Form 8283, Noncash Charitable Contributions

IRS Form 8283 is used to report non-cash charitable contributions. This includes non-cash donations to an IRS-accepted charity, such as furniture, clothing, vehicles, or other non-cash assets. Donations made by cash, check, credit, or debit card should not be reported on Form 8283.

Who Should File Form 8283?

Individual taxpayers and businesses (corporations and partnerships) should use Form 8283 if the amount of their deduction for each non-cash contribution is more than $500 or they have a group of similar items for which a total deduction of over $500 is claimed. The one exception is C corporations (excluding personal service corporations and closely held corporations). C corporations should only file Form 8283 if the amount claimed as a deduction is more than $5,000 per item or group of similar items.

Do not list more than five donations to five different organizations on the form. If you have additional donations, you’ll need to complete multiple forms.

How to Complete Form 8283

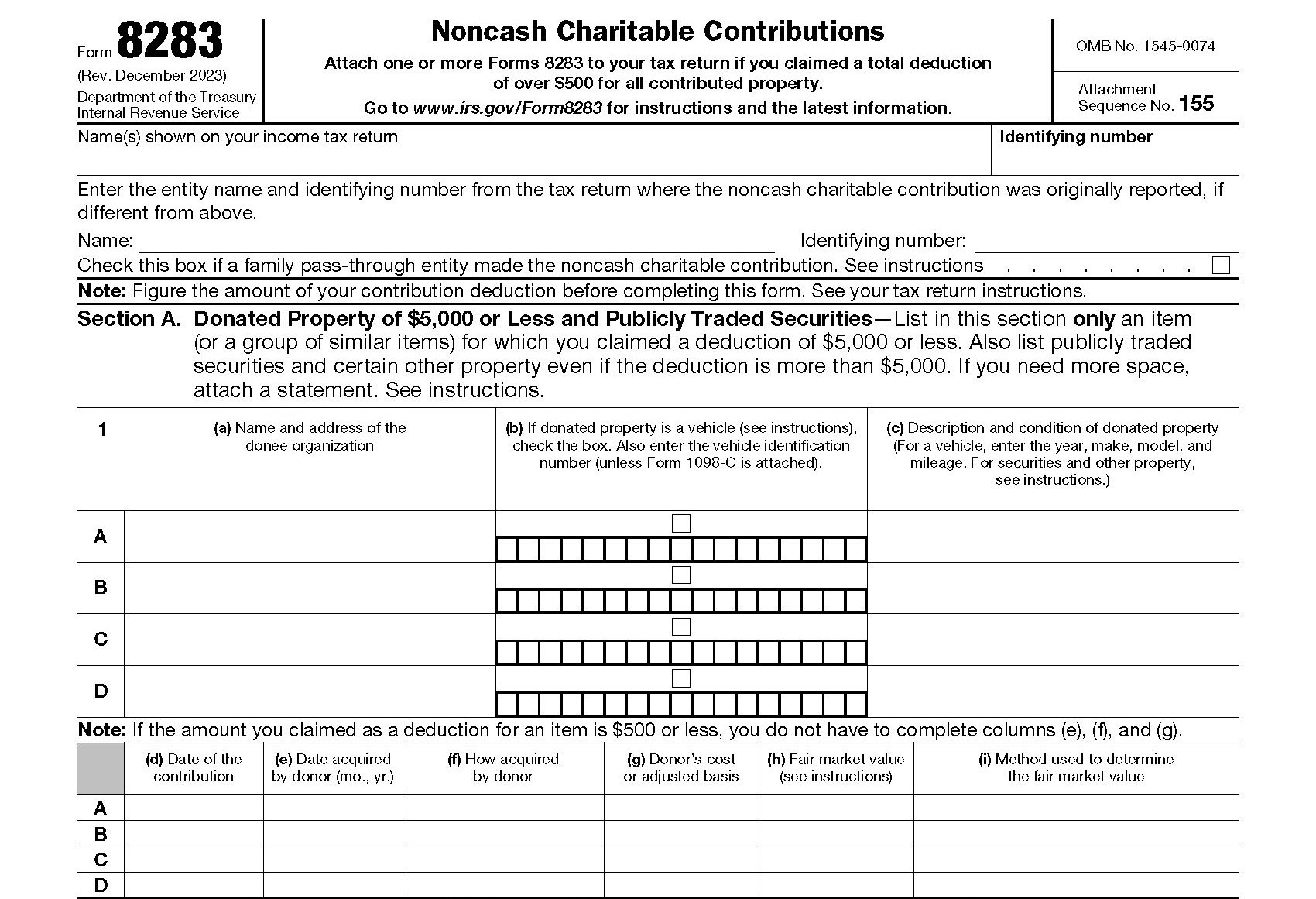

Form 8283 has two sections. Depending on the type of property donated and the amount claimed, you will need to complete either Section A or Section B.

