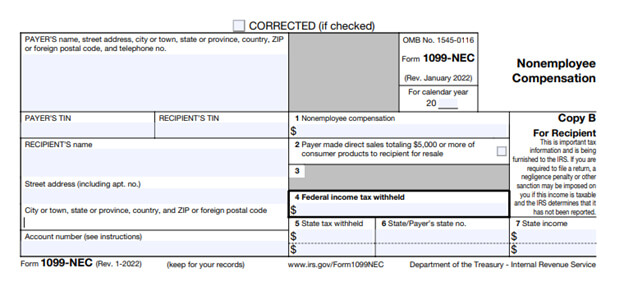

Form 1099-NEC, Nonemployee Compensation

Form 1099-NEC, Nonemployee Compensation, is used to report compensation paid to non-employees. Any business that paid a non-employee more than $600 during the tax year is required to file a 1099-NEC with the IRS. The form must be filed (by mail or e-file) no later than January 31 of the following year. If the deadline falls on a weekend or holiday, however, it’s due the next business day. In most cases, a 1099-NEC must also be filed with the state.

Is The 1099-NEC The Same As a 1099-MISC?

Prior to the 2020 tax year, Form 1099-MISC was used to report compensation made to those who were not on the payroll (non-employees). This typically included gig workers, independent contractors, or other self-employed individuals. Although Form 1099-MISC still exists, Form 1099-NEC has taken its place for reporting non-employee compensation for services rendered. Other types of payments, such as rents, prizes, and award money, are still reported on a 1099-MISC.

Understanding Your 1099-NEC

Form 1099-NEC will include the payer’s name, tax identification number, and address. It will also include your name, Social Security number (SSN), and address. Additionally, it will list any non-employee compensation you received, as well as state and/or federal taxes withheld.

Box 1 – Nonemployee Compensation. Includes money paid to you by the payer. If the amount in this box is self-employment income and you’re a sole proprietor, report it on Schedule C or F (Form 1040). If you’re part of a partnership, report it on Form 1065 and Schedule K-1. The recipient/partner must also complete Schedule SE (Form 1040).

Box 2 – Direct Sales. If consumer products totaling more than $5,000 were sold to you for resale (buy-sell, deposit-commission, or other basis), this should be checked. Any income from the sale of these items must be reported on Schedule C (Form 1040).

Box 3. This is reserved for future use and left blank.

Box 4 – Federal Income Tax Withheld. Your backup withholding is entered here. Include this amount on your tax return as tax withheld.

Box 5 through 7 – State Income & Taxes. Information for your state income taxes is included in these boxes.

Need Help?

If you’re self-employed and need assistance preparing your tax returns using Form 1099-NEC, call Tax Defense Network at 855-476-6920. Our team of tax specialists can help you maximize your deductions and credits, as well as minimize your tax liabilities.