Form 4562, Depreciation and Amortization

Use IRS Form 4562 to claim depreciation and amortization deductions on your annual tax return. Each year, you can use the form to deduct the cost of business property that has depreciated. This generally includes large ticket items, such as vehicles or equipment, that have a lifespan of more than a year. Intangible items, such as patents and trademarks, fall under amortization, which can help you spread the expense of the asset over its useful life.

Who Should Use Form 4562?

If you own a business, complete and file Form 4562 if you plan to claim any of the following:

- Depreciation for property placed in service during the current tax year.

- A Section 179 expense deduction, including carryovers from a previous year.

- Depreciation on any vehicle or other listed property (regardless of service year).

- A deduction for any vehicle reported on a form other than Schedule C, Profit or Loss From Business.

- Any depreciation on a corporate income tax return (not including Form 1120-S).

- Amortization of costs that begins in the current tax year.

You should file a separate Form 4562 for each business on your return.

How To Complete Form 4562

To ensure you accurately complete Form 4562, there are several things you will need in addition to your regular tax records. This includes the price of the property/asset you are claiming, the date it was put into service, and the total income you’re reporting for the tax year. You should also have receipts for the property or asset you are depreciating. If the item is being used for both personal and business use, you should know the percentage of time it was used for business and have documentation to substantiate your claim.

Before you dive into Form 4562, it’s a good idea to get a general overview of each section. Determining depreciation and amortization can be tricky, however, so we highly recommend working with a CPA or tax professional when completing this form.

