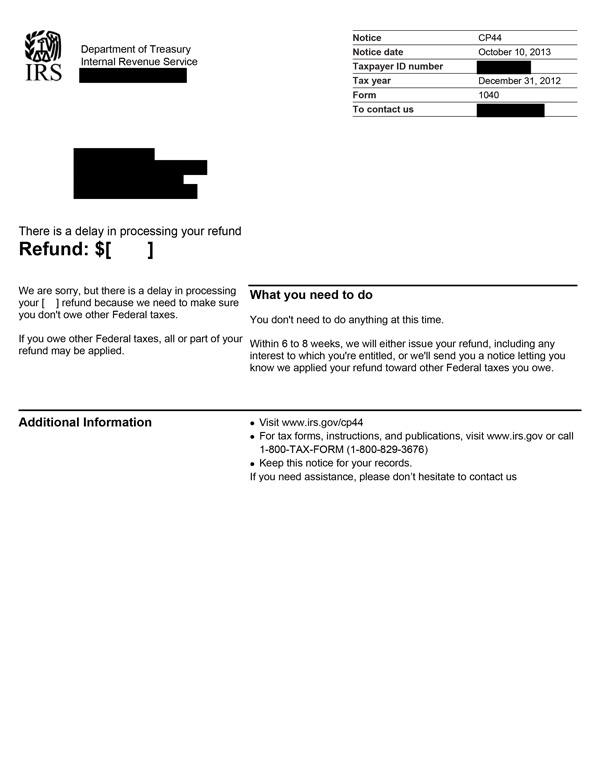

IRS Notice CP44 – Tax Refund Delayed

IRS Notice CP44 is sent to a taxpayer when the IRS withholds their tax refund because it believes there may be taxes owed.

Why Did I Receive IRS Notice CP44?

You received IRS Notice CP44 because your refund is being delayed pending further investigation by the IRS.

Next Steps

Unfortunately, there is nothing for you to do at this time. After the IRS audits your account, it will determine if you owe any taxes. If so, some or all of your tax refund will be applied to your outstanding balance. The IRS will then send you a notice explaining how they applied your refund toward your tax debt.

If you have a refund due, you will receive it, and any applicable interest, in six to eight weeks.

Who Should I Contact if I Have More Questions?

If you have any questions regarding your IRS Notice CP44, please wait at least eight weeks before calling the IRS. After that time, you may contact the number provided on your notice.