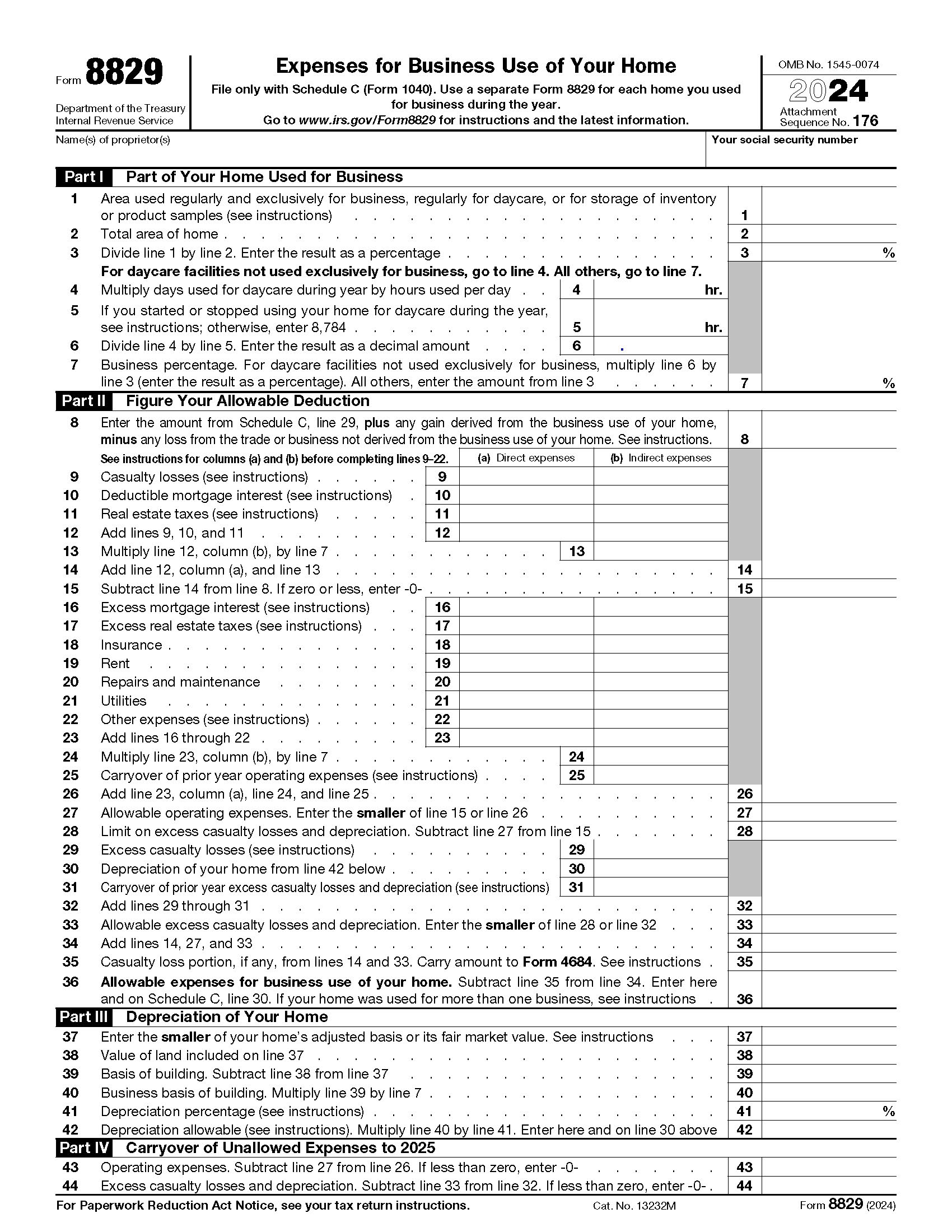

Form 8829, Expenses for Business Use of Your Home

IRS Form 8829 is used to calculate the allowable home office expenses you may be eligible to claim on Schedule C (Form 1040) and any carryover amounts you may be able to deduct the following tax year. The IRS pays close attention to those who use Form 8829, so be sure you are eligible to take the home office deduction before submitting this form.

Who Should Use Form 8829?

You must meet three specific requirements to deduct expenses for the business use of your home.

- You must be self-employed or a business owner,

- Your home must be your principal place of business, and

- You must regularly use part of your home exclusively for business.

Do not use Form 8829 in any of the following situations:

- You are claiming home office expenses as a partner, or you are claiming these expenses on Schedule F (Form 1040).

- All of the expenses for business use of your home are allocated to inventory costs (Use Schedule C, Part III).

- You are using the simplified method to determine your home office deduction.

If you are an employee for another company and working remotely from home, you are not eligible to take the home office deduction and should not complete Form 8829.

Allowable Business Expenses

There are various direct and indirect expenses that you can deduct for the business use of your home. Not all, however, should be included on Form 8829. For example, some direct expenses specific to operating your business should only be included on Schedule C. These typically include:

- Advertising costs

- Legal expenses

- Employee salaries/payments

Other direct costs pertaining to the business part of your home and indirect expenses shared by both your business space and home should be included in Form 8829. These generally include, but are not limited to:

- Electrical upgrades to your business space only (other direct costs)

- Separate internet for your office (other direct costs)

- Utilities (indirect)

- General home maintenance (indirect)

- HOA fees (indirect)

- Mortgage interest (indirect)

- Rent (indirect)

- Real estate taxes (indirect)

Keep in mind that your deduction is limited to the percentage of your home that is used exclusively for business purposes. Your business income may also restrict the amount you can deduct for certain business expenses.

How to Complete Form 8829

Filling out Form 8829 is fairly complicated and involves quite a bit of math. We strongly encourage enlisting the help of a tax professional if you plan to use this form. Here is a basic overview of the various sections you’ll need to complete.

Part I – Part of Your Home Used for Business. Here you will need to calculate what percentage of your home is being used exclusively for business. You’ll need to enter the square footage of your office space (line 1) and the total area of your home (line 2). Divide line 1 by line 2 to determine the percentage (line 3). Next, skip to line 7 (unless you are operating a daycare) and enter the amount from line 3 here, as well.

Part II – Figure Your Allowable Deduction. In this section, you’ll enter your direct and indirect expenses to determine your allowable deduction. You’ll also need to calculate any carryover operating expenses from the prior year. If you have casualty losses, that will also be determined in this section. For line 30, depreciation of your home, you’ll need to complete Part III.

Part III – Depreciation of Your Home. Before completing this section, you’ll need to know your home’s adjusted basis and its fair market value (FMV). Use the chart provided in the form instructions to determine the depreciation percentage (line 41).

Part IV – Carryover of Unallowed Expenses. If your business income was less than your allowable business expenses, you’ll use this section to determine what amount you can carry over into next year.

Need Help?

If you need assistance completing Form 8829, contact Tax Defense Network at 855-476-6920. We offer affordable business tax preparation and other tax services. You can also download the instructions from IRS.gov.