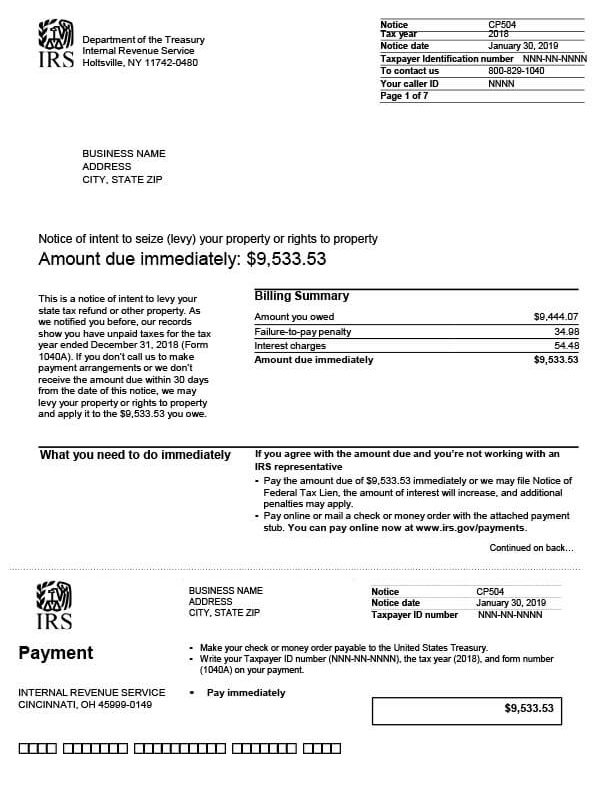

IRS Notice CP504 – Notice of Intent to Levy

IRS Notice CP504 is a Notice of Intent to Levy. It is sent to taxpayers who continue to ignore balance due notices and the IRS initiates the tax levy process.

Why Did I Receive IRS Notice CP504?

You received notice CP504 because you have failed to pay your back taxes or respond to any previous attempts to collect your tax debt. The IRS is now moving forward with placing a tax levy on your property. If you don’t pay the amount due immediately, the IRS can levy your bank accounts and income (wage garnishment), as well as seize your property. This includes your state and federal tax refunds.

Next Steps

Read your CP504 notice carefully and keep a copy for your records. The notice will explain how much you owe, including penalties and interest. You have 30 days from the date of the notice to pay your balance in full or make payment arrangements.

If you agree with the amount due:

- Pay your balance by the deadline date. Use the payment stub provided if paying by money order or check. Go to www.irs.gov/payments to make a payment online.

- If you can’t pay in full, pay what you can now and apply for a payment plan. You may also be eligible for other tax relief programs.

If you disagree with the amount due:

- Call the number listed on your CP504 notice and speak with an IRS representative. Be sure to have your account number ready before calling.

The IRS can move forward with the levy if they do not receive the money within 30 days from the date of the notice. You can, however, request an appeal under the Collection Appeals Program (CAP) before the collection takes place.

Who Should I Contact if I Have More Questions?

For questions about your IRS Notice CP504, call the number listed on your notice or 800-829-1040. If you need assistance with requesting a payment plan or other tax relief, call Tax Defense Network at 855-476-6920 for a free consultation.