IRS Notice CP87A – Dependent Verification Request

The IRS sends notice CP87A when a taxpayer claims a dependent that is subsequently listed on another taxpayer’s return.

Why Did I Receive IRS Notice CP87A?

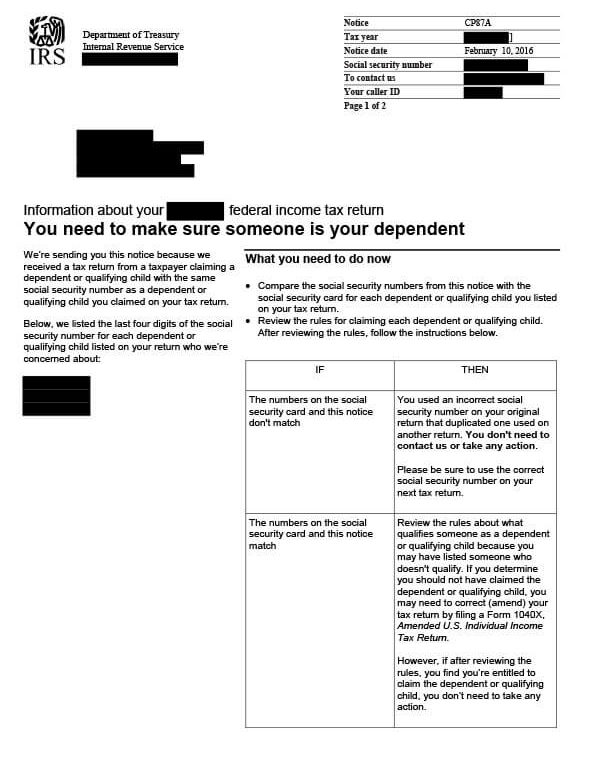

You received IRS Notice CP87A because you filed a tax return that included a dependent or qualifying child with the same Social Security number (SSN) as a dependent or qualifying child that is also being claimed by another taxpayer. The IRS needs you to verify that the person you listed qualifies as your dependent.

Next Steps

Carefully review the information included on your notice CP87A. Compare the SSN on the notice with the one you listed for your dependent or qualifying child.

If the SSN matches:

- Review the rules for claiming a dependent or qualifying child. No changes are needed if you are eligible to claim your dependent or qualifying child. If you determine that you claimed them in error, however, submit Form 1040X, Amended U.S. Individual Income Tax Return.

If the SSN doesn’t match:

- Should you discover that the SSN is incorrect, no additional action is required. Just be sure to use the correct SSN on your next tax return.

It’s important to note that the IRS will not disclose the names of the other taxpayer who used the same SSN as your dependent or qualifying child. If you’re worried that your child may be a victim of identity theft, review the tips at IdentityTheft.gov and take the necessary steps to protect their information.

Who Should I Contact if I Have More Questions?

For questions concerning your IRS Notice CP87A, call the number listed on your notice or 800-829-1040.