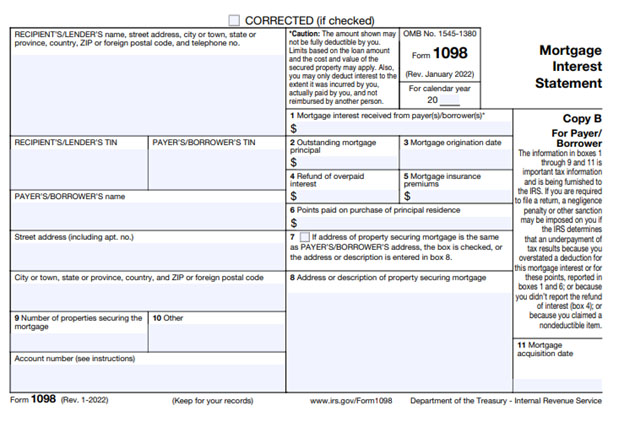

Form 1098, Mortgage Interest Statement

Form 1098, Mortgage Interest Statement, is used by taxpayers to determine how much interest they have paid on their mortgages during the tax year. Taxpayers also use the form to help calculate the mortgage interest deduction on their itemized tax returns. Lenders must issue Form 1098 when a homeowner has paid $600 or more in interest and/or related expenses on a qualified mortgage. Per the IRS, this includes first and second mortgages, refinanced mortgages, as well as home equity loans. If you have more than one qualified mortgage, you will receive a separate form for each one.

Understanding Form 1098

If you plan to itemize your taxes and receive a Form 1098, you aren’t required to include the form with your tax return. Your lender has already sent the information to the IRS. You will, however, need to use the information on the form to determine your mortgage interest deduction.

Box 1 – This is the total interest you paid for the tax year. It does not include points.

Box 2 – The amount shown here is the remaining balance on your principal balance.

Box 3 – The mortgage origination date is the date you closed on the property and signed the deed.

Box 4 – If you received a refund of any overpaid interest, it will be included in this box.

Box 5 – Mortgage insurance premiums (MIP) are used by Federal Housing Administration (FHA) lenders to protect themselves against borrowers who are more likely to default. If you have an FHA-backed mortgage, those MIP fees will be listed here.

Box 6 – Mortgage points are fees paid to a lender in exchange for a lower interest rate. Generally, the points reported here are fully deductible in the year paid.

Box 7 – If the property’s address is the same as the borrower’s address, either the box is checked or the address is entered into box 8.

Box 8 – This is the address or description of the property securing the mortgage.

Box 9 – If there is more than one property under the loan, the total number is entered here. The box may be empty if only one property secures the loan.

Box 10 – Other information, such as real estate taxes and insurance paid from escrow will be included in this space.

Box 11 – If the lender acquired the mortgage during the calendar year, the acquisition date is entered here. Otherwise, it will remain blank.

If you have more than one qualified mortgage, you should receive a separate Form 1098 for each property.

Other 1098 Forms

The IRS has four different forms under the 1098 heading. All are related to tax deductions. The other three include:

- Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes. Organizations complete this form when someone donates a qualified vehicle to them which is valued at more than $500. Donors should receive Copy B and C of Form 1098-C for their tax records so they may claim the deduction when itemizing taxes.

- Form 1098-E, Student Loan Interest Statement. Student loan lenders are required to file this form if a borrower has paid $600 or more in interest during the tax year. A copy of this form or an acceptable substitute is also sent to the borrower.

- Form 1098-T, Tuition Statement. Eligible educational institutions must file Form 1098-T for each enrolled student for whom a reportable transaction is made. Students receive a copy of Form 1098-T and can use it to claim education credits on Form 1040.

Need Help?

If you need assistance understanding your Form 1098 or any other tax forms, please contact Tax Defense Network at 855-476-6920. Since 2007, we’ve helped thousands of taxpayers file their taxes and find affordable solutions for their tax debt issues.