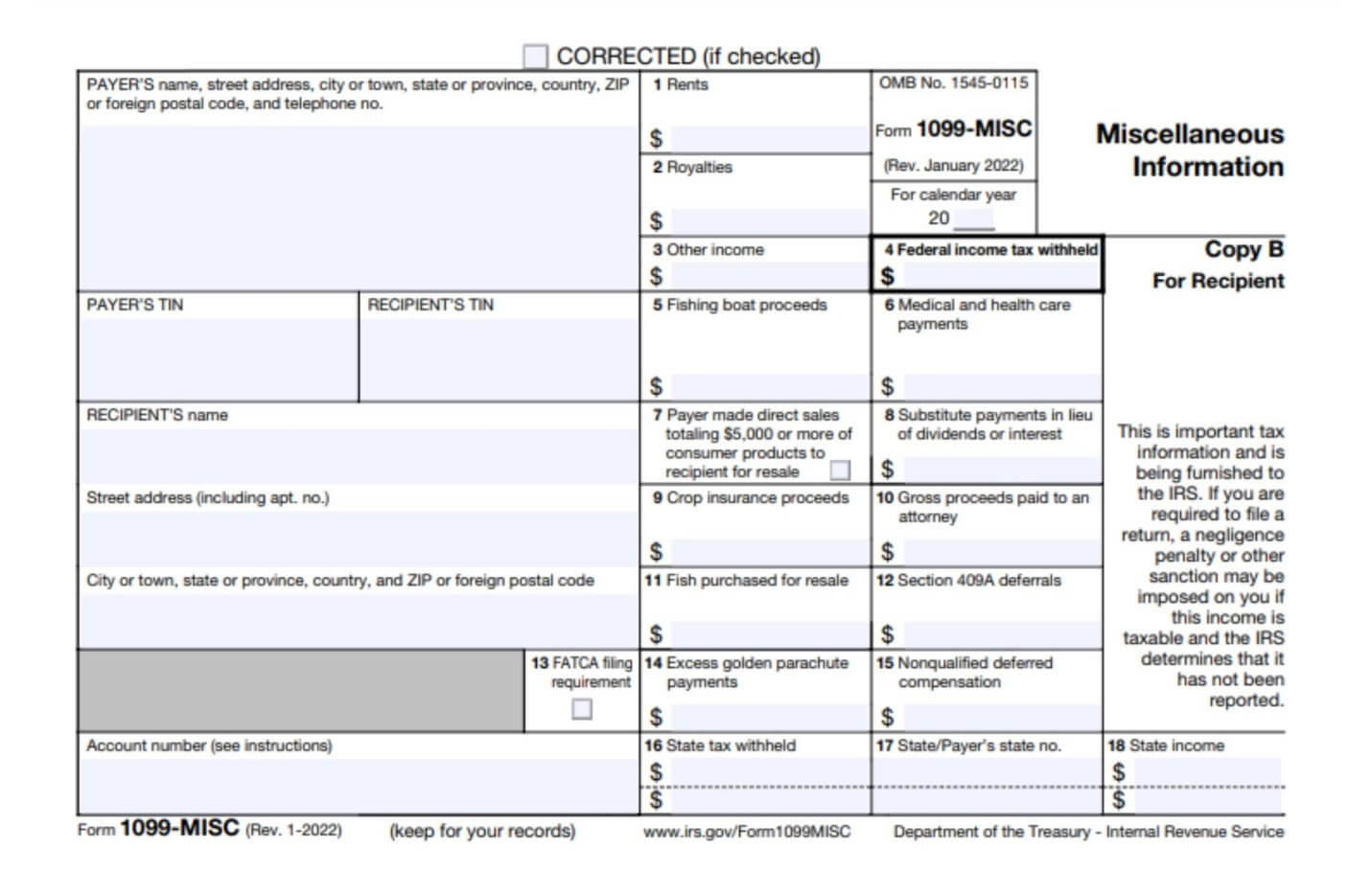

Form 1099-MISC, Miscellaneous Information

Form 1099-MISC, Miscellaneous Information, is used to report various types of compensation paid to non-employees. This may include royalties, prizes, awards, rents, and other income. Before the 2020 tax year, businesses typically reported payments to independent contractors, freelancers, and other non-employees on this form. Starting in tax year 2020, however, payments for services rendered should be reported on Form 1099-NEC.

