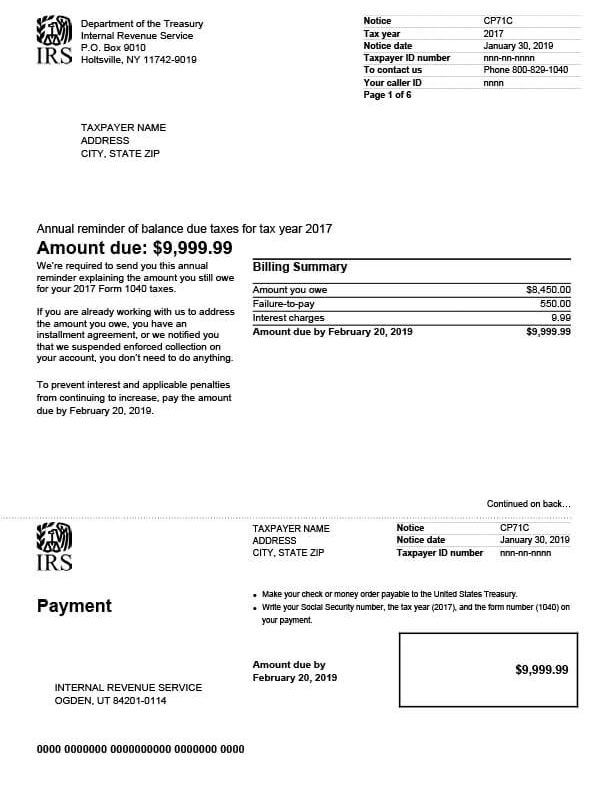

IRS Notice CP71C – Annual Balance Due Reminder

IRS Notice CP71C is an annual reminder sent to taxpayers who still have an outstanding tax balance with the IRS. It also includes information on the denial or revocation of a United States passport.

Why Did I Receive IRS Notice CP71C?

You received a CP71C notice because you have unpaid taxes, penalties, and interest fees. The IRS is required to send this annual reminder to give you an update on your current total due and explain the potential consequences of continued delinquency.

Next Steps

Read your CP71C notice thoroughly and keep a copy for your records.

If you agree with the amount due:

- Pay the amount due by the notice deadline date to avoid additional fees, or

- Set up a payment plan if you are unable to pay in full.

If you disagree with the amount due:

- Contact the IRS at the number listed on your CP71C notice and speak with a representative. Have your account information on hand before calling.

Whether you agree or disagree, it may also be beneficial to speak with a tax professional and explore all your tax relief options.

Who Should I Contact if I Have More Questions?

For questions regarding your IRS Notice CP71C, call the number listed on the notice or call 800-829-1040. To explore your tax relief options, contact Tax Defense Network at 855-476-6920 and request a free consultation.