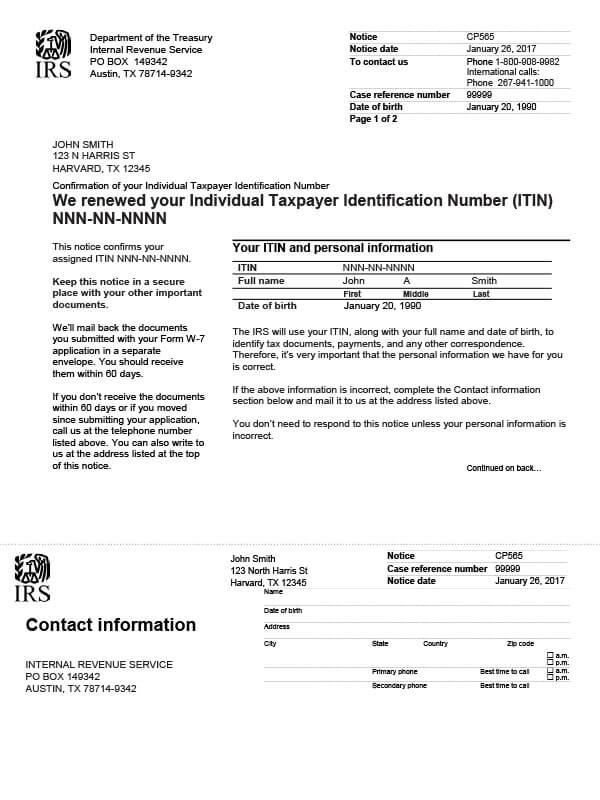

IRS Notice CP565 – Renewal of Individual Taxpayer Identification Number

IRS Notice CP565 is sent when a person’s Taxpayer Identification Number (ITIN) is renewed.

Why Did I Receive IRS Notice CP565?

You received notice CP565 because you renewed your existing or expired ITIN.

Next Steps

Read notice CP565. Make sure the name and date of birth are correct. If there is an error, complete the Contact Information section included with the notice and mail it to the address provided. Keep a copy of this notice for your records. You do not need to respond to the notice if no changes are required.

If you change your name:

- Send the IRS a copy of your CP565 notice, along with the original or certified copies of legal documents (marriage certificate, court record, etc.) supporting your name change to the address listed at the top of your notice.

If you become a U.S. citizen or legal resident alien:

- Apply for a Social Security number (SSN). Once you receive your SSN, send a copy of CP565 and your Social Security card to the address listed on the notice. The IRS will update your record and you will no longer use your ITIN.

Who Should I Contact if I Have More Questions?

For questions about your IRS Notice CP565, contact the IRS at the number listed on the notice or 800-829-1040.