Form 8949, Sales and Other Dispositions of Capital Assets

IRS Form 8949 is used to reconcile the amounts reported to a taxpayer and the IRS on Form 1099-B or 1099-S (or substitute statement) with the amounts reported on the taxpayer’s return. The subtotals from Form 8949 are then carried over to Schedule D (of the tax return filed), where the gain or loss is calculated in aggregate.

Who Should Use Form 8949?

IRS Form 8949 is used by individuals, partnerships, and corporations that must report capital gains or losses from an investment. Although Schedule D is generally used to report these types of transactions, Form 8949 must be completed first.

Transactions Typically Reported on IRS Form 8949

Generally, the following types of transactions are reported on Form 8949:

- Capital gains (distributed and undistributed)

- Capital losses

- Non-deductible losses

- The sale of your main home

- Sales of any capital assets held for personal use

- The sale of any partnership interest

- Short sales

- Wash sale losses

You aren’t required to file Form 8949 if all of your capital gains and/or losses are reported on IRS Form 1099-B with the correct basis and no adjustments are needed.

How to Complete Form 8949

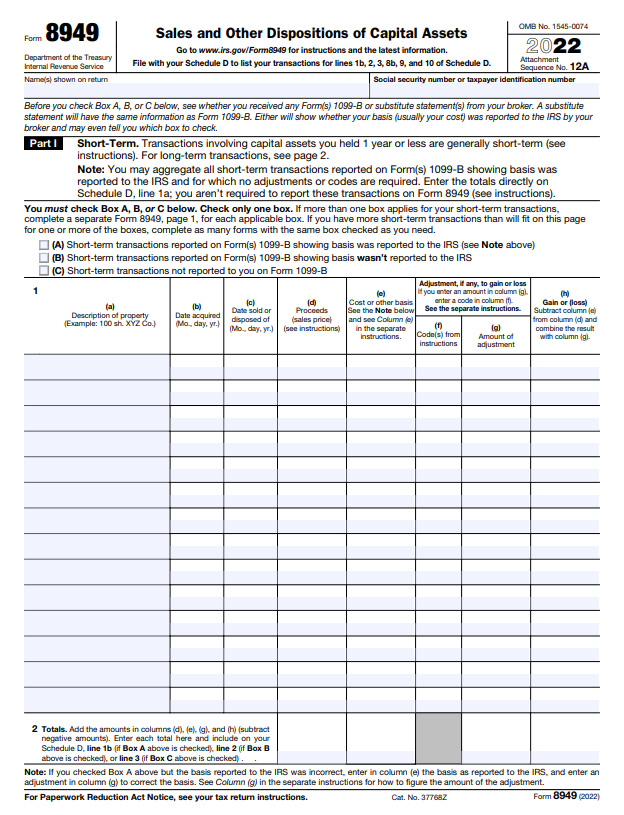

When completing Form 8949, you’ll report any short-term gains and losses in Part I. Long-term gains and losses are reported in Part II. Be sure to include your name and Social Security number (SSN) or taxpayer identification number (TIN) at the top of the form.

Part I

Check either A, B, or C to indicate how your short-term transactions were reported to you and the IRS. If more than one box applies, complete a separate page 1 for each applicable box.

Line 1 – Enter all sales and exchanges of capital assets. This includes stocks, bonds, and real estate. You must include these transactions even if you did not receive Form 1099-B or 1099-S. If you selected more than one box (A, B, or C), only include short-term transactions that correspond with the box checked.

Line 2 – Add the amounts in columns d, e, g, and h. Be sure to subtract any negative amounts. Enter the totals on line 2. If you checked box A, also enter these amounts on Schedule D, line 1b. For box B, enter on line 2 (Schedule D), or line 3 if you checked box C.

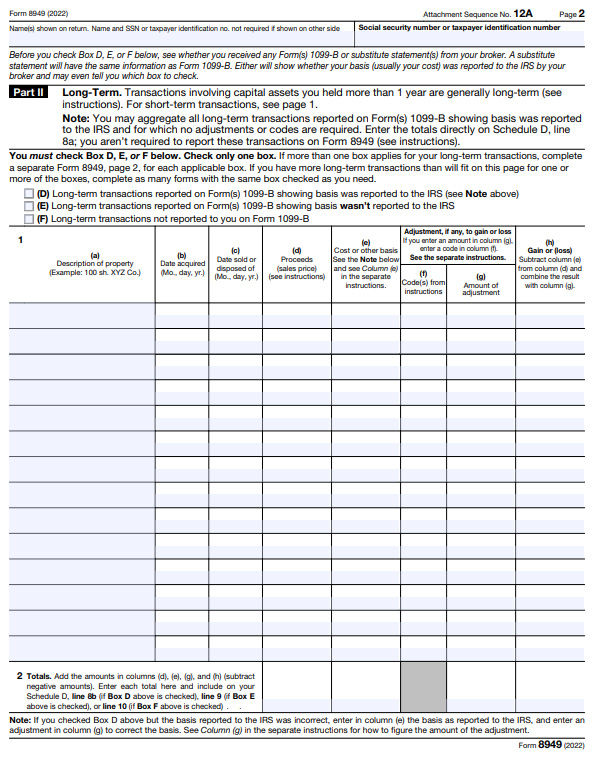

Part II

Transactions involving capital assets held for longer than a year should be entered in this section. Check either D, E, or F to indicate how your long-term transactions were reported to you and the IRS. Complete a separate page 2 for each box checked.

Line 1 – Enter all sales and exchanges of your long-term capital assets in this section. If you checked more than one box, only include the transactions that correspond with the box checked.

Line 2 – Add the amounts in columns d, e, g, and h. Be sure to subtract any negative amounts. Enter the totals on line 2. If you checked box D, also enter these amounts on Schedule D, line 8b. For box E, enter on line 9 (Schedule D), or line 10 if you checked box F.

Need Help?

Although IRS Form 8949 is only two pages, there is a lot of information required. There are also exceptions to the rule for who must report separate transactions on each row of Part I and Part II. We recommend working with a tax professional when completing this form. If you need assistance, please contact Tax Defense Network at 855-476-6920 or download the instructions from IRS.gov.