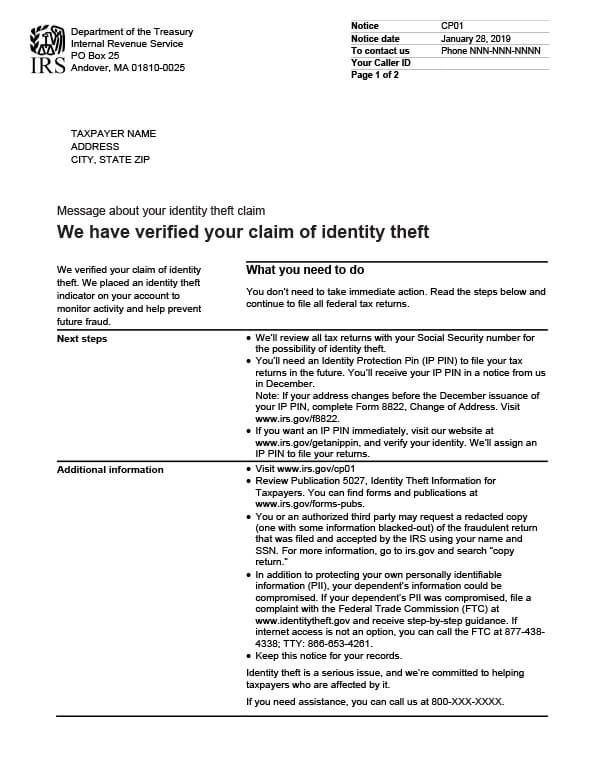

IRS Notice CP01 – Identity Theft Indicator

The IRS verified your claim of identity theft and placed an indicator on your account. They’ll monitor your tax account to help prevent future fraud.

Why Did I Receive IRS Notice CP01?

You received IRS Notice CP01 because you are a victim of identity theft. The IRS is alerting you to the fact that they are taking the necessary steps to protect your account from additional tax fraud attempts.

Next Steps

No additional action is required at this time. The indicator will remain on your account until you ask the IRS to remove it. In the meantime, consider taking the following steps to protect yourself.

- Continue to file and pay your taxes on time.

- Review the IRS’s Identity Protection page for helpful tips.

- Monitor your financial accounts and credit report for suspicious or unauthorized activity.

Who Should I Contact if I Have More Questions?

Please refer to the contact details listed on your CP01 IRS notice. You may also call the IRS directly at 800-908-4490 for assistance regarding identity theft related to your tax account. If you have additional questions regarding a tax balance or need help preparing your tax return, please call Tax Defense Network at 855-476-6920 for a free consultation and quote.