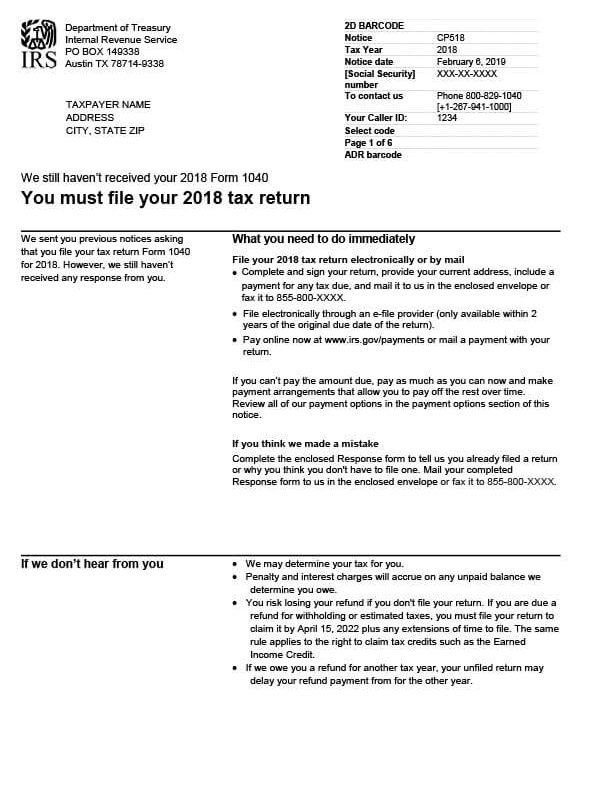

IRS Notice CP518 – Unfiled Return, Final Reminder

IRS Notice CP518 is a final reminder that a taxpayer has not filed their required tax return(s).

Why Did I Receive IRS Notice CP518?

You received notice CP518 because you ignored previous requests to submit your unfiled tax return(s). The IRS is sending a final reminder before it determines your tax for you.

Next Steps

Read your CP518 notice and keep a copy for your records.

What you need to do immediately:

- Complete and sign your tax return for the year(s) requested. Include your payment for any taxes due or pay online at www.irs.gov/payments. You may e-file your unfiled return if it’s within two (2) years of the original filing deadline.

- If you can’t pay your taxes in full, pay what you can now and make payment arrangements with the IRS.

If you don’t think you need to file:

- Complete Form 15103, Form 1040 Return Delinquency. Be sure to explain why you don’t think you need to file your return. Sign and mail Form 15103 to the IRS.

If you’ve already filed:

- Nothing is required if you filed within the last eight (8) weeks.

- If you submitted your return more than eight weeks ago, complete Form 15103 and enclose a signed and dated copy of your tax return as verification.

If you do not respond to the notice, the IRS will file a Substitute for Return to determine what you owe, including penalties and interest charges. You risk losing your tax refund if you wait for more than three (3) years to file from the original filing deadline.

Who Should I Contact if I Have More Questions?

For questions about your IRS Notice CP518, call the IRS at the number listed on your notice or 800-829-1040. If you need help with unfiled return(s), call Tax Defense Network at 855-476-6920 for a free consultation and quote.