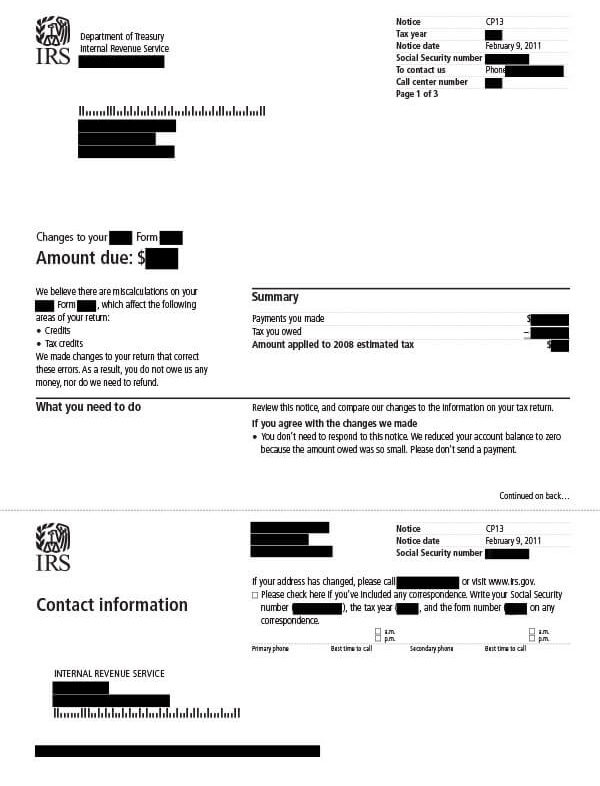

IRS Notice CP13 – Adjustments Made to Your Tax Return

The IRS sends out notice CP13 when it makes changes to your tax return. Unlike CP11 (balance due) or CP12 (refund due), however, those changes did not result in a tax refund or balance due.

Why Did I Receive IRS Notice CP13?

You received IRS Notice CP13 because there were miscalculations on your tax return. The IRS corrected these errors. The changes made to your return did not result in any additional refund or balance due. The letter explains the adjustments made to your return.

Next Steps

When you receive IRS Notice CP13, carefully review the adjustments made and compare them to your return.

If you agree with the changes:

- Make the necessary changes to your tax return and keep a copy for your records. Do not send this to the IRS.

If you disagree with the changes:

- Call the IRS at the number listed on the top right corner of your notice or reply by mail to the address provided. Be sure to include a copy of your notice and any supporting documentation if you respond by postal mail.

You have 60 days to ask the IRS to reverse the changes made to your tax return. It’s important to note that the IRS may forward your case for audit if you don’t provide sufficient documentation to support your request. If you don’t respond within the 60-day window, the IRS will assume you agree with the findings and you’ll forfeit your right to appeal the decision.

Who Should I Contact if I Have More Questions?

If you additional questions about your CP13 notice, call the IRS at the number listed in your notice.