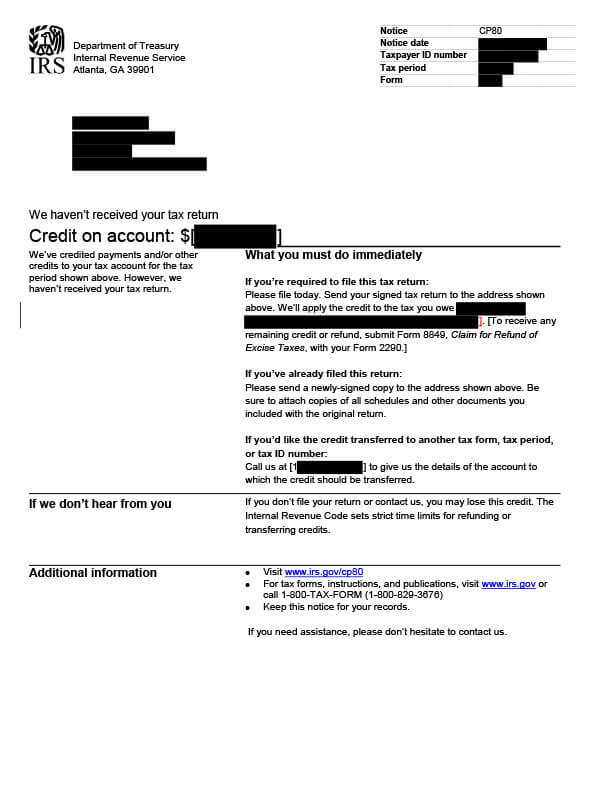

IRS Notice CP80 – Credit on Account, No Tax Return Received

IRS Notice CP80 is sent when payments and/or tax credits are credited to a taxpayer’s account but the IRS has not received a tax return for the period in which they were applied.

Why Did I Receive IRS Notice CP80?

You received a CP80 notice because the IRS made credits to your tax account even though it has not received your tax return for that period. If you don’t file the required return, or fail to contact the IRS, you could lose the credit(s).

Next Steps

Read your notice CP80 and keep a copy for your records.

If you’re required to file a tax return:

- Complete your tax return and send it to the address on your CP80 notice. The IRS will apply the credit(s) to any tax you may owe.

If you’ve already filed your return:

- Send a newly-signed copy of your tax return to the address on your notice. Be sure to attach copies of all scheduled and other documents included with the original return.

If you’d like the credit transferred to another tax form, period, or tax ID:

- Call the IRS at the number listed on your tax notice.

Due to processing delays for 2019 and 2020 tax returns, the IRS temporarily suspended the issuance of CP80. If you received a notice for your 2019 return and you filed timely, please refile the return. If you received a notice for your 2020 return DO NOT refile.

Who Should I Contact if I Have More Questions?

For questions concerning your IRS Notice CP80, call the number listed on your notice or call 800-829-1040. If you need assistance filing your tax return, call Tax Defense Network at 855-476-6920 for a free consultation and quote.