Section A

Use Section A if you are claiming a deduction of $5,000 or less (per item or group). You should also complete this section if you donated any of the following, even if the value exceeded $5,000:

- Publicly traded securities,

- Certain intellectual property,

- A qualified vehicle, or

- Inventory or property held primarily for sale to customers in the ordinary course of your trade or business.

For non-cash donations exceeding $500, you should keep an inventory of items donated, as well as receipts for the donations.

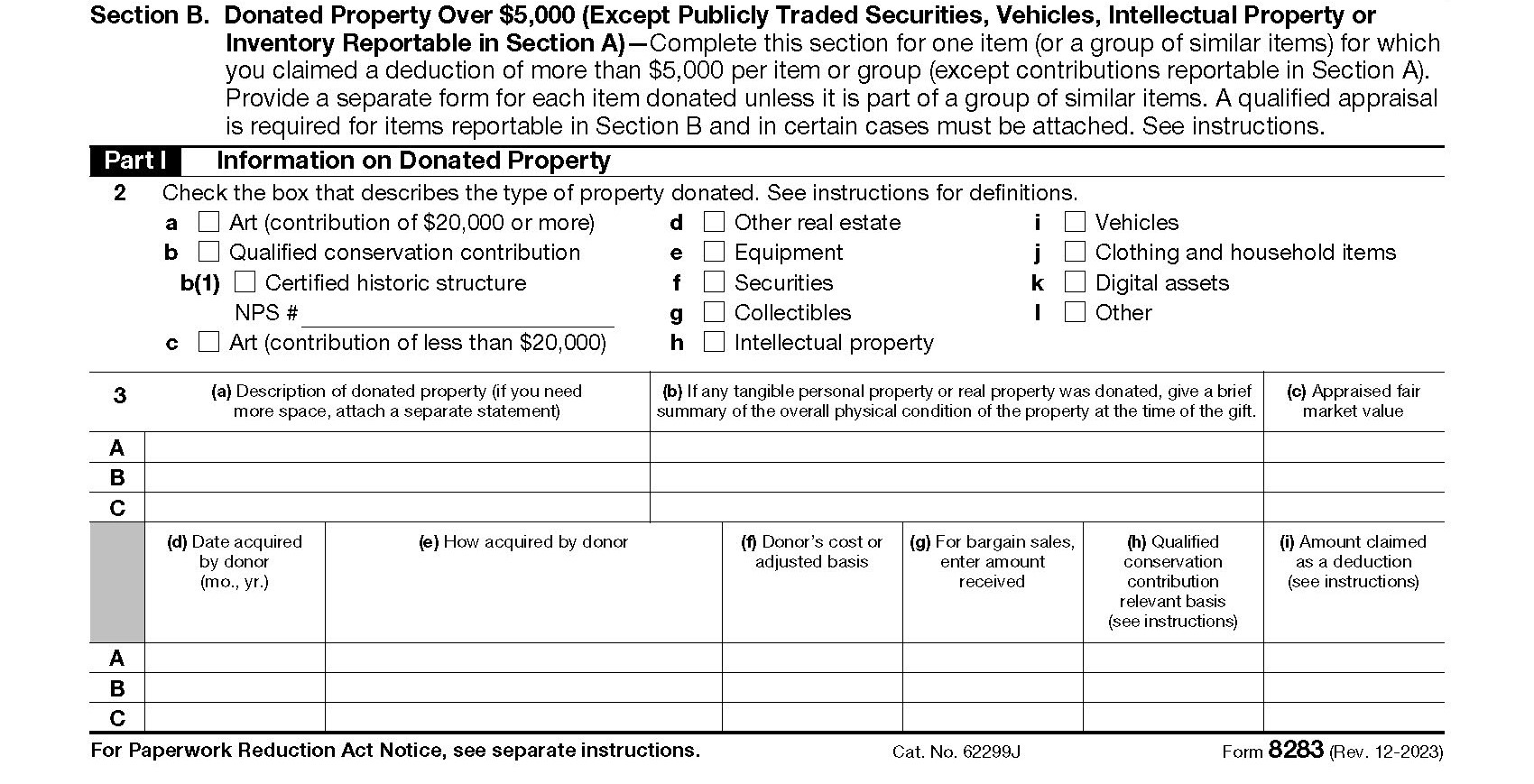

Section B

Use Section B to claim non-cash deductions of more than $5,000 (per item or group). Do not include any items listed in Section A. You must file a separate Form 8283, Section B (all five parts), for each organization and item (or group of similar items) claimed. You must also complete Section B if you:

- Contribute a single article of clothing or household item valued at over $500 that is not in good condition or better, or

- Gave less than an entire interest in a property or conditions were placed on the use of the donated property.

