IRS Notice CP14 – Balance Due

IRS Notice CP14 is sent to taxpayers when they have unpaid taxes.

Why Did I Receive IRS Notice CP14?

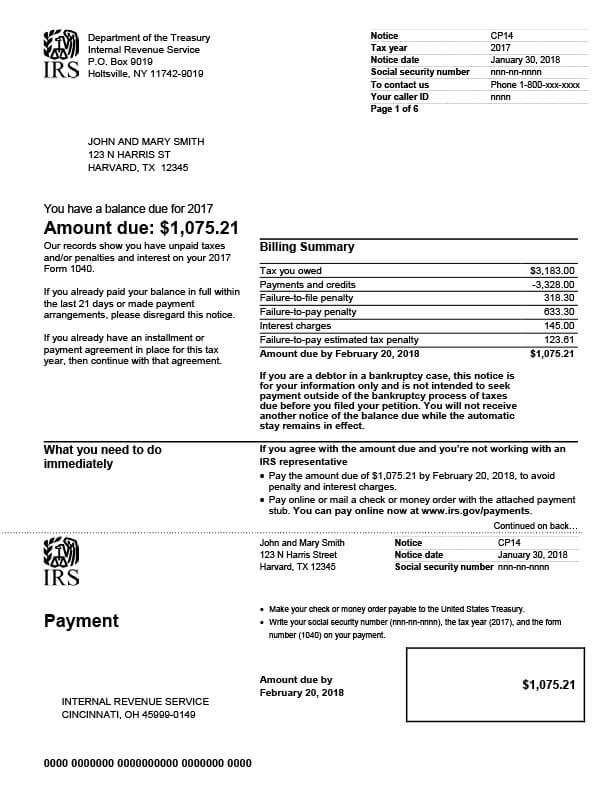

If you filed your return but did not pay the taxes due, the IRS will send you a CP14 notice. It’s typically the first tax notice sent requesting payment for unpaid taxes. It will contain a billing summary that lists the amount you owe, any payments or credits applied to that balance, penalties and interest added, and the total amount now due.

Next Steps

Do not ignore your CP14 notice. Make sure you carefully review the information provided and compare it to your tax return. The notice will explain how much you owe and how to pay it.

If you agree with the amount due:

- Pay the amount due by the deadline date to avoid additional penalty and interest charges. You can pay online or mail in your payment (check or money order). Checks and money orders should be made payable to the United States Treasury. Always include your SSN, tax year, and form number (1040) on your payment.

- If you can’t pay in full, pay as much as you can and make payment arrangements with the IRS. You could be eligible for a payment plan, Offer in Compromise, or other tax relief programs. Speak with a tax relief specialist to determine which course of action is best for you. Depending on your situation, you may also qualify for penalty abatement or a payment extension.

If you disagree with the amount due:

- Call the IRS at the toll-free number listed on the top right corner of your notice as soon as possible. Be sure to have your account information handy before speaking with a representative.

- Contact a tax professional for assistance. A tax pro will review your return and ensure you haven’t missed any vital deductions or credits which can lower your tax bill. If your return is audited, they can also represent you during the process to ensure you get the best outcome possible.

In some cases, it is possible to receive a CP14 notice by mistake. Generally, this happens if you’ve made a payment or paid the balance in full within the past 21 days. If you paid your account in full or already made payment arrangements, you can ignore the notice.

Who Should I Contact if I Have More Questions?

If you have additional questions about your IRS CP14 notice, we strongly recommend speaking with an experienced tax professional. For a free consultation and case review, call Tax Defense Network at 855-476-6920 today!