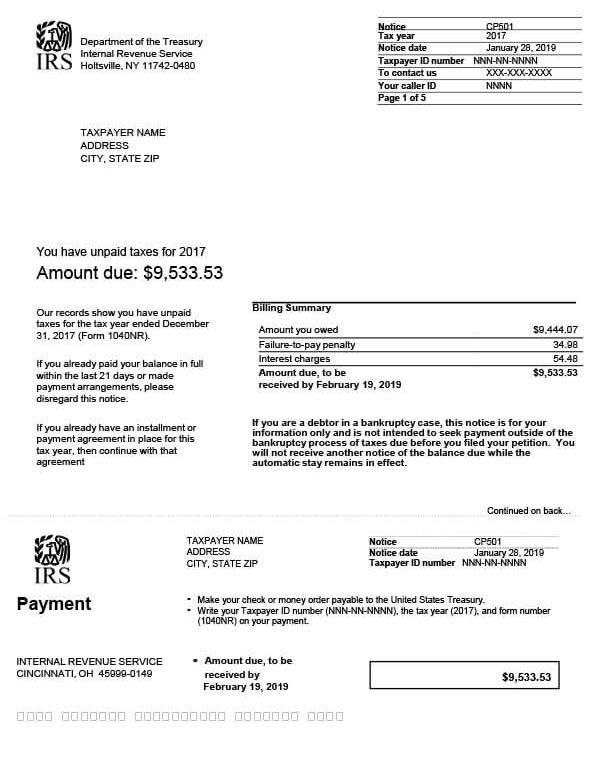

IRS Notice CP501 – Balance Due

IRS Notice CP501 is sent to taxpayers who have a balance due on one of their accounts.

Why Did I Receive IRS Notice CP501?

You received notice CP501 because the IRS sent you several letters requesting payment but you did not respond. This notice is requesting payment by a certain date to avoid additional penalties and interest charges. It’s also a warning that continued non-payment will result in a tax lien being filed against your property.

Next Steps

Carefully review your CP501 notice and save a copy for your records.

If you agree with the amount due:

- Pay the amount due by the deadline date to avoid additional penalties and interest fees. You can send a check or money order with the payment stub provided with the notice, or you can pay online at www.irs.gov/payments.

- If you are unable to pay the amount in full, apply for a payment plan or see if you qualify for other types of tax relief, such as Currently Not Collectible status.

If you disagree with the amount due:

- Contact the IRS at the number listed on your CP501 notice. Make sure you have your account information available when you call.

If you do not respond to the notice, the IRS will move forward and file a Notice of Federal Tax Lien, making it difficult for you to borrow against your property or sell it.

Who Should I Contact if I Have More Questions?

For questions about your IRS Notice CP501, please call the number on the notice or 800-829-1040. If you need assistance paying your tax balance, contact Tax Defense Network at 855-476-6920 for a free consultation. We can help you get into an affordable payment plan and determine which tax relief programs are best for your situation.