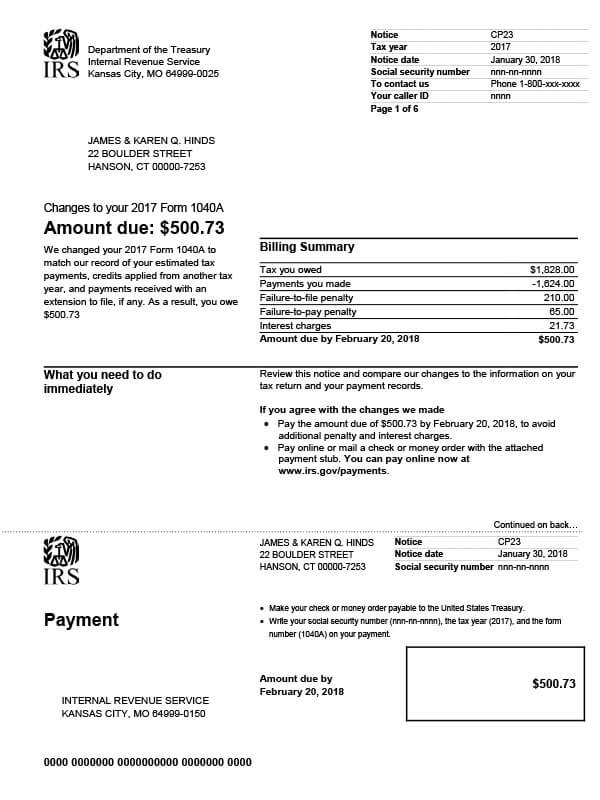

IRS Notice CP23 – Estimated Tax Payments/Balance Due

The IRS will send notice CP23 if the amount of estimated tax payments indicated on your return does not match the amount posted to your account. Due to this discrepancy, there is now a balance due.

Why Did I Receive IRS Notice CP23?

You will receive IRS Notice CP23 if you reported estimated tax payments when you filed your taxes and the IRS found a discrepancy when it compared the amount received to the amount claimed on your return. As a result of this discovery, the IRS adjusted your return to reflect the amount posted to your account. Unfortunately, you now owe additional money to the IRS.

Next Steps

Read your CP23 notice thoroughly and compare the payments on your notice to your records. Make sure all payments are listed, including any payments from the prior year.

If you agree with the changes made:

- Pay the amount due by the date indicated on the notice to avoid additional penalties and interest fees. You can pay online or remit your payment (check or money order) by mail. If sending by mail, be sure to include the payment stub from your notice.

- Correct the copy of your tax return and keep it for your records. Do not send an updated version to the IRS.

- If you are unable to pay the balance due in full, apply for a payment plan online or request one by calling the number on your notice.

If you disagree with the changes made:

- Contact the IRS within 60 days by calling the number listed on your tax notice. You may be able to provide the information needed verbally and have the account corrected immediately.

- You can also dispute the changes by sending a letter by mail. Include a copy of your notice and any relevant documentation to support your case. Please allow 60 or more days for a resolution.

- Another option is to contact a tax professional. An experienced tax professional will review your case and determine your next steps. They can also see if you qualify for penalty abatement or other tax relief.

The IRS will reverse the changes made upon request (within 60 days) but your case may be forwarded for audit if you do not provide enough information to justify the reversal.

Who Should I Contact if I Have More Questions?

If you need help with IRS Notice CP23, call the number listed on your notice or call 800-829-1040. You may also request a free consultation and case review by contacting Tax Defense Network at 855-476-6920.