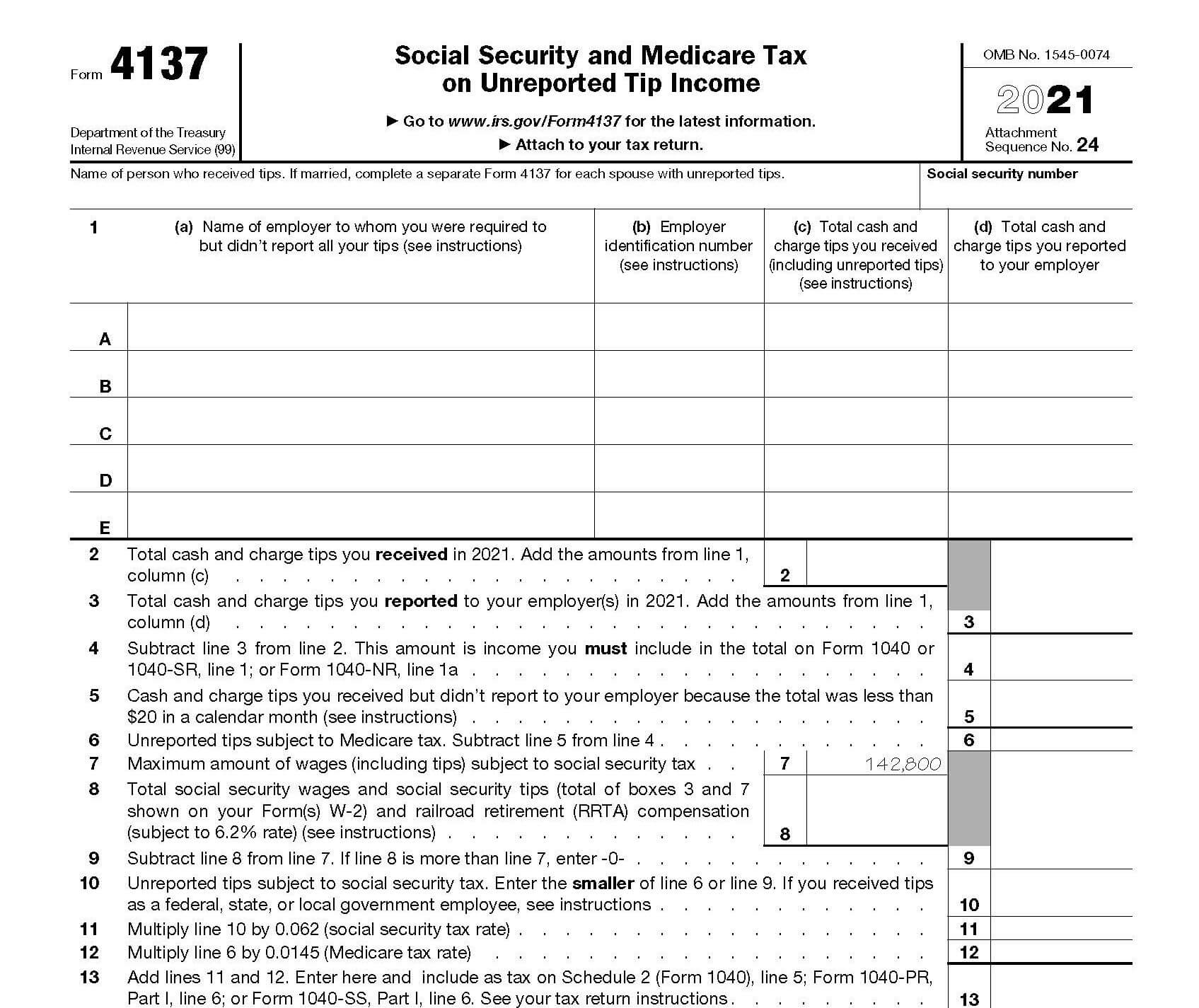

Form 4137, Social Security and Medicare Tax on Unreported Tip Income

Use IRS Form 4137 to determine the Social Security and Medicare tax owed on tips you did not report to your employer. This includes any allocated tips shown on Form W-2 that you must report as income. Completing this form will also ensure that your Social Security record will correctly reflect your total tip income.

Who Should Use Form 4137?

If you received tips (cash or charge) of $20 or more in a calendar month and did not report all of your tips to your employer, you must file Form 4137. You must also file if your Form W-2, box 8, included allocated tips that you must report as income. If you worked for multiple employers, the $20 tip threshold applies to each separately. Do not use Form 4137 as a substitute W-2.

How to Complete Form 4137

Form 4137 is short and easy to complete. Just follow the basic instructions below.

Line 1. For each employer, fill out the requested information. If you have more than five (5) employers, you’ll need to attach additional forms (line 1 only) or attach a statement that includes all the required information. Be sure to include the employer identification number (EIN), total tips received, and total tips reported for each employer.

Line 2. Add all amounts from line 1, column (c), and put the total here.

Line 3. Add all amounts from line 1, column (d), and put the total here.

Line 4. Subtract line 3 from line 2 and enter the amount on line 4. You’ll also need to enter this total on Form 1040 or 1040-SR (line 1), or Form 1040-NR (line 1a).

Line 5. If you received tips under $20 in a calendar month, enter them on this line. These tips aren’t subject to Social Security or Medicare tax.

Line 6. If you’re required to file Form 8959, enter the amount from line 2 of that form on line 6 of Form 4137.

Line 7. This line is already filled out for you.

Line 8. Enter the total amount in boxes 3 and 7 of your Form W-2 and railroad retirement compensation, if applicable.

Lines 9 through 13. Follow the math instructions and enter the results in the appropriate spaces.

It’s important to note that failure to report your tips to your employer could result in a penalty equal to 50% of the Social Security and Medicare tax due on those unreported tips. If you can show that your failure to report those tips was due to reasonable cause and not willful neglect, the IRS may waive the penalty.

Need Help?

If you need help completing Form 4137, contact Tax Defense Network at 855-476-6920. We offer affordable tax preparation and tax relief services. You can also download the instructions from IRS.gov.