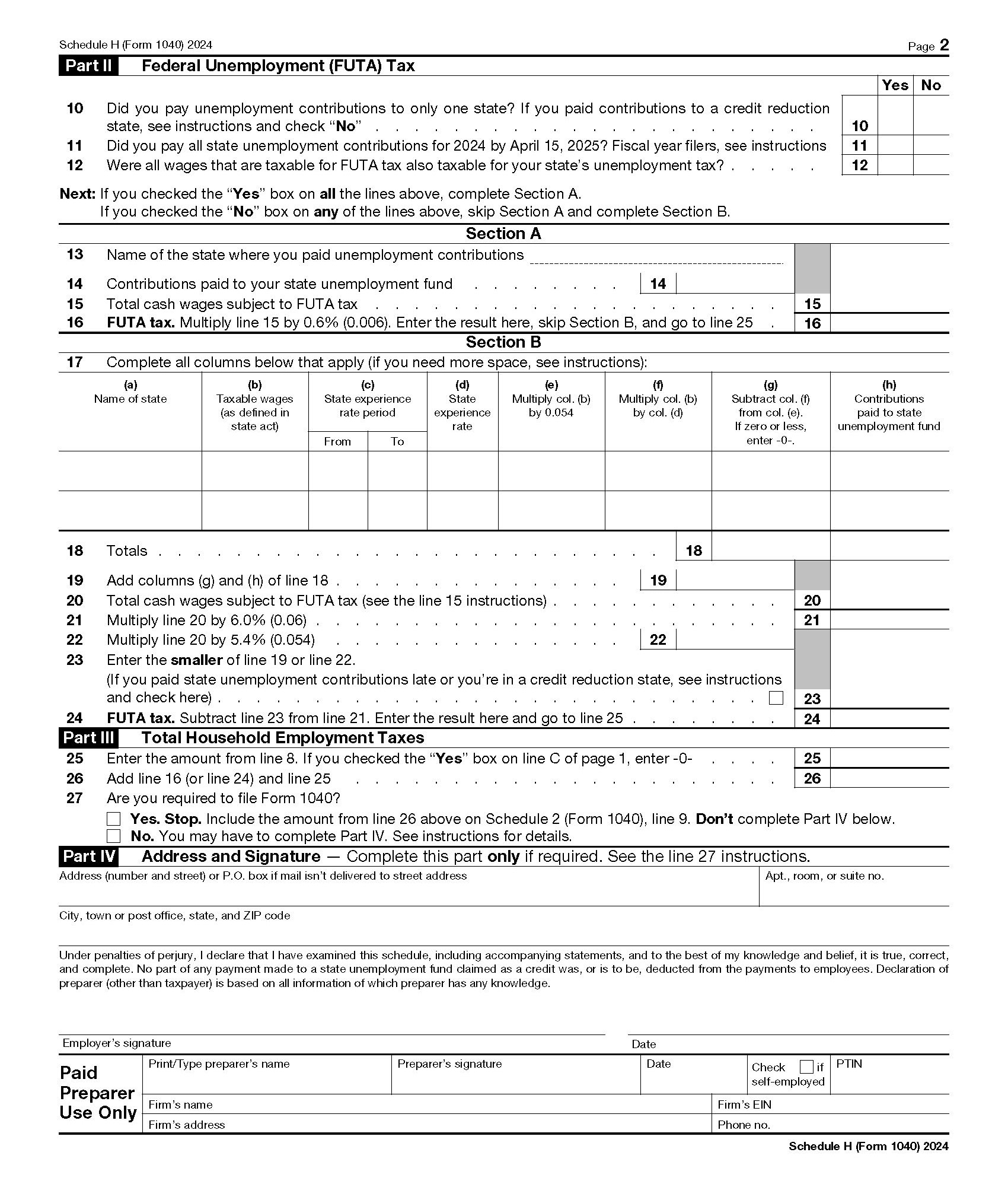

Part II – Federal Unemployment (FUTA) Tax

FUTA tax, with state unemployment systems, provides unemployment compensation payments to workers who have lost their jobs. Most employers, including household employers, pay both a federal and state unemployment tax. Do not collect this tax from your employee’s wages. You must pay this tax from your funds. The FUTA tax rate is 6%, but you may be eligible to receive a credit of up to 5.4% against what you paid.

In Part II, you’ll calculate and report FUTA tax for your employee. if you answer “yes” to questions 10 through 12, you only need to complete Section A. If you answered “no” to even one of those questions, skip Section A and complete Section B.

Part III – Total Household Employment Taxes

In this section, fill in the calculations to determine how much you owe in employment taxes. Your payment and Schedule H are then submitted with your Form 1040 or 1041. If you don’t file either of these forms, you’ll need to complete Part IV (Address and Signature), and follow the directions in the instructions packet on where and when to file.

Need Help?

Determining whether someone is a household employee or not can get a bit tricky. If you have questions or need assistance with completing your tax return and forms, contact Tax Defense Network at 855-476-6920. We offer affordable tax services for individuals and small business owners.