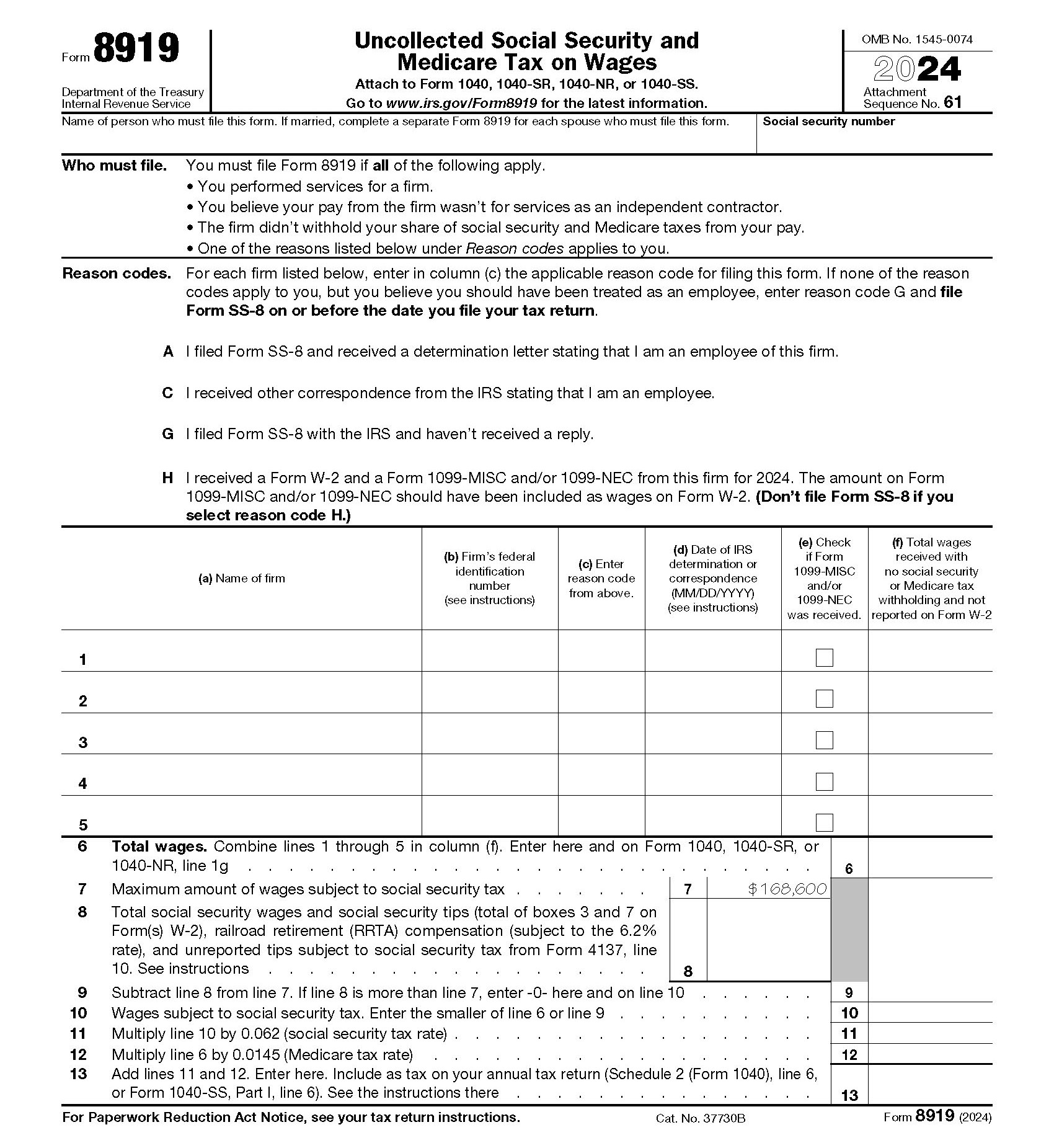

Form 8919, Uncollected Social Security and Medicare Tax on Wages

Use IRS Form 8919 to figure and report your share of the uncollected Social Security and Medicare taxes due on your earnings, if you were an employee who was treated as an independent contractor by your employer.

When to Use Form 8919

When an employer mistakenly identifies you as an independent contractor, it can have serious tax implications. Thankfully, there is a way to rectify the situation and potentially reduce the taxes you may owe. First, you should file IRS Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, before you file your tax return. This four-page questionnaire gives the IRS the necessary information it needs to determine your correct worker status. Although it can take months for the IRS to review and make a decision, the odds are generally in your favor.

Once you’ve submitted Form SS-8, you’ll want to file Form 8919. This can save you from paying the 7.65% of employment taxes your employer should have covered. Your Social Security earnings will also be properly credited to your Social Security record. It’s important to note that you do not have to wait for a final determination on Form SS-8 before filing Form 8919. Be sure to include Form 8919 when submitting your tax return.

How to Complete Form 8919

Form 8919 is easy to understand and doesn’t take very long to complete. Just follow the steps below.

Lines 1 through 5. Fill out a separate line for each employer you worked for during the tax year that misidentified you as an independent contractor. If there were more than five, attach another Form 8919 and fill in lines 1 through 5 as needed. Do not complete lines 6 through 13 on more than one form.

Line 6. Combine the amounts in column (f) for lines 1 through 5 (including additional forms) and include the total wages on line 6. You’ll also enter this number on your Form 1040 or 1040-SR (line 1), or Form 1040-NR (line 1a). If you are required to complete Form 8959, enter the line 6 (Form 8919) total on line 3 of that form, as well.

Line 7. The maximum amount ($142,800) subject to Social Security tax is already entered for you.

Line 8. Enter your total Social Security wages and tips, unreported tips, and railroad retirement compensation here.

Line 9 through 13. Follow the math instructions for each line and enter the results.

Need Help?

Although IRS Form 8919 isn’t particularly long, there are quite a few calculations required. If you need assistance completing the form, please contact Tax Defense Network at 855-476-6920 or download the instructions from IRS.gov.