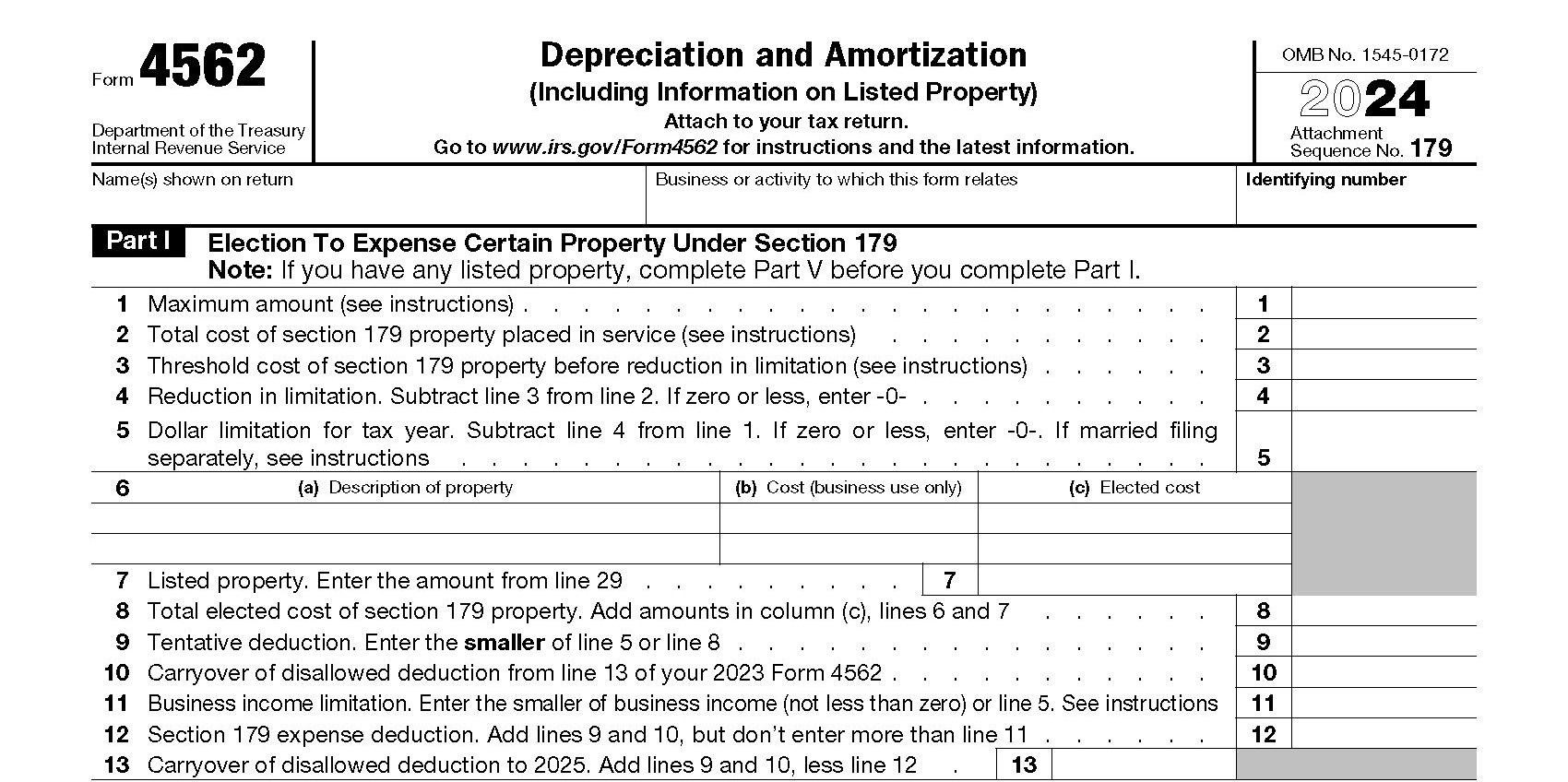

Part I, Section 179 Deductions

Before completing Part I, be sure to skip to Part V and fill out that section first.

Line 1. Use Worksheet 1 provided in the Form 4562 instructions to determine the amount entered on line 1. Generally, the maximum Section 179 expense deduction is $1,050,000 for property placed into service during the 2021 tax year.

Line 2. Enter the total cost of all Section 179 property placed into service during the tax year, as well as any listed property in Part V. You should also include property placed in service by your spouse, even if you file separately.

Line 3. The amount entered here is limited to the amount shown on line 1. If the cost of Section 179 property placed into service (2021 tax year) is greater than $2,620,000, the amount is reduced.

Line 4. Subtract line 3 from line 2 and enter the amount here.

Line 5. Subtract line 4 from line 5 and enter the amount here. If it is zero, you cannot take the Section 179 deduction and should skip lines 6 through 11.

Line 6. Enter the description of the property you elect to expense in column (a). Do not include any listed property, as this should go in column (i) on line 26 (Part V). Enter the cost of the property in column (b). In column (c), enter the amount you elect to expense.

Line 7. If you elect to expense any listed property on line 29 (Part V), it should be included here, too.

Lines 8 & 9. Follow the math instructions per each line.

Line 10. If you wrote off any portion of the property the previous tax year, and you are carrying over and depreciating the remaining value this year, enter the amount on this line.

Line 11. Enter either your net earnings/profits for the year or the amount on line 5, whichever is smaller.

Line 12. To determine your deduction amount, add lines 9 and 10. If the amount is higher than line 11, enter the amount from line 11.

Line 13. If you have carryover depreciation for next year, the amount is entered here.

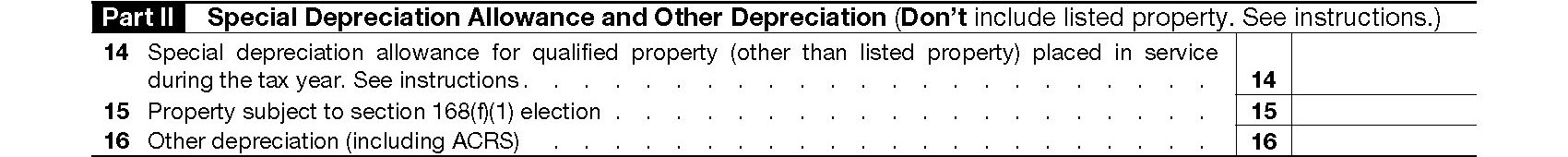

Part II, Special Depreciation Allowance and Other Depreciation

This section only applies to certain qualified property that may be eligible for an additional depreciation allowance. It’s very complex and there are various exceptions, so it’s best to seek professional help if you think you may be eligible to take the additional allowance.

