IRS Notice CP60 – Misapplied Tax Payments

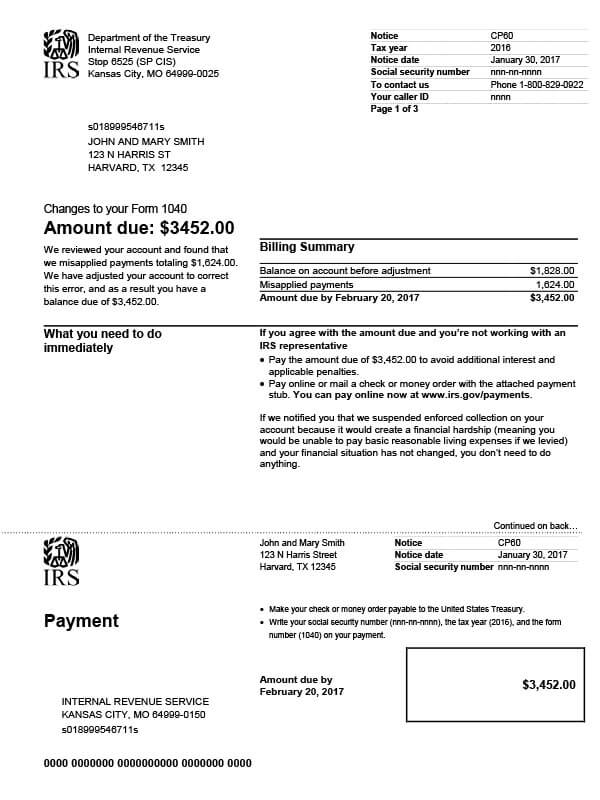

IRS Notice CP60 is sent to a taxpayer when the IRS removes a payment it incorrectly applied to their account.

Why Did I Receive IRS Notice CP60?

Unfortunately, when the IRS makes mistakes it’s not always in your favor. In this case, they erroneously applied a credit to your account. The incorrect payment was then removed, leaving you with a balance due.

Next Steps

Carefully review your CP60 notice. It will provide the date and the amount of the payment the IRS removed from your account.

If you agree with the amount due:

- Pay the balance due in full by the deadline date to avoid additional interest charges and penalty fees. You can pay online or submit your payment by mail along with the attached payment stub.

- If you are unable to pay in full, apply for a payment plan or contact a tax professional to explore your tax relief options.

If you disagree with the amount due:

- Contact the IRS at the number listed on your CP60 notice and review your account with a representative. Be sure to have your account information available when you call.

Who Should I Contact if I Have More Questions?

If you have concerns about your IRS Notice CP60, call the number on your tax notice or 800-829-1040. You can also call Tax Defense Network at 855-476-6920 and request a free consultation.