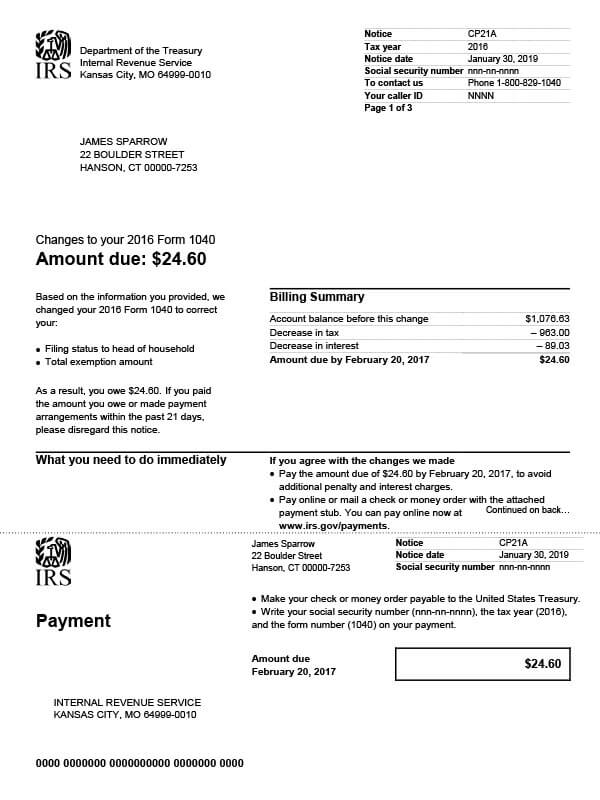

IRS Notice CP21A – Changes to Your Form 1040

The IRS sends notice CP21A when it makes changes to Form 1040 based on information provided by the taxpayer. As a result of those changes, there is now a balance due.

Why Did I Receive IRS Notice CP21A?

You received CP21A because you originally filed your tax return and discovered an error. Then, you either submitted an amended return or contacted the IRS directly to correct them. Once the IRS made the requested changes, it resulted in a balance due.

Next Steps

Review IRS Notice CP21A carefully. It details the changes made to your tax return and the resulting tax balance.

If you agree with the changes made:

- Pay the amount due by the deadline date (typically 21 days from the notice date) to avoid additional penalties and interest fees.

- You can pay online or by mail (check or money order). If submitting payment by mail, be sure to include the payment stub provided with your CP21A. Checks or money orders should be made out to the United States Treasury. Include your Social Security number, the tax year, and form (1040) on the check or money order, as well.

If you disagree with the changes made:

- Call the toll-free number listed on your notice and speak with an IRS representative. Make sure you have a copy of your tax return and the notice before you call.

If you are unable to pay the resulting tax balance in full, you’ll need to make payment arrangements with the IRS. Depending on your situation, you may qualify for an installment agreement, online payment plan, Offer in Compromise, or some other type of tax relief.

Who Should I Contact if I Have More Questions?

You can contact the IRS at the number listed on your CP21A notice if you have additional questions. You may also call Tax Defense Network at 855-476-6920 to request a free consultation.