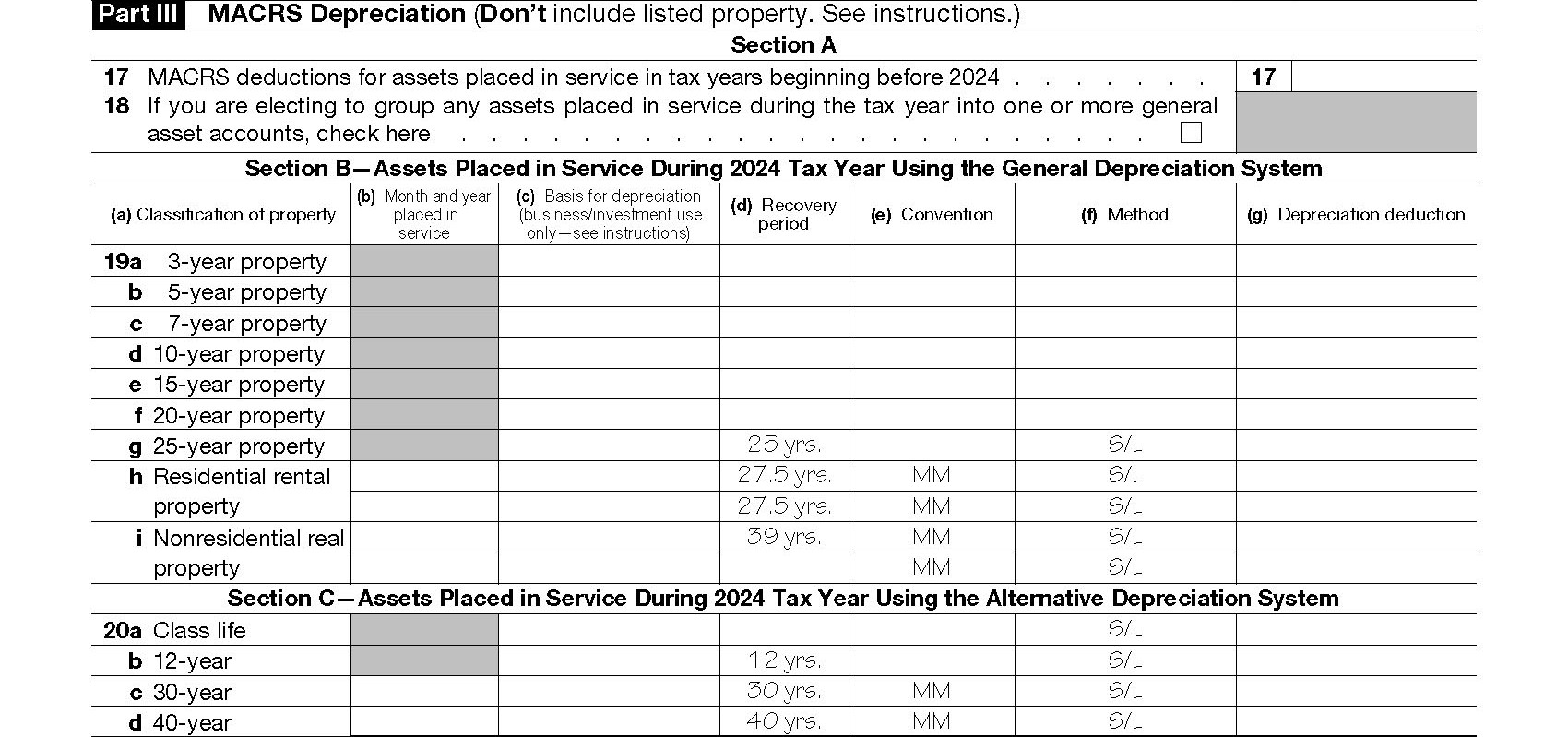

Part III, MACRS Depreciation

MACRS (Modified Accelerated Cost Recovery System) is used to depreciate any tangible property placed in service after 1986. It does not, however, apply to film, video, or audio recordings. You should complete Part III if you plan to depreciate property/assets over several years instead of taking the Section 179 deduction (Part I) or bonus depreciation (Part II).