Items listed in Section B require a written appraisal by a qualified appraiser. The appraisal must be done no earlier than 60 days before you donated the item. There are a few exceptions to the appraisal requirement, however, including intellectual property and non-publicly traded securities (valued at $10,000 or less). If you are donating the proceeds from the sale of a vehicle, an appraisal of the vehicle is not required.

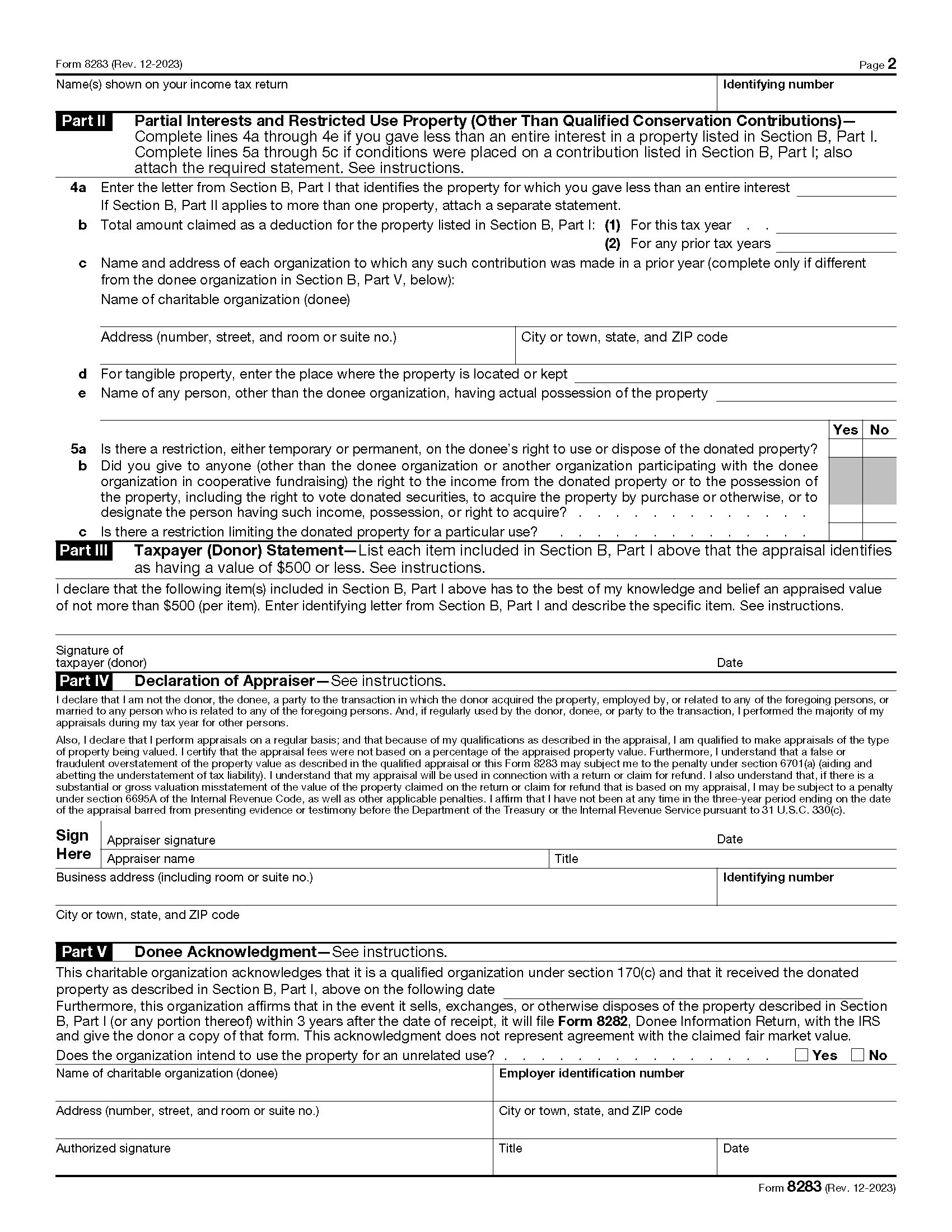

Before submitting Form 8283, Section B, make sure you complete Part III, Taxpayer (Donor) Statement. For Part IV, the appraiser will need to sign and date the form. The organization that received the donation must also sign and complete Part V of Section B. The person acknowledging the gift must be an official authorized to sign the tax returns of the organization, or a person specifically designated to sign Form 8283.

Failure to get the required signatures, provide the necessary appraisals, or attach Form 8283 to your tax return will generally result in the IRS rejecting your deduction.

Need Help?

If you need assistance completing Form 8283, please contact Tax Defense Network at 855-476-6920 or download the form instructions from IRS.gov.