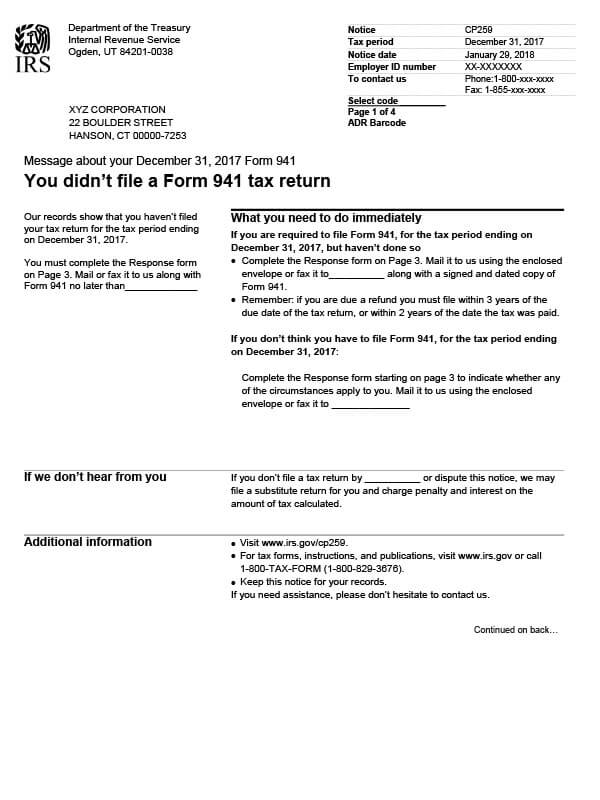

IRS Notice CP259 – Unfiled Business Return

IRS Notice CP259 is sent to taxpayers who are required to file a business return for an indicated tax period but have failed to do so.

Why Did I Receive IRS Notice CP259?

You received notice CP259 because the IRS did not receive your business tax return by the deadline date for the tax period identified on the notice. The IRS believes that you are required to file and wants you to send in your return immediately.

Next Steps

Review your CP259 notice and save a copy for your records. Pay close attention to the response/filing deadline and follow the instructions provided.

If you are required to file:

- Complete the response form included with the notice. Mail it, along with a signed and dated copy of your return (including all required schedules), using the enclosed envelope.

- If you can’t pay your taxes due in full, request a payment plan.

If you don’t think you need to file:

- Complete the response form and indicate which circumstances apply to you. Mail the form using the envelope provided. You may also fax the form to 855-800-5944.

If you don’t file your return or fail to dispute the notice by the deadline date, the IRS may file a Substitute for Return (SFR). This may include penalty and interest fees in addition to the amount of tax calculated.

You may disregard the notice if you filed your return within the last four weeks before receiving the notice.

Who Should I Contact if I Have More Questions?

If you have questions about your IRS Notice CP259, call the number listed on your notice. For assistance with filing a late tax return, call Tax Defense Network at 855-476-6920 for a free consultation and quote.