Form 1099-MISC Income Information

If you received any of the following types of payments, you’ll most likely get a Form 1099-MISC from the person or business who paid you.

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest

- At least $600 for:

- Rent

- Prizes and awards (including those from a game show)

- Other income payments

- Cash from a notional principal contract to an individual, partnership, or estate

- Medical and health care payments

- Proceeds from a fishing boat

- Crop insurance proceeds

- Section 409A deferrals

- Non-qualified deferred compensation

- Fish or other aquatic life sold for resale

You should also receive Form 1099-MISC from anyone who withheld any federal income tax on your behalf under backup withholding rules, regardless of how much was withheld or paid.

Understanding Your 1099-MISC

Form 1099-MISC will include the payer’s name, address, and tax identification number (TIN). It will also include your name, address, and Social Security number (SSN). Depending on the type of miscellaneous income you received, one or more of the other boxes will contain amounts that you’ll need to report on your tax return.

Box 1 – Rents. Report rents from real estate on Schedule E (Form 1040). If you provided significant services to the tenant, sold real estate as a business, or rented personal property as a business, report the amount on Schedule C (Form 1040).

Box 2 – Royalties. Report royalties from oil, gas, or mineral properties, copyrights, and patents on Schedule E (Form 1040). Follow the instructions regarding payments for a working interest as explained in the Schedule E (Form 1040) instructions. For royalties on timber, coal, and iron ore, see IRS Pub. 544.

Box 3 – Other Income. The amount shown may be payments received as the beneficiary of a deceased employee, prizes, awards, taxable damages, Indian gaming profits, or other taxable income. This is typically entered on the “Other Income” line of Schedule 1 (Form 1040). If it is for trade or business income, report the amount on Schedule C or F (Form 1040).

Box 4 – Federal Income Tax Withheld. Backup withholding or withholding on Indian gaming profits are included here. Report this amount on your income tax return as tax withheld.

Box 5 – Fishing Boat Proceeds. This box includes amounts paid to you as a fishing boat crew member by the operator, who considers you to be self-employed. Report this amount on Schedule C (Form 1040).

Box 6 – Medical and Health Care Payments. This box is generally empty unless you are a medical or health care provider (physician, supplier, etc.). It includes payments of $600 or more made in the course of business or payments received from insurers (accident, sickness, and health insurance programs).

Box 7 – Direct Sales. If this box is checked, consumer products totaling $5,000 or more were sold to you for resale, on a buy-sell, a deposit-commission, or other basis. Report any income from your sale of these products on Schedule C (Form 1040).

Box 8 – Substitute Payments in Lieu of Dividends or Interest. Includes substitute payments in lieu of dividends or tax-exempt interest received by your broker on your behalf as a result of a loan of your securities. Report this amount on the “Other income” line of Schedule 1 (Form 1040).

Box 9 – Crop Insurance Proceeds. Enter this amount on Schedule F (Form 1040). If you’re not a farmer, this should be empty.

Box 10 – Gross Proceeds Paid to an Attorney. Shows gross proceeds ($600 or more) paid to an attorney in connection with legal services. Report only the taxable part as income on your return.

Box 11 – Fish Purchased For Resale. Includes the amount of cash you received for the sale of fish if you are in the trade or business of catching fish.

Box 12 – Section 409A Deferrals. This box includes current year deferrals as a nonemployee under a nonqualified deferred compensation (NQDC) plan that is subject to the requirements of section 409A plus any earnings on current and prior year deferrals.

Box 13 – FATCA Filing Requirement. The Foreign Account Tax Compliance Act (FATCA). Don’t check the FATCA box in your tax software unless it appears and is checked on your 1099-MISC.

Box 14 – Excess Golden Parachute Payments. This box will include total compensation of excess golden parachute payments subject to a 20% excise tax.

Box 15 – Nonqualified Deferred Compensation. Shows income as a nonemployee under an NQDC plan that does not meet the requirements of section 409A. Any amount included in box 12 that is currently taxable is also included in this box. Report this amount as income on your tax return.

Box 16 through 18 – State Tax Information. If you had local or state income tax withheld from payments, it will be included in these boxes.

Need Help?

If you need help preparing your tax return using Form 1099-MISC or Form 1099-NEC, call tax Defense Network at 855-476-6920. Our tax professionals can help make sure you get every tax credit and deduction available to you!