IRS Notice CP71A – Balance Due Reminder For CNC Status

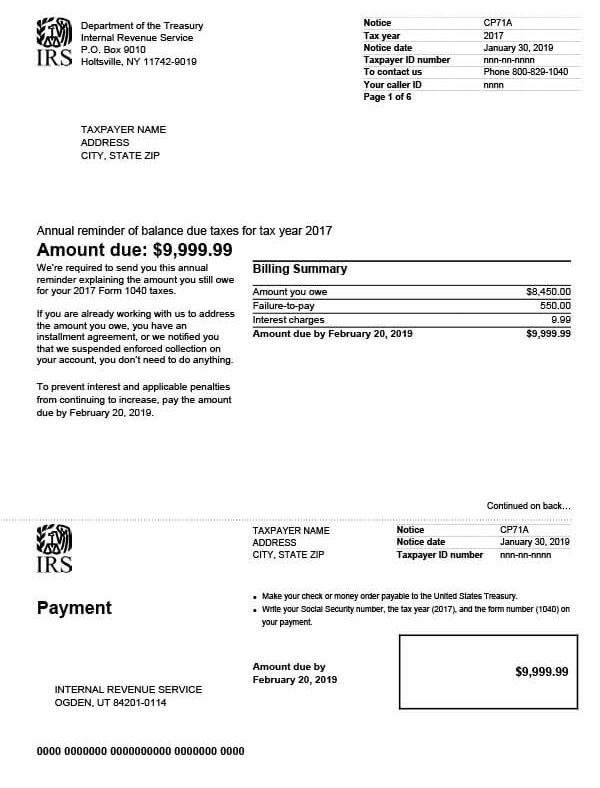

IRS Notice CP71A is sent annually to taxpayers who are in a Currently Not Collectible (CNC) status. It reminds them of tax, penalties, and interest fees owed.

Why Did I Receive IRS Notice CP71A?

You received a CP71A notice because you were placed in a CNC status due to financial hardship and have an existing tax debt. This annual notice simply updates you on the total outstanding balance now owed, including penalties and interest fees. The notice also explains the possible denial or revocation of your U.S. passport due to the outstanding tax debt.

Next Steps

Read your CP71A carefully and keep a copy for your records. If collection actions are suspended due to an active CNC status, no action is required at this time.

If you agree with the amount due but no longer qualify for CNC status:

- Pay the total amount due by the notice deadline date to avoid additional fees.

- Contact a tax professional to explore your tax relief options, such as a payment plan or an Offer in Compromise.

If you disagree with the amount due:

- Call the number listed on your CP71A notice and speak with an IRS representative. Be sure to have your account available before you call.

Who Should I Contact if I Have More Questions?

If you have questions about IRS Notice CP71A, contact the IRS at the number listed on the notice or call 800-829-1040. To explore your tax relief options, contact Tax Defense Network at 855-476-6920 and request a free consultation.