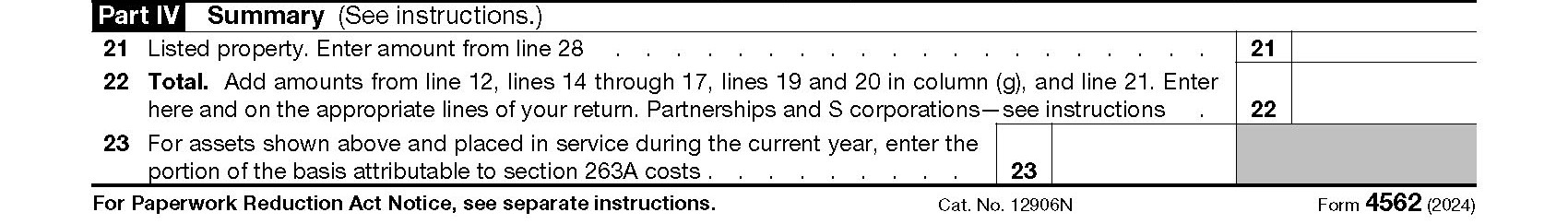

Part IV, Summary

Part IV is a summary section for the IRS. Before filling it out, you’ll need to complete the remainder of Form 4562.

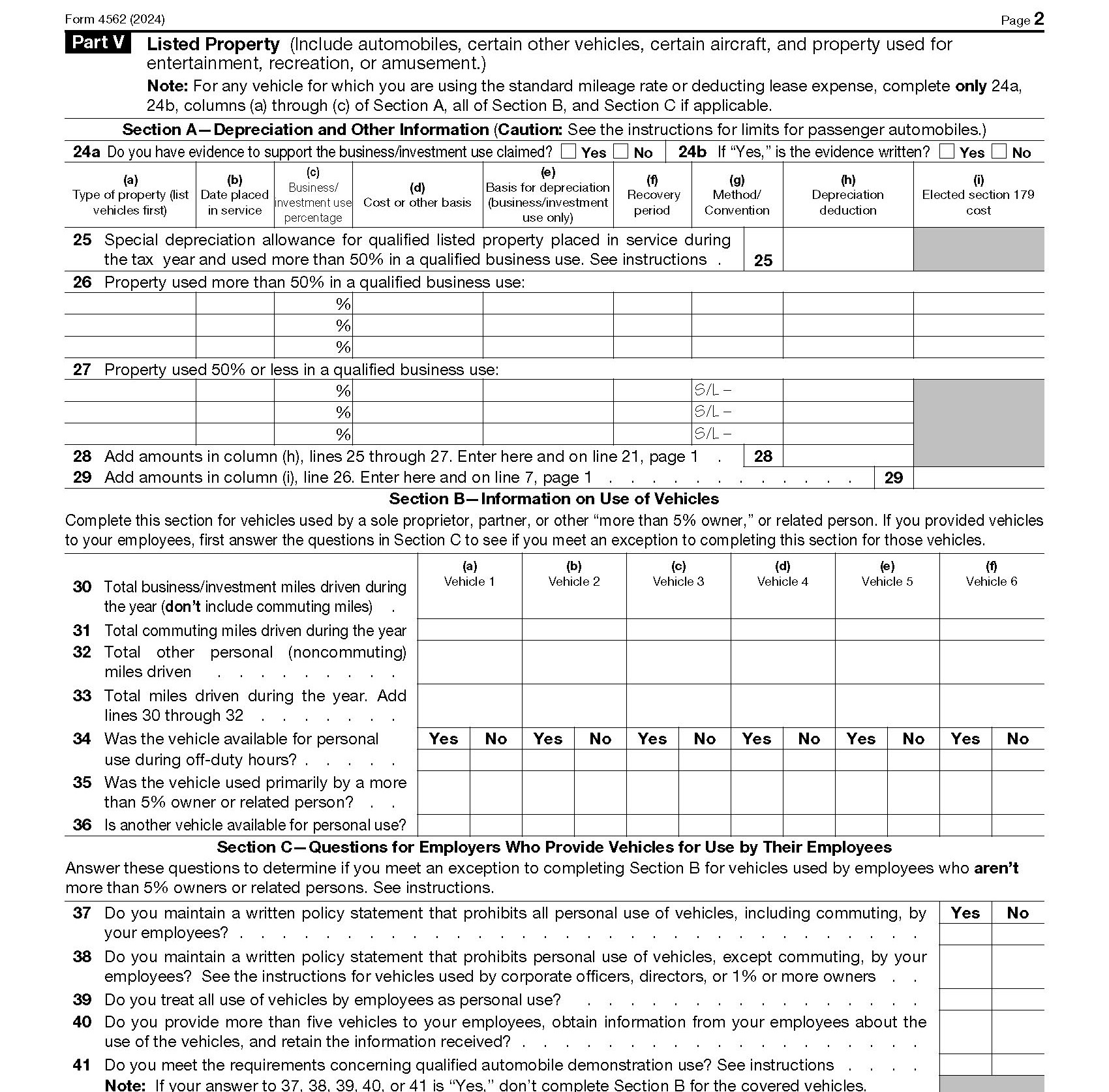

Part V, Listed Property

Part V is where you’ll list vehicles and property used for both personal and business needs. If you claim actual vehicle expenses (including depreciation), the standard mileage rate, or depreciation on any other listed property, you must complete Part V of Form 4562. If you use Schedule C to claim the standard mileage rate or actual vehicle expenses (excluding depreciation) and are not required to use Form 4562 for any other reason, do not use this form. You should also skip Part V if you use Form 2106.

Line 24a & 24b. Check the appropriate boxes on these lines.

Line 25. You may be eligible for an additional deduction if the property is listed and qualified. Refer to instructions in Part II, line 14 to determine the amount placed here.

Line 26. Property mainly used for business purposes is listed here.

Line 27. Property used mainly for personal use is listed here.

Line 28. Add together the amounts in column (h), lines 25 through 27, and enter the total on line 28 and line 21 (Part IV).

Line 29. Add together the amounts in column (i), line 26, and enter the total on line 29 and line 7 (Part I).

Part V, Section B – Information on Use of Vehicles. Complete lines 30 through 36 for each business vehicle claimed.

Part V, Section C – Questions for Employers Who Provide Vehicles for Use by Their Employees. Answer the questions on lines 37 through 41 to determine if you are required to complete Section B.

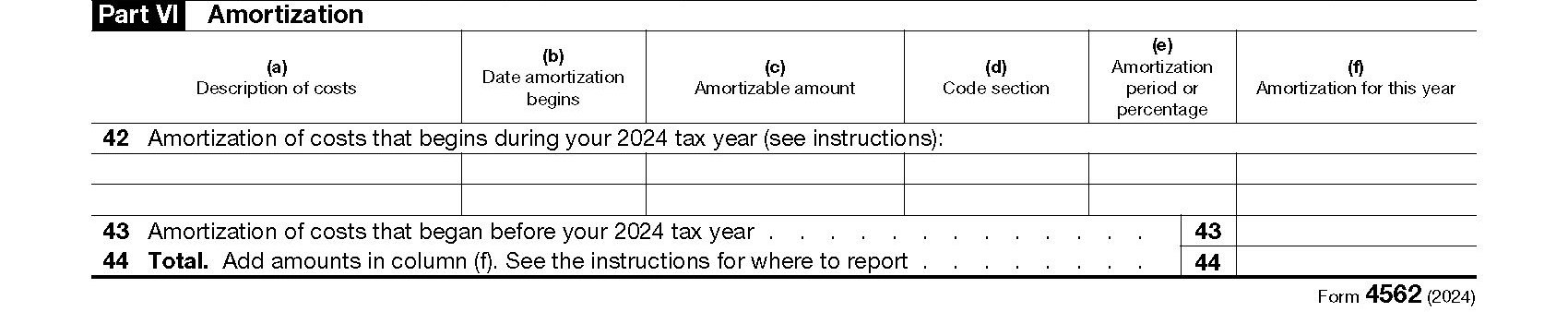

Part VI, Amortization

If you have intangible assets (patents, trademarks, etc.) you plan to amortize, list them in this section. Any assets listed here are not eligible for a Section 179 deduction or a depreciation deduction.

Need Help?

Form 4562 is complicated and requires a good understanding of depreciation and amortization rules. To ensure everything is filled out accurately, we encourage you to work with an experienced tax professional. At Tax Defense Network, we offer affordable business services to help you reduce your tax liability and set you up for success. Call 855-476-6920 today for a free consultation and quote.