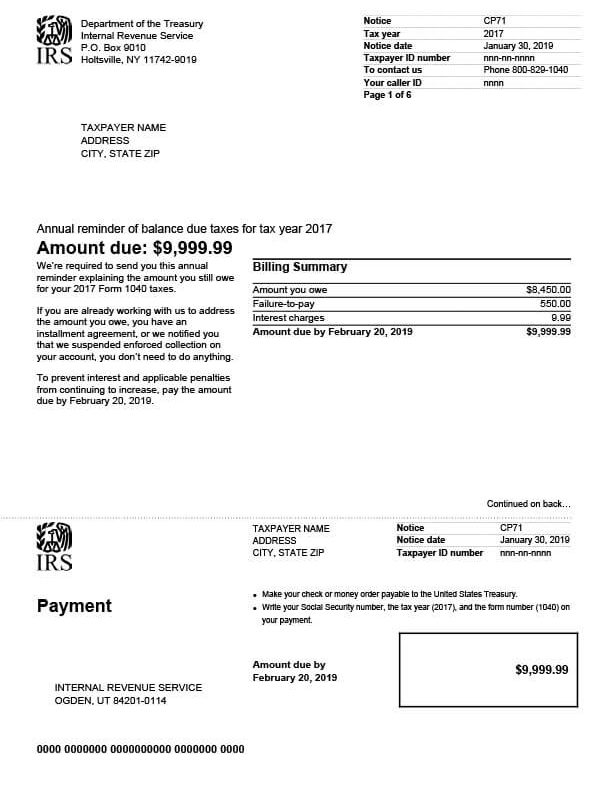

IRS Notice CP71 – Annual Reminder of Balance Due

IRS Notice CP71 is an annual reminder that the IRS is required to send when you have an outstanding balance due.

Why Did I Receive IRS Notice CP71?

You received a CP71 notice because you have an outstanding tax debt with the IRS. The IRS is legally required to send this notice to you each year. It is a reminder to pay your balance due to prevent penalty and interest fees from increasing.

Next Steps

Review your CP71 notice and keep a copy for your records. If you have an installment agreement in place or your account is in a Currently Not Collectible (CNC) status, there’s nothing you need to do.

If you agree with the amount due but aren’t working to address your balance:

- Apply for a payment plan or an installment agreement.

- See if you qualify for an Offer in Compromise or CNC status.

- Contact a tax professional to explore all your tax relief options.

If you disagree with the amount due:

- Call the IRS at the number listed on your CP71 notice and review your account with a representative. Make sure you have your account information handy when you call.

Who Should I Contact if I Have More Questions?

If you need assistance with your IRS Notice CP71, contact the IRS at the number listed on the notice or call 800-829-1040. To explore your tax relief options, call Tax Defense Network at 855-476-6920 for a